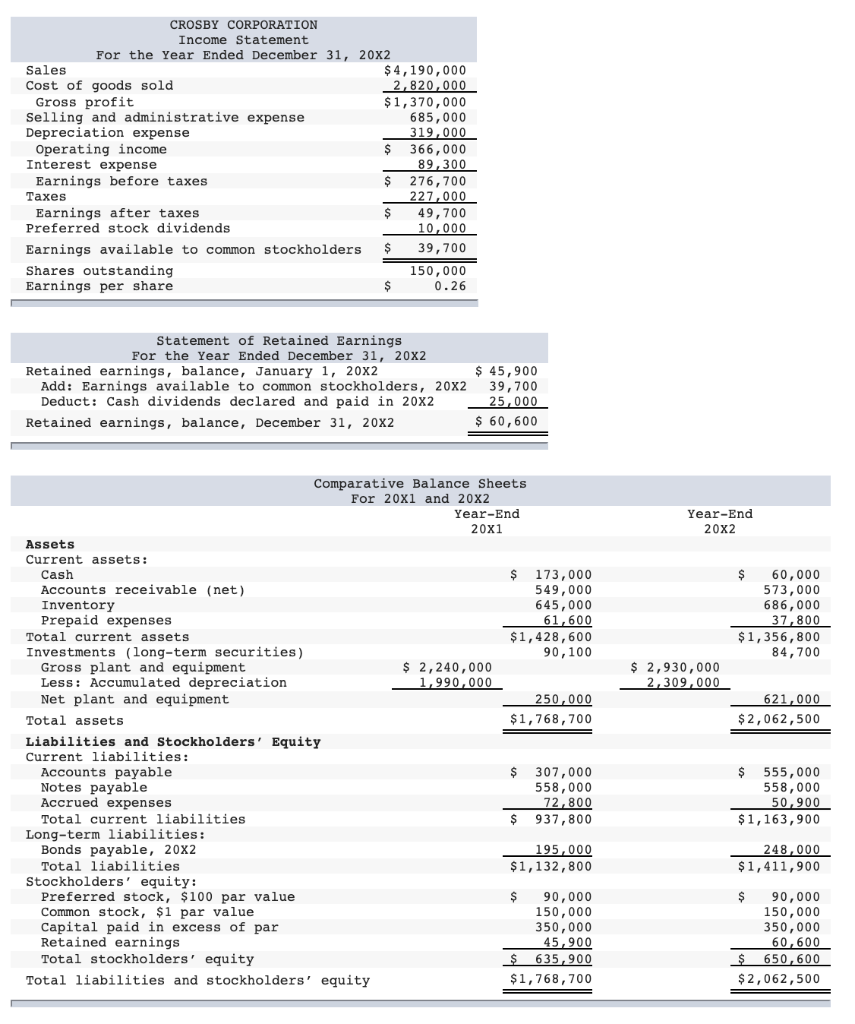

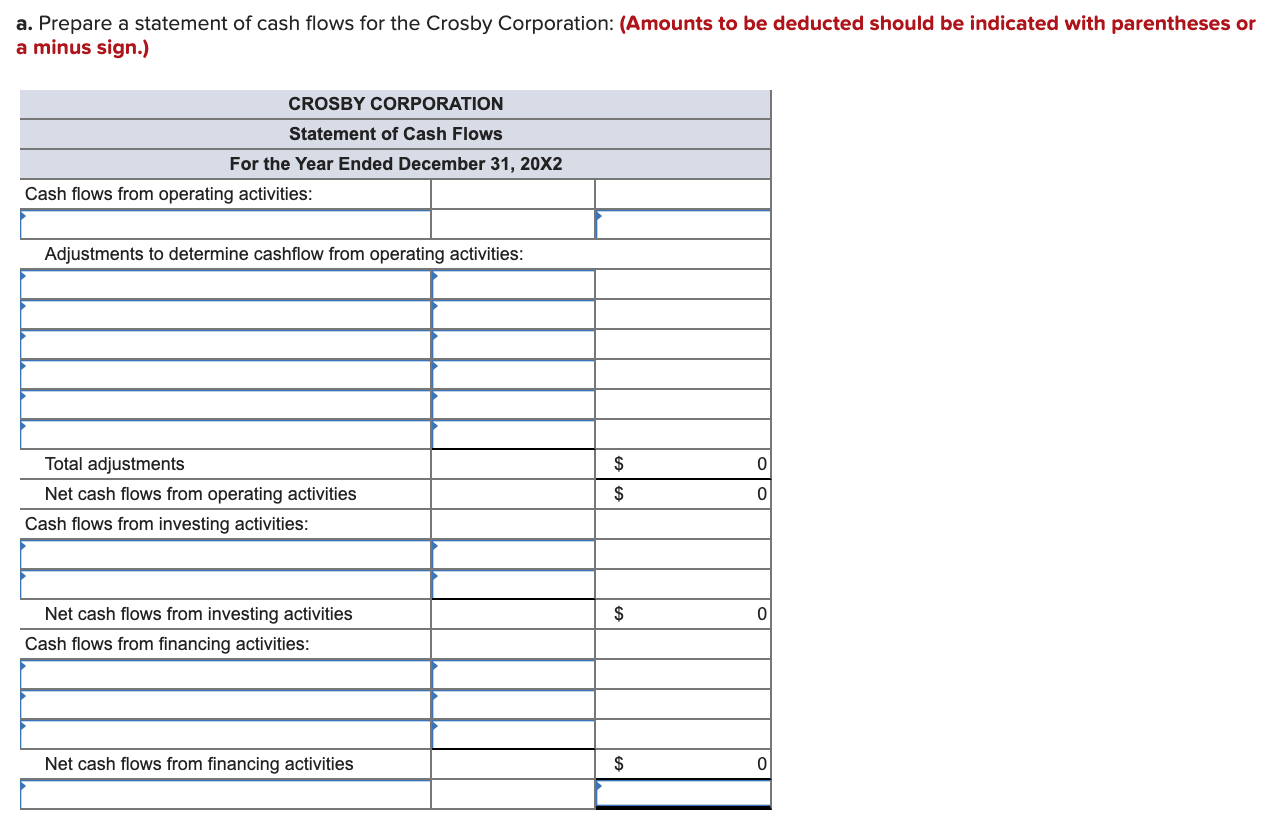

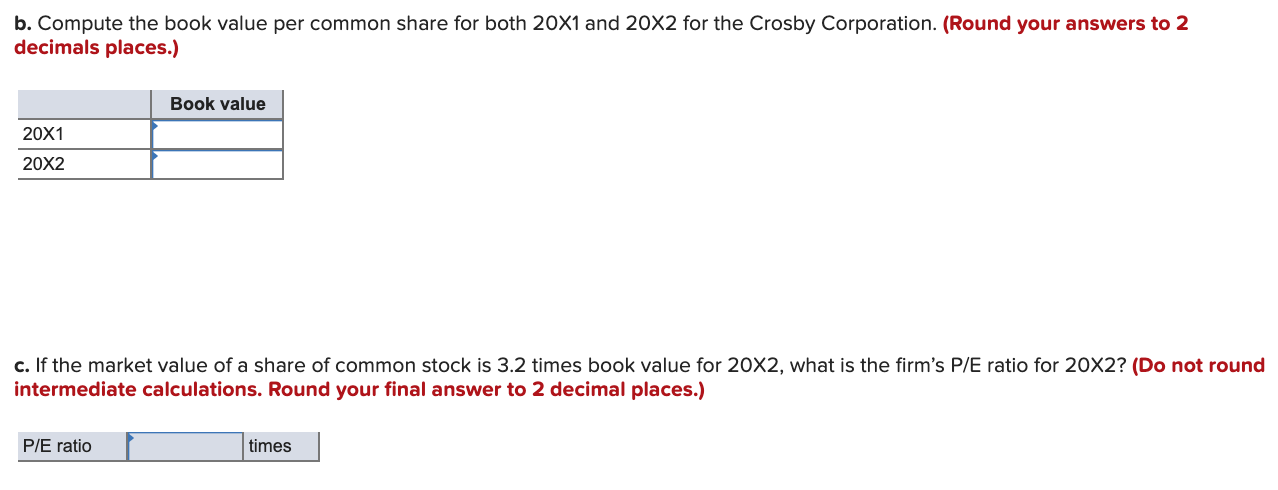

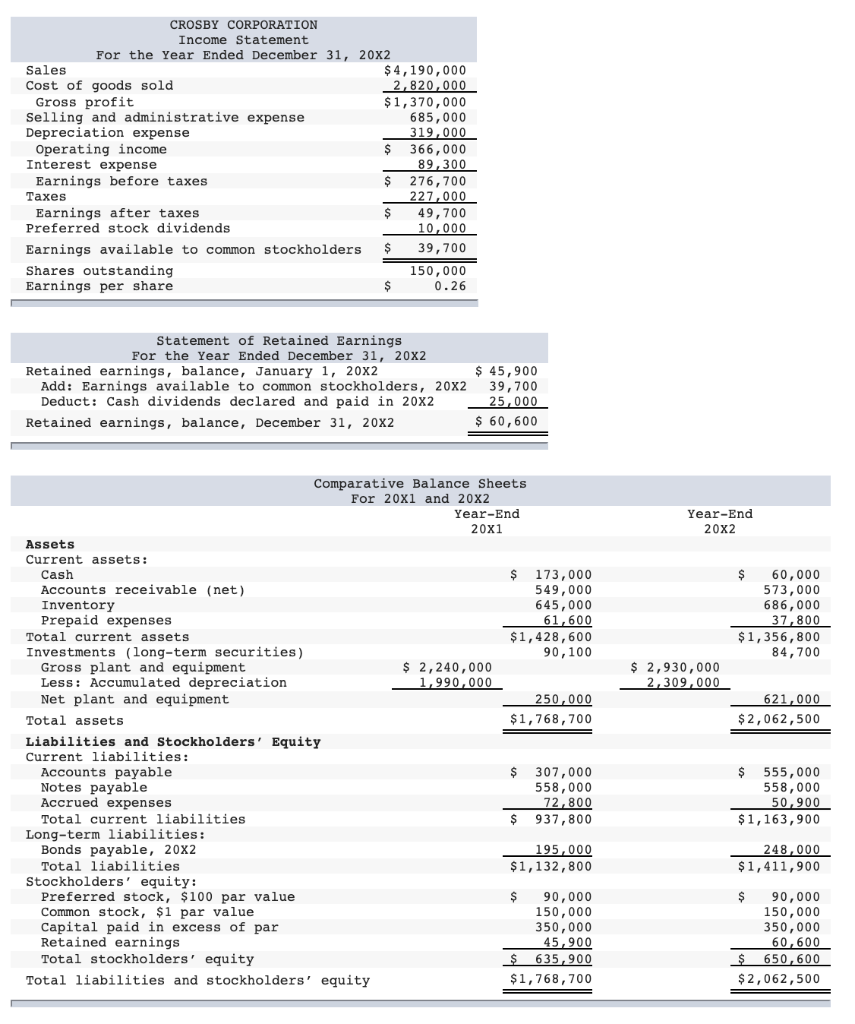

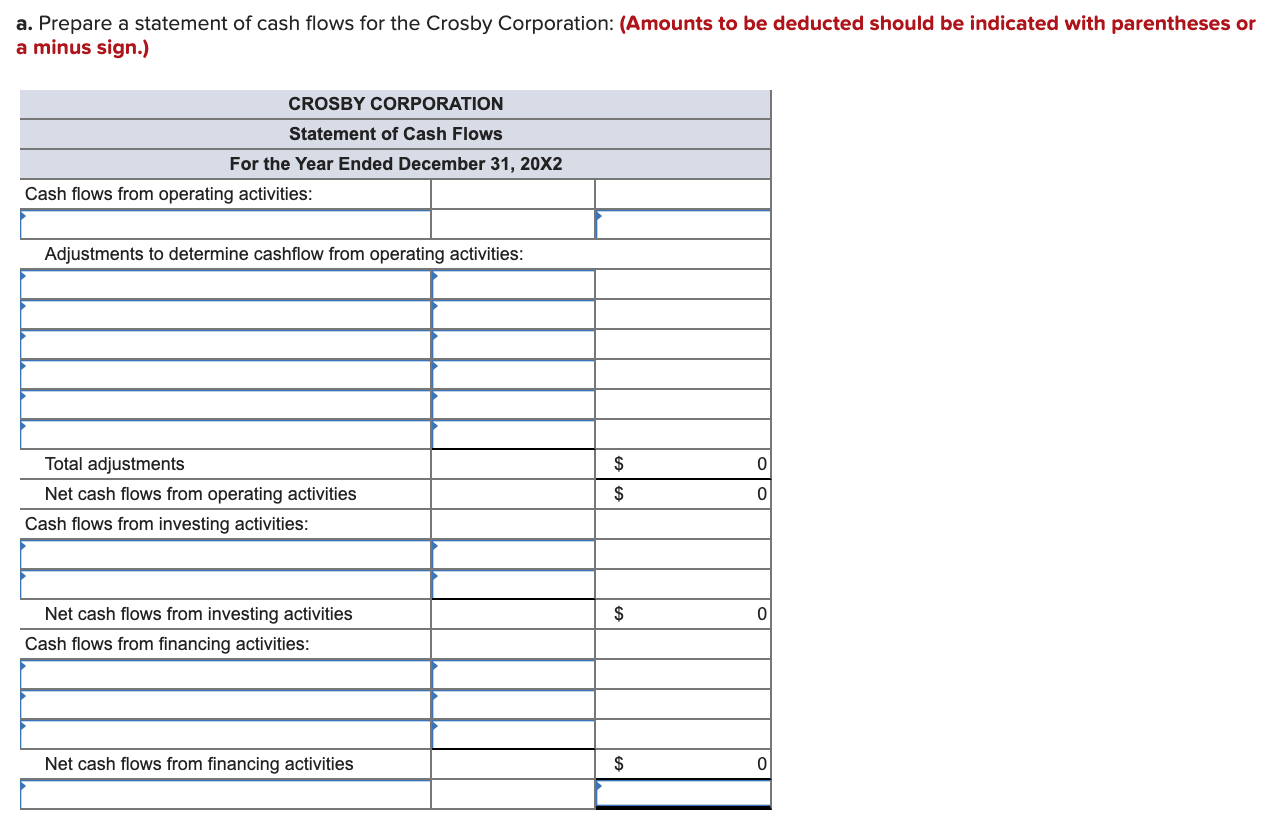

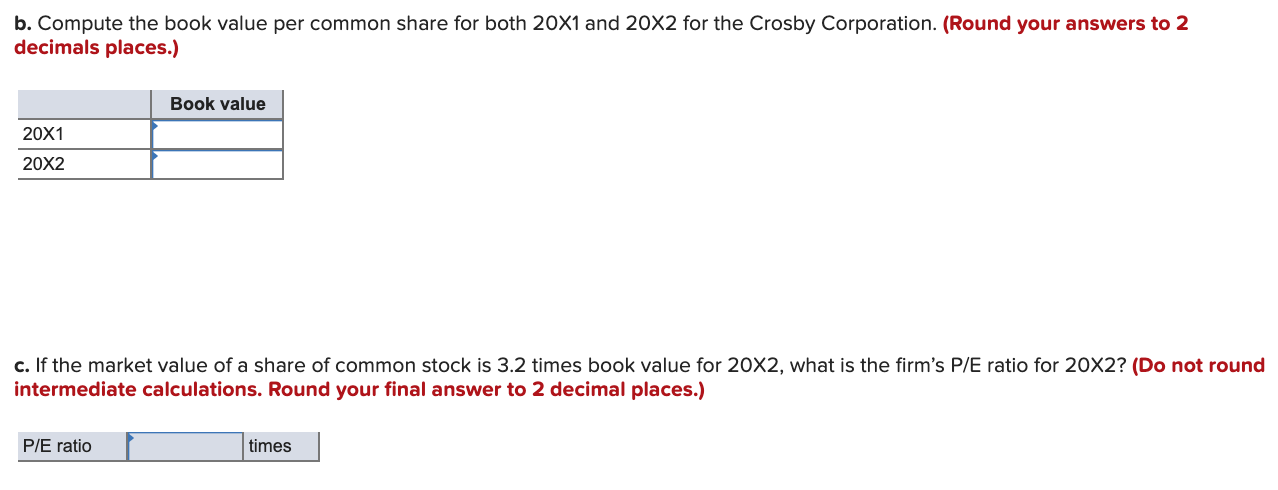

CROSBY CORPORATION Income Statement For the Year Ended December 31, 20x2 Sales $4,190,000 Cost of goods sold 2,820,000 Gross profit $1,370,000 Selling and administrative expense 685,000 Depreciation expense 319,000 Operating income $ 366,000 Interest expense 89,300 Earnings before taxes $ 276,700 Taxes 227,000 Earnings after taxes 49,700 