Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CT7.2 PepsiCo's financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of

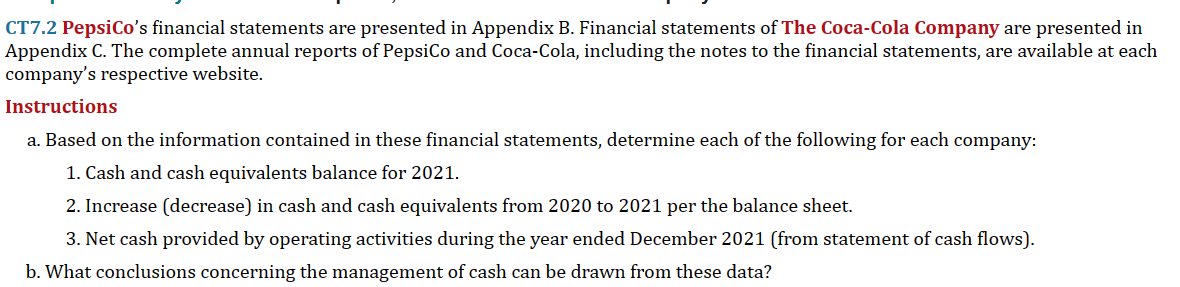

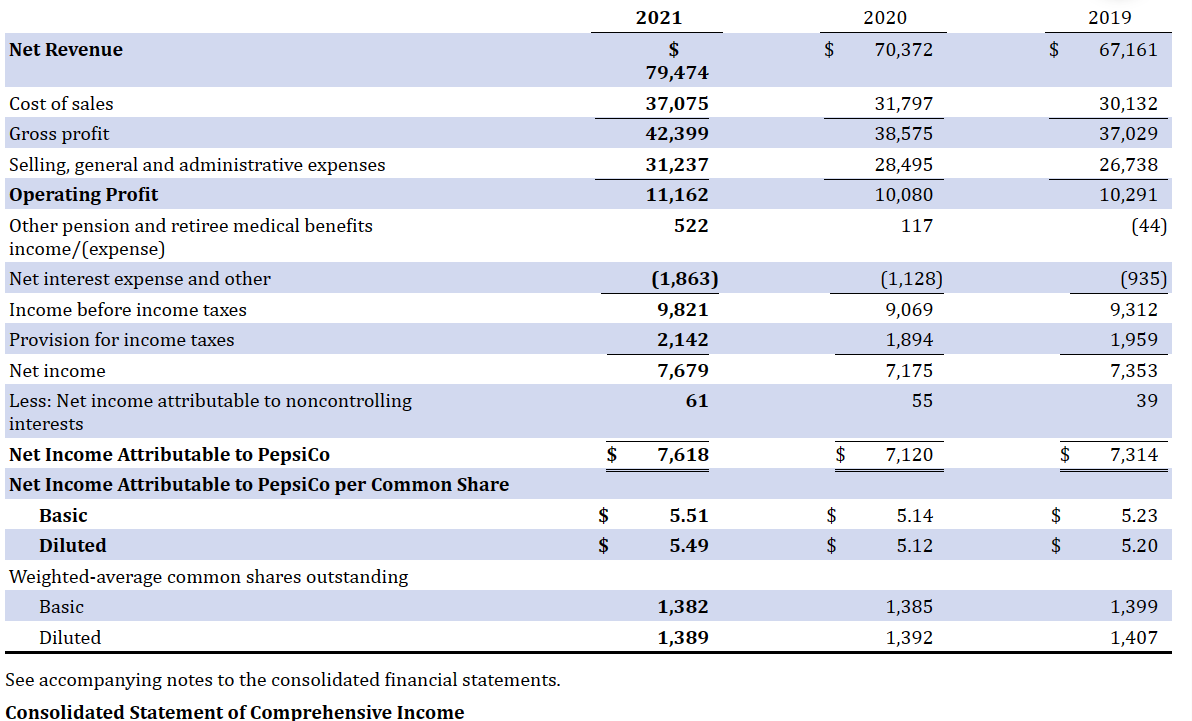

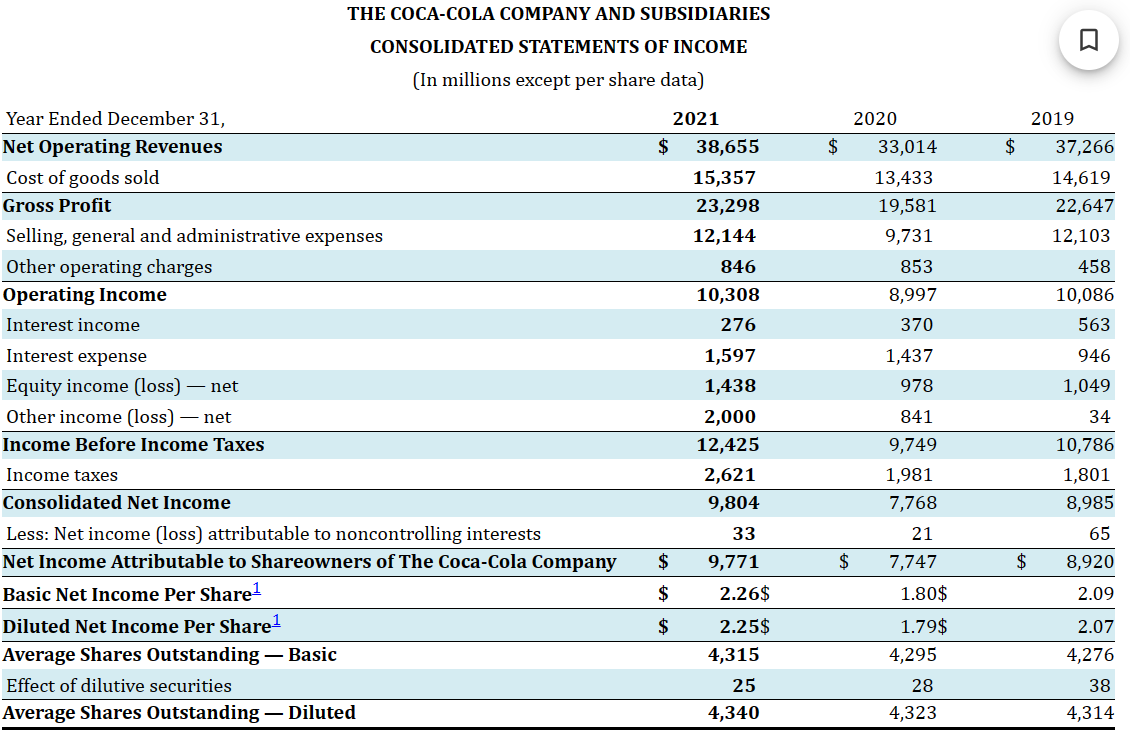

CT7.2 PepsiCo's financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements, are available at each company's respective website. Instructions a. Based on the information contained in these financial statements, determine each of the following for each company: 1. Cash and cash equivalents balance for 2021. 2. Increase (decrease) in cash and cash equivalents from 2020 to 2021 per the balance sheet. 3. Net cash provided by operating activities during the year ended December 2021 (from statement of cash flows). b. What conclusions concerning the management of cash can be drawn from these data? THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per share data) \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Net Revenue } & \multicolumn{2}{|c|}{2021} & \multicolumn{2}{|c|}{2020} & \multicolumn{2}{|c|}{2019} \\ \hline & & \begin{tabular}{c} $ \\ 79,474 \end{tabular} & $ & 70,372 & $ & 67,161 \\ \hline Cost of sales & & 37,075 & & 31,797 & & 30,132 \\ \hline Gross profit & & 42,399 & & 38,575 & & 37,029 \\ \hline Selling, general and administrative expenses & & 31,237 & & 28,495 & & 26,738 \\ \hline Operating Profit & & 11,162 & & 10,080 & & 10,291 \\ \hline \begin{tabular}{l} Other pension and retiree medical benefits \\ income/(expense) \end{tabular} & & 522 & & 117 & & (44) \\ \hline Net interest expense and other & & (1,863) & & (1,128) & & (935) \\ \hline Income before income taxes & & 9,821 & & 9,069 & & 9,312 \\ \hline Provision for income taxes & & 2,142 & & 1,894 & & 1,959 \\ \hline Net income & & 7,679 & & 7,175 & & 7,353 \\ \hline \begin{tabular}{l} Less: Net income attributable to noncontrolling \\ interests \end{tabular} & & 61 & & 55 & & 39 \\ \hline Net Income Attributable to Pepsico & $ & 7,618 & $ & 7,120 & $ & 7,314 \\ \hline \multicolumn{7}{|c|}{ Net Income Attributable to PepsiCo per Common Share } \\ \hline Basic & $ & 5.51 & $ & 5.14 & $ & 5.23 \\ \hline Diluted & $ & 5.49 & $ & 5.12 & $ & 5.20 \\ \hline \multicolumn{7}{|l|}{ Weighted-average common shares outstanding } \\ \hline Basic & & 1,382 & & 1,385 & & 1,399 \\ \hline Diluted & & 1,389 & & 1,392 & & 1,407 \\ \hline \end{tabular} See accompanying notes to the consolidated financial statements. Consolidated Statement of Comprehensive Income

CT7.2 PepsiCo's financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements, are available at each company's respective website. Instructions a. Based on the information contained in these financial statements, determine each of the following for each company: 1. Cash and cash equivalents balance for 2021. 2. Increase (decrease) in cash and cash equivalents from 2020 to 2021 per the balance sheet. 3. Net cash provided by operating activities during the year ended December 2021 (from statement of cash flows). b. What conclusions concerning the management of cash can be drawn from these data? THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per share data) \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Net