Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Crude oil futures contracts are 1,000 barrels, are quoted in dollars per barrel, and the initial margin is $9,000 per contract. Soybean futures contracts are

Crude oil futures contracts are 1,000 barrels, are quoted in dollars per barrel, and the initial margin is $9,000 per contract. Soybean futures contracts are 5,000 bushels, are quoted in cents per bushel, and have an initial margin of $4,725. E-mini S&P 500 futures contracts are quoted in S&P 500 index value with a $50 multiplier and have an initial margin of $12,650 per contract. Gold futures contracts are 100 ounces and are quoted in dollars per ounce.

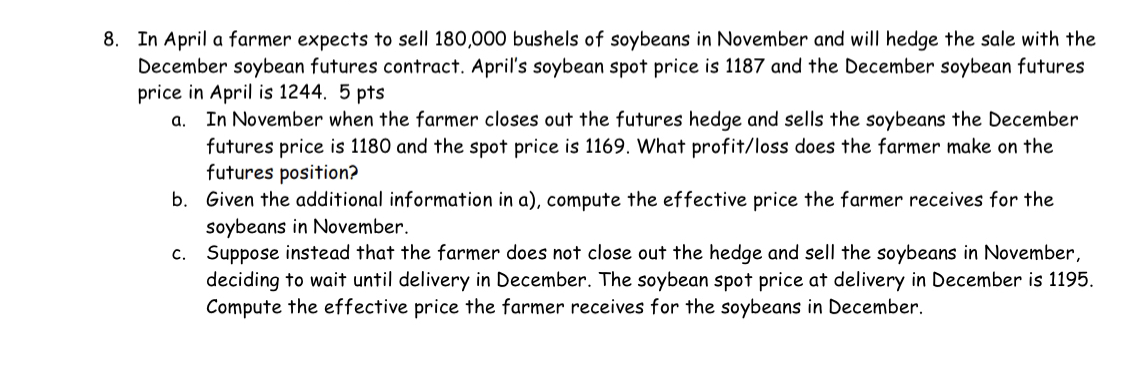

8. In April a farmer expects to sell 180,000 bushels of soybeans in November and will hedge the sale with the December soybean futures contract. April's soybean spot price is 1187 and the December soybean futures price in April is 1244. 5 pts a. In November when the farmer closes out the futures hedge and sells the soybeans the December futures price is 1180 and the spot price is 1169 . What profit/loss does the farmer make on the futures position? b. Given the additional information in a), compute the effective price the farmer receives for the soybeans in November. c. Suppose instead that the farmer does not close out the hedge and sell the soybeans in November, deciding to wait until delivery in December. The soybean spot price at delivery in December is 1195. Compute the effective price the farmer receives for the soybeans in DecemberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started