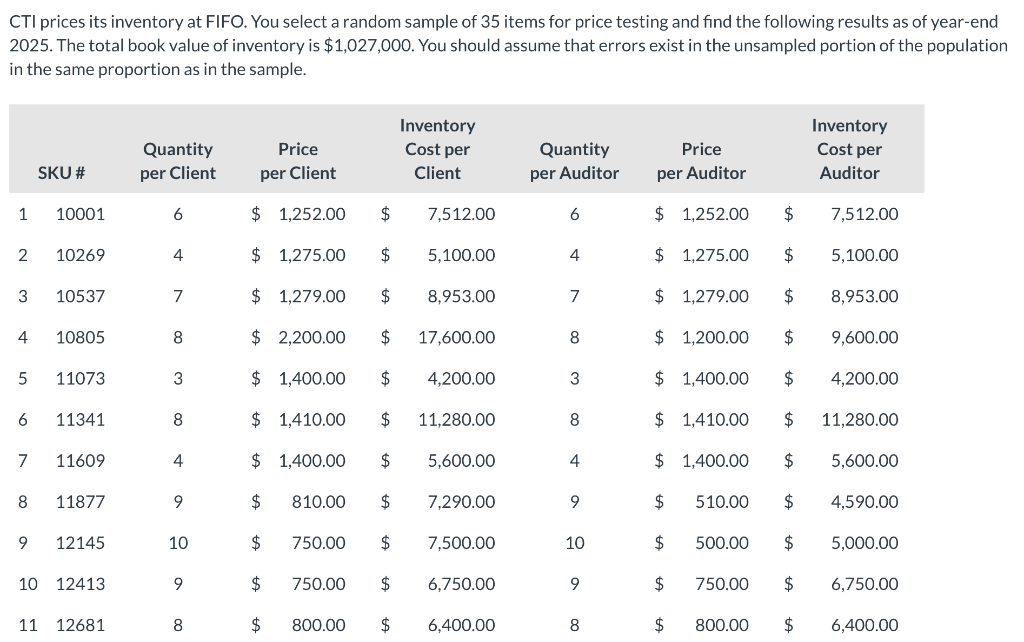

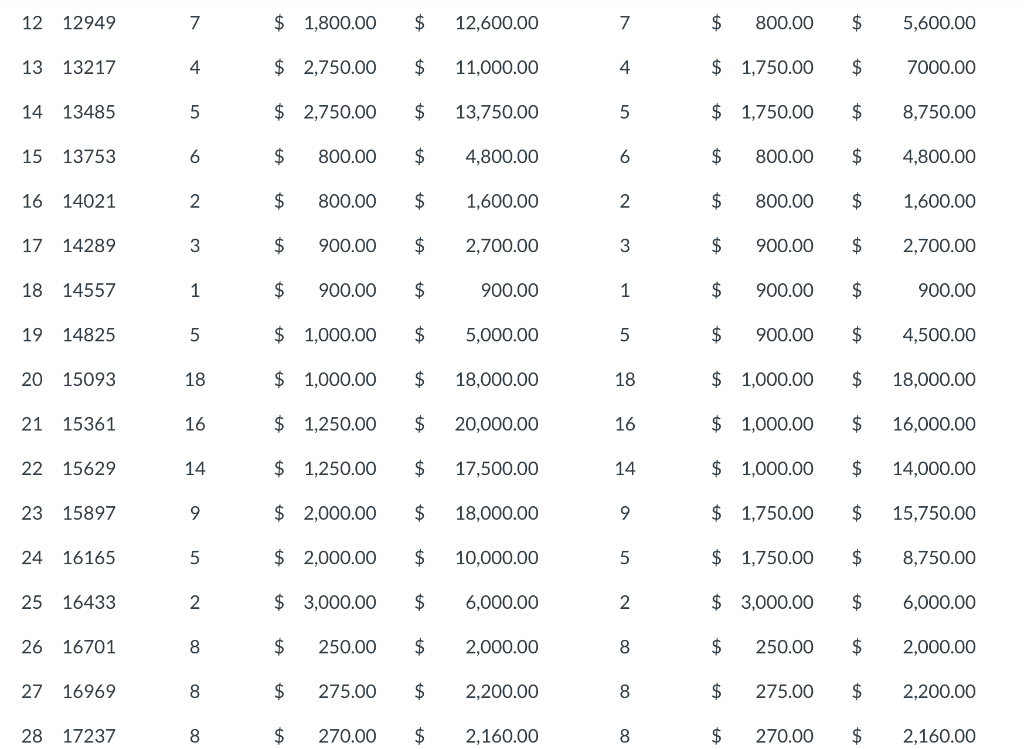

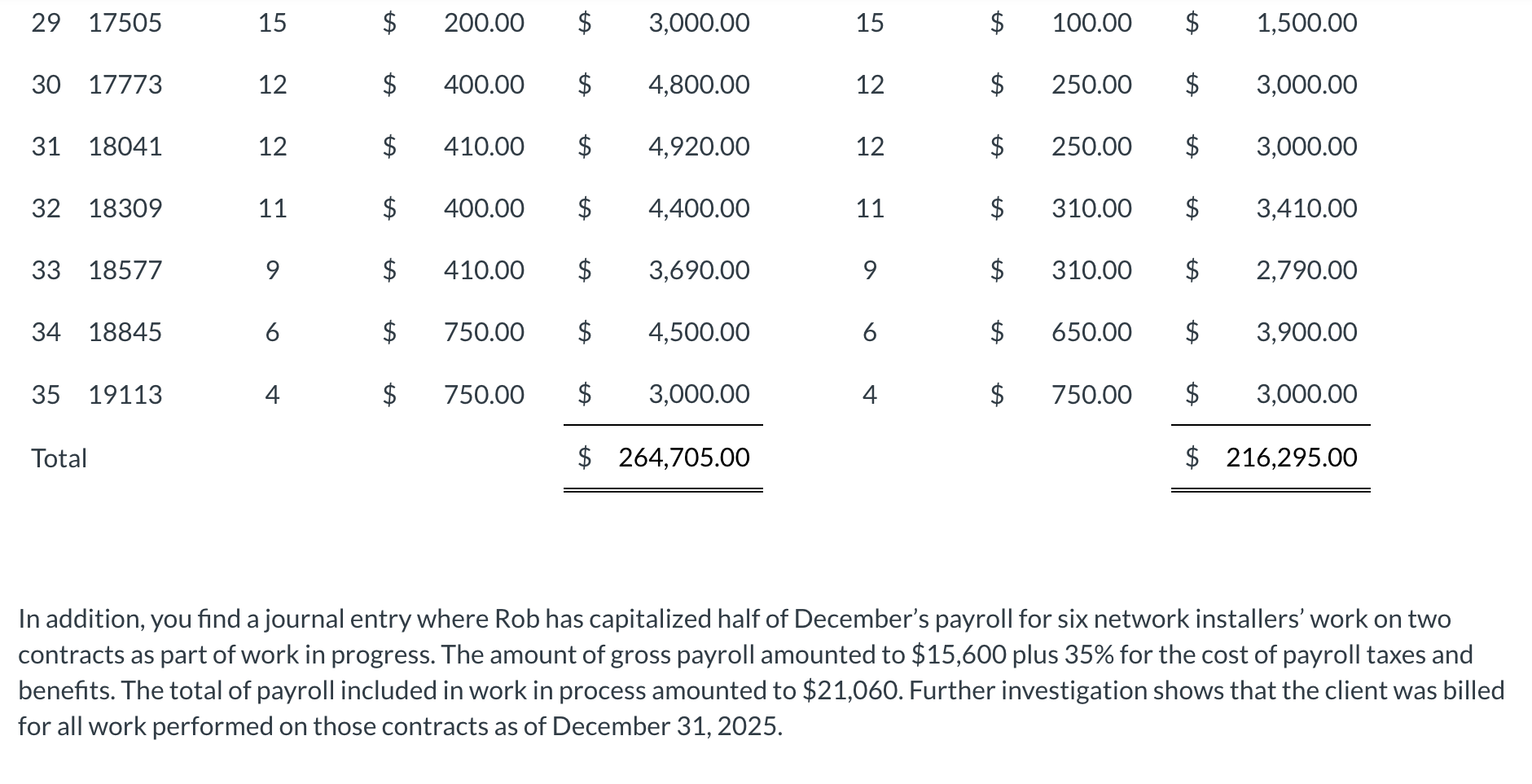

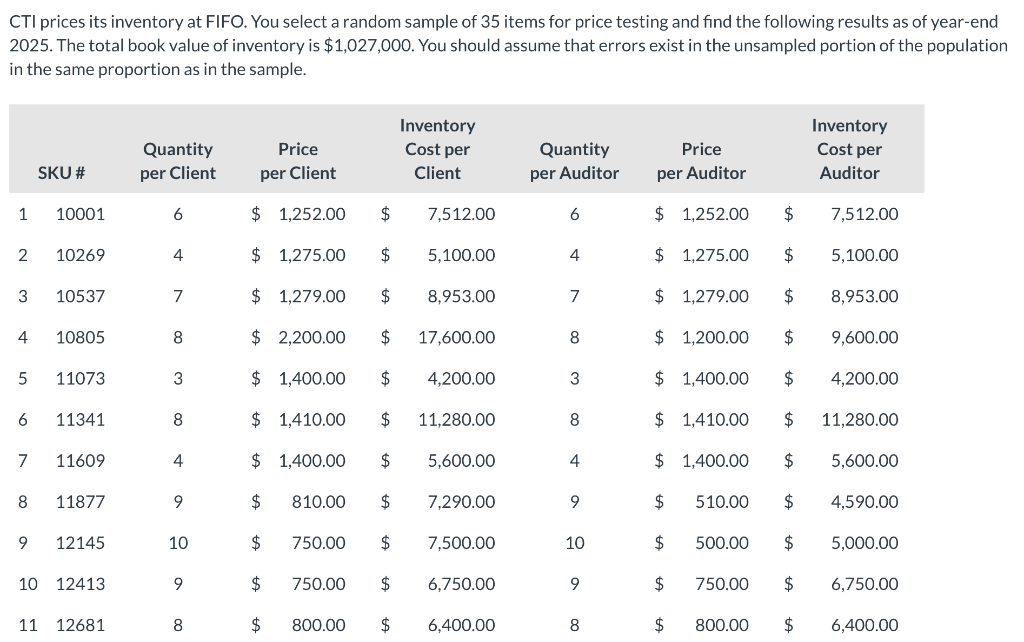

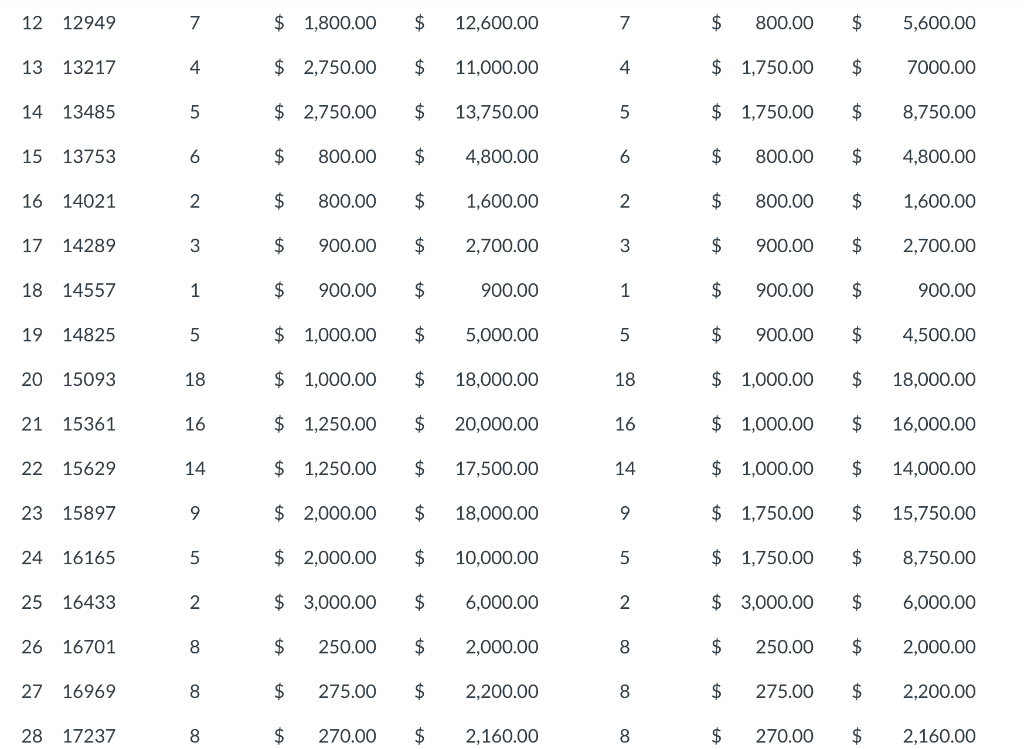

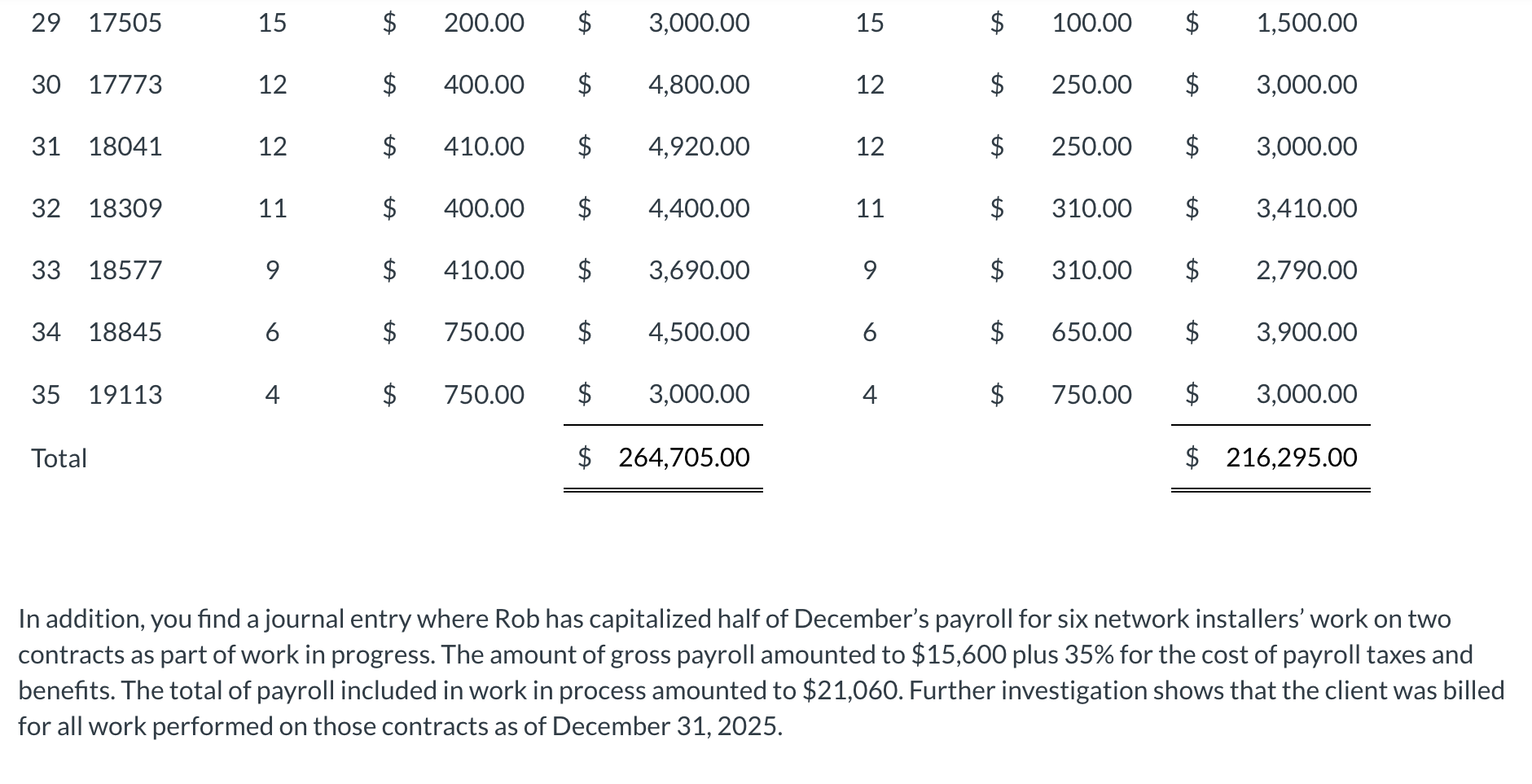

CTI prices its inventory at FIFO. You select a random sample of 35 items for price testing and find the following results as of year-end 2025. The total book value of inventory is $1,027,000. You should assume that errors exist in the unsampled portion of the population in the same proportion as in the sample. In addition, you find a journal entry where Rob has capitalized half of December's payroll