Answered step by step

Verified Expert Solution

Question

1 Approved Answer

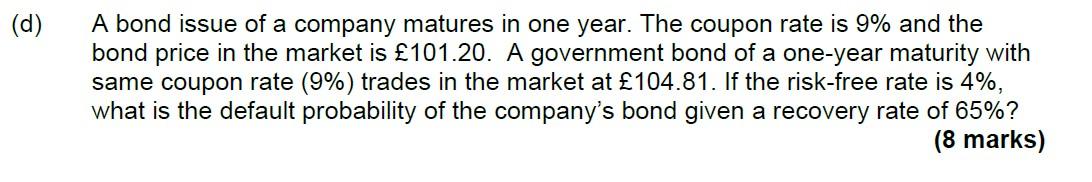

CREDIT RISK MANAGEMENT ONE QUESTION ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- SOME IMPORTANT FORMULAE: SOME NOTES: (d) A bond issue of a company matures in one year. The coupon rate

CREDIT RISK MANAGEMENT ONE QUESTION

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

SOME IMPORTANT FORMULAE:

SOME NOTES:

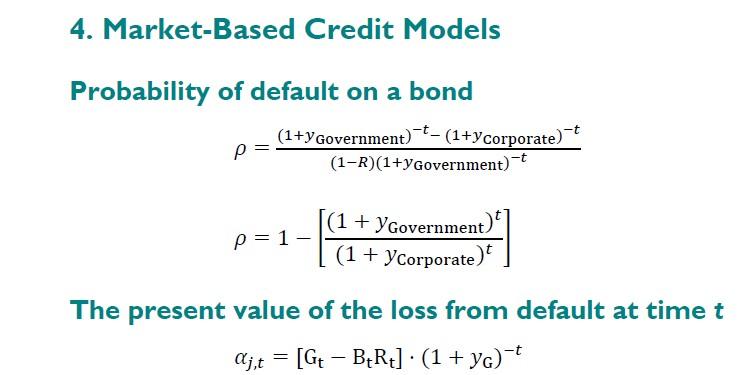

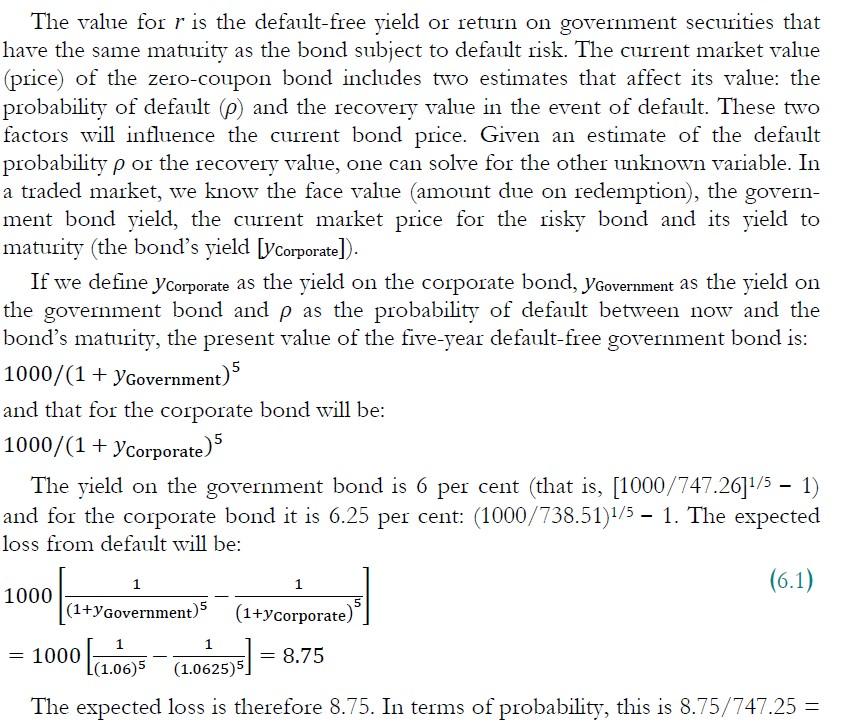

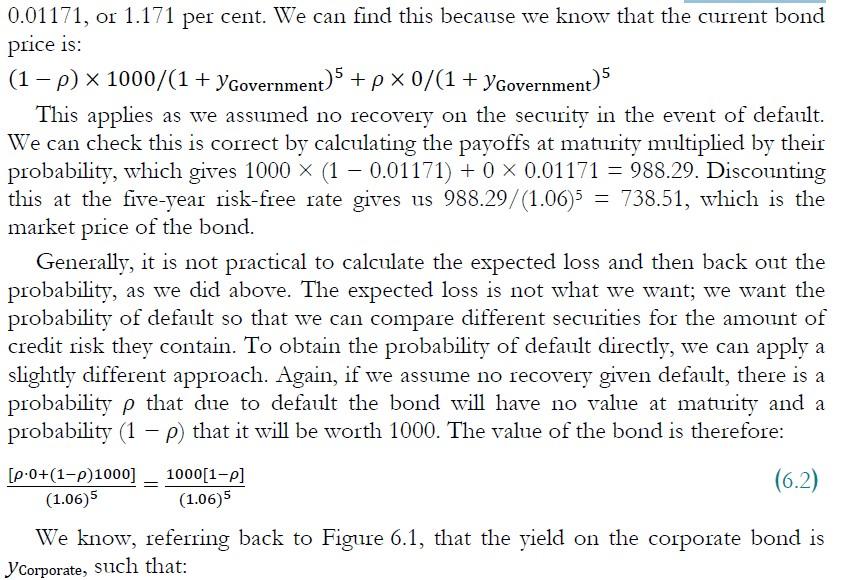

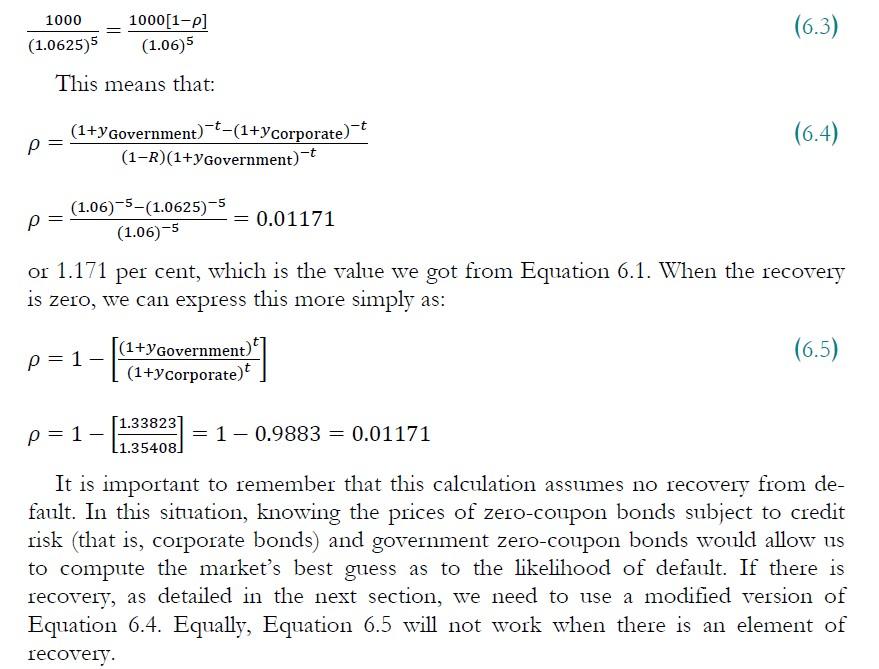

(d) A bond issue of a company matures in one year. The coupon rate is 9% and the bond price in the market is 101.20. A government bond of a one-year maturity with same coupon rate (9%) trades in the market at 104.81. If the risk-free rate is 4%, what is the default probability of the company's bond given a recovery rate of 65%? (8 marks) The value for r is the default-free yield or return on government securities that have the same maturity as the bond subject to default risk. The current market value (price) of the zero-coupon bond includes two estimates that affect its value: the probability of default ) and the recovery value in the event of default. These two factors will influence the current bond price. Given an estimate of the default probability p or the recovery value, one can solve for the other unknown variable. In a traded market, we know the face value (amount due on redemption), the govern- ment bond yield, the current market price for the risky bond and its yield to maturity (the bond's yield [yCorporate]). If we define y corporate as the yield on the corporate bond, yGovernment as the yield on the government bond and p as the probability of default between now and the bond's maturity, the present value of the five-year default-free government bond is: 1000/(1 + yGovernment) 5 and that for the corporate bond will be: 1000/(1 + Ycorporate) The yield on the government bond is 6 per cent (that is, [1000/747.26]1/5 - 1) and for the corporate bond it is 6.25 per cent: (1000/738.51)1/5 1. The expected loss from default will be: (6.1) (1+yGovernment) (1+Ycorporate) 1 1 1000 = 1000 (1.06) = 8.75 (1.0625) The