Question

Crude oil futures contracts are 1,000 barrels, are quoted in dollars per barrel, and the initial margin is $9,000 per contract. Soybean futures contracts are

Crude oil futures contracts are 1,000 barrels, are quoted in dollars per barrel, and the initial margin is $9,000 per contract. Soybean futures contracts are 5,000 bushels, are quoted in cents per bushel, and have an initial margin of $4,725. E-mini S&P 500 futures contracts are quoted in S&P 500 index value with a $50 multiplier and have an initial margin of $12,650 per contract. Gold futures contracts are 100 ounces and are quoted in dollars per ounce. (THE PARAGRAPH ABOVE IS NOT A QUESTION, USE THE INFORMATION GIVEN IF NEEDED TO ANSWER THE QUESTION BELOW)

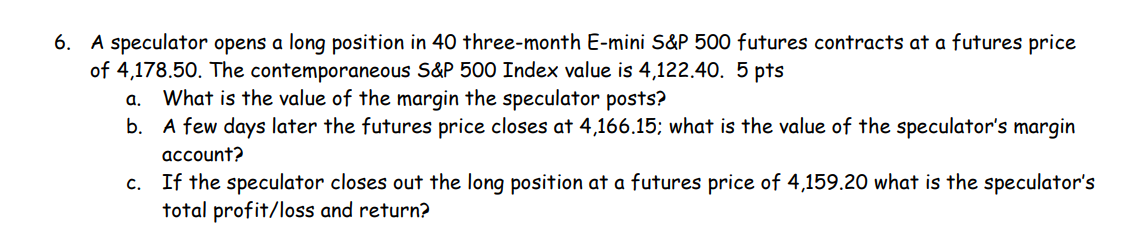

6. A speculator opens a long position in 40 three-month E-mini S\&P 500 futures contracts at a futures price of 4,178.50. The contemporaneous S\&P 500 Index value is 4,122.40. 5pts a. What is the value of the margin the speculator posts? b. A few days later the futures price closes at 4,166.15; what is the value of the speculator's margin account? c. If the speculator closes out the long position at a futures price of 4,159.20 what is the speculator's total profit/loss and return? 6. A speculator opens a long position in 40 three-month E-mini S\&P 500 futures contracts at a futures price of 4,178.50. The contemporaneous S\&P 500 Index value is 4,122.40. 5pts a. What is the value of the margin the speculator posts? b. A few days later the futures price closes at 4,166.15; what is the value of the speculator's margin account? c. If the speculator closes out the long position at a futures price of 4,159.20 what is the speculator's total profit/loss and return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started