Preferred stock dividends 10,000 Earnings available to common stockholders $ 39,700 Shares outstanding 150,000 Earnings per share $ 0.26 Statement of Retained Earnings For the Year Ended December 31, 20X2 Retained earnings, balance, January 1, 20x2 Add: Earnings available to common stockholders, 20x2 Deduct: Cash dividends declared and paid in 20X2 Retained earnings, balance, December 31, 20X2 $ 45,900 39,700 25,000 $ 60,600 Year-End 20x2 $ 60,000 573,000 686,000 37,800 $1,356,800 84,700 $ 2,930,000 2,309,000 621,000 $2,062,500 Comparative Balance Sheets For 20x1 and 20x2 Year-End 20x1 Assets Current assets: Cash $ 173,000 Accounts receivable (net) 549,000 Inventory 645,000 Prepaid expenses 61,600 Total current assets $1,428,600 Investments (long-term securities) 90,100 Gross plant and equipment $ 2,240,000 Less: Accumulated depreciation - 1,990,000 Net plant and equipment 250,000 Total assets $1,768,700 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 307,000 Notes payable 558,000 Accrued expenses 72,800 Total current liabilities $ 937,800 Long-term liabilities: Bonds payable, 20x2 195,000 Total liabilities $1,132,800 Stockholders' equity: Preferred stock, $100 par value $ 90,000 Common stock, $1 par value 150,000 Capital paid in excess of par 350,000 Retained earnings 45,900 Total stockholders' equity $ 635,900 Total liabilities and stockholders' equity $1,768, 700 $ 555,000 558,000 50,900 $1,163,900 248,000 $ 1,411,900 $ 90,000 150,000 350,000 60,600 $ 650, 600 $2,062,500 a. Prepare a statement of cash flows for the Crosby Corporation: (Amounts to be deducted should be indicated with parentheses or a minus sign.) CROSBY CORPORATION Statement of Cash Flows For the Year Ended December 31, 20X2 Cash flows from operating activities: Adjustments to determine cashflow from operating activities: Total adjustments Net cash flows from operating activities Cash flows from investing activities: Net cash flows from investing activities Cash flows from financing activities: Net cash flows from financing activities b. Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation. (Round your answers to 2 decimals places.) Book value 20X1 20X2 c. If the market value of a share of common stock is 3.2 times book value for 20X2, what is the firm's P/E ratio for 20x2? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) P/E ratio times