expected loss is therefore 8.75. In terms of probability, this is 8.75/747.25 = 0.01171, or 1.171 per cent. We can find this because we know that the current bond price is: (1-P) x 1000/(1+ yGovernment)5 +px 0/(1+ Ygovernment)5 This applies as we assumed no recovery on the security in the event of default. We can check this is correct by calculating the payoffs at maturity multiplied by their probability, which gives 1000 x (1 0.01171) + 0 x 0.01171 = 988.29. Discounting this at the five-year risk-free rate gives us 988.29/(1.06)5 = 738.51, which is the market price of the bond. Generally, it is not practical to calculate the expected loss and then back out the probability, as we did above. The expected loss is not what we want; we want the probability of default so that we can compare different securities for the amount of credit risk they contain. To obtain the probability of default directly, we can apply a slightly different approach. Again, if we assume no recovery given default, there is a probability p that due to default the bond will have no value at maturity and a probability (1 P) that it will be worth 1000. The value of the bond is therefore: [p.0+(1-0)1000] (1.065 1000[1-p] (1.065 (6.2) We know, referring back to Figure 6.1, that the yield on the corporate bond is Y Corporate, such that: 1000 1000[1-p] (1.065 (6.3) (1.0625) This means that: (1+yGovernment)-+-(1+Ycorporate) (1-R)(1+yGovernment)-t (6.4) p= (1.06)-5-(1.0625) -5 -= 0.01171 (1.06)-5 or 1.171 per cent, which is the value we got from Equation 6.1. When the recovery is zero, we can express this more simply as: (1+yGovernment) (1+y Corporate) (6.5) = 1- (1.338231 11.35408) p=1 1-0.9883 = 0.01171 It is important to remember that this calculation assumes no recovery from de- fault. In this situation, knowing the prices of zero-coupon bonds subject to credit risk (that is, corporate bonds) and government zero-coupon bonds would allow us to compute the market's best guess as to the likelihood of default. If there is recovery, as detailed in the next section, we need to use a modified version of Equation 6.4. Equally, Equation 6.5 will not work when there is an element of recovery

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started