Answered step by step

Verified Expert Solution

Question

1 Approved Answer

cromeducation.com/ext/map/index.html_conecontexternal browser=0&launchUrl https%253A%252F%252Fbb9 tamucc.edu.252Fwebappst.252Fportal 252Fframesetjsp.253Ftab tab group Jax2500 2.125-2590125233 pter 5 Homework 7 The following data are available for Sellco for the fiscal year ended

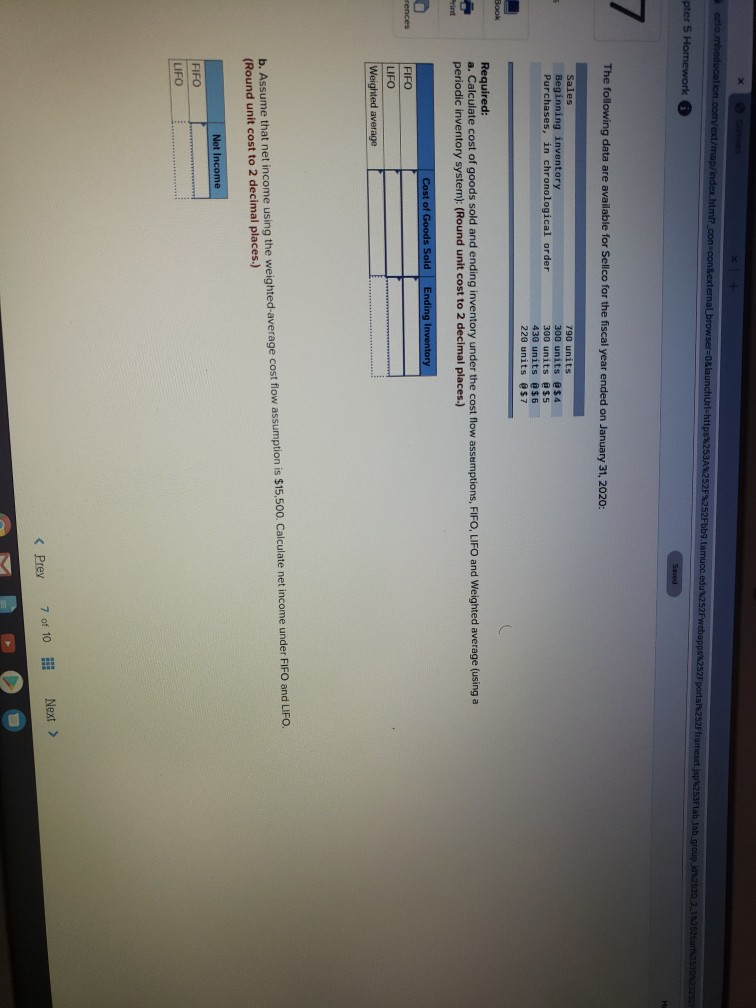

cromeducation.com/ext/map/index.html_conecontexternal browser=0&launchUrl https%253A%252F%252Fbb9 tamucc.edu.252Fwebappst.252Fportal 252Fframesetjsp.253Ftab tab group Jax2500 2.125-2590125233 pter 5 Homework 7 The following data are available for Sellco for the fiscal year ended on January 31, 2020: Sales Beginning inventory Purchases, in chronological order 790 units 300 units $4 300 units @ $5 430 units @$6 220 units @ $7 Book Required: a. Calculate cost of goods sold and ending inventory under the cost flow assumptions, FIFO, LIFO and Weighted average (using a periodic inventory system): (Round unit cost 2 decimal places.) Print Cost of Goods Sold Ending Inventory rences FIFO LIFO Weighted average b. Assume that net income using the weighted average cost flow assumption is $15,500. Calculate net income under FIFO and LIFO. (Round unit cost to 2 decimal places.) Net Income FIFO LIFO Next > 7 of 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started