for six network installers' work on two contracts as part of work in progress. The amount of gross payroll amounted to $15,600 plus 35% for the cost of payroll taxes and benefits. The total of payroll included in work in process amounted to $21,060. Further investigation shows that the client was billed for all work performed on those contracts as of December 31, 2025. Evaluate the implications of the evidence you noted above. 1. What are the implications of your direct findings for fair presentation in the financial statements? You may assume that it is your best guess that errors found in your sample are representative of errors that would exist in items that you did not sample. 2. Based on your findings, what additional audit procedures should be performed, if any? CTI prices its inventory at FIFO. You select a random sample of 35 items for price testing and find the following results as of year-end 2025. The total book value of inventory is $1,027,000. You should assume that errors exist in the unsampled portion of the population in the same proportion as in the sample. In addition, you find a journal entry where Rob has capitalized half of December's payroll for six network installers' work on two contracts as part of work in progress. The amount of gross payroll amounted to $15,600 plus 35% for the cost of payroll taxes and benefits. The total of payroll included in work in process amounted to $21,060. Further investigation shows that the client was billed for all work performed on those contracts as of December 31, 2025. Evaluate the implications of the evidence you noted above. 1. What are the implications of your direct findings for fair presentation in the financial statements? You may assume that it is your best guess that errors found in your sample are representative of errors that would exist in items that you did not sample. 2. Based on your findings, what additional audit procedures should be performed, if any