Revenue } & \multicolumn{2}{|c|}{2021} & \multicolumn{2}{|c|}{2020} & \multicolumn{2}{|c|}{2019} \\ \hline & & \begin{tabular}{c} $ \\ 79,474 \end{tabular} & $ & 70,372 & $ & 67,161 \\ \hline Cost of sales & & 37,075 & & 31,797 & & 30,132 \\ \hline Gross profit & & 42,399 & & 38,575 & & 37,029 \\ \hline Selling, general and administrative expenses & & 31,237 & & 28,495 & & 26,738 \\ \hline Operating Profit & & 11,162 & & 10,080 & & 10,291 \\ \hline \begin{tabular}{l} Other pension and retiree medical benefits \\ income/(expense) \end{tabular} & & 522 & & 117 & & (44) \\ \hline Net interest expense and other & & (1,863) & & (1,128) & & (935) \\ \hline Income before income taxes & & 9,821 & & 9,069 & & 9,312 \\ \hline Provision for income taxes & & 2,142 & & 1,894 & & 1,959 \\ \hline Net income & & 7,679 & & 7,175 & & 7,353 \\ \hline \begin{tabular}{l} Less: Net income attributable to noncontrolling \\ interests \end{tabular} & & 61 & & 55 & & 39 \\ \hline Net Income Attributable to Pepsico & $ & 7,618 & $ & 7,120 & $ & 7,314 \\ \hline \multicolumn{7}{|c|}{ Net Income Attributable to PepsiCo per Common Share } \\ \hline Basic & $ & 5.51 & $ & 5.14 & $ & 5.23 \\ \hline Diluted & $ & 5.49 & $ & 5.12 & $ & 5.20 \\ \hline \multicolumn{7}{|l|}{ Weighted-average common shares outstanding } \\ \hline Basic & & 1,382 & & 1,385 & & 1,399 \\ \hline Diluted & & 1,389 & & 1,392 & & 1,407 \\ \hline \end{tabular} See accompanying notes to the consolidated financial statements. Consolidated Statement of Comprehensive Income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started