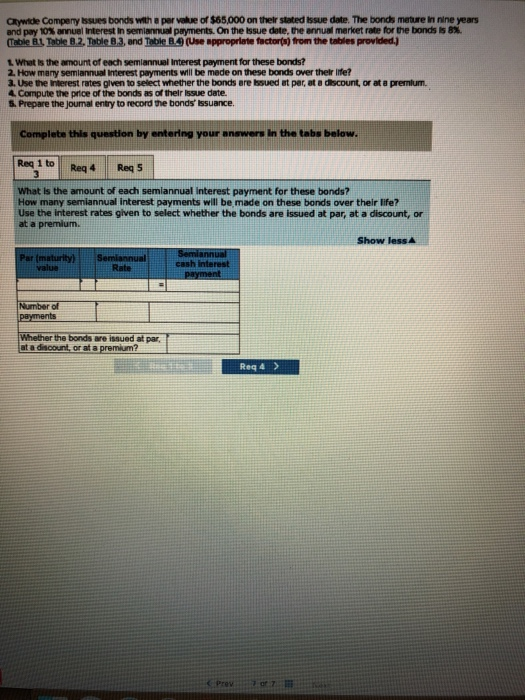

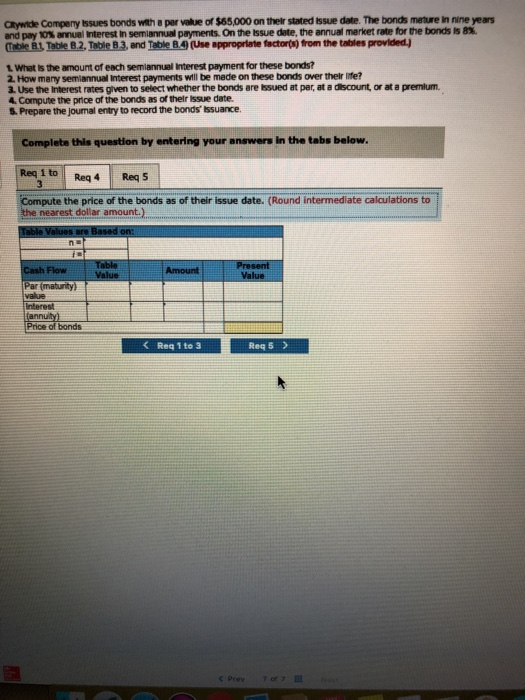

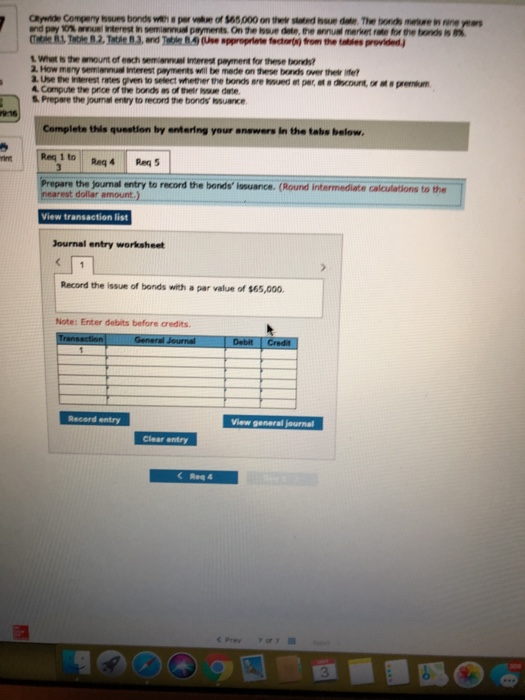

Ctywide Compeny Issues bonds with e per velue of $65,000 on their stated Issue date. The bonds meture in nine years and pay 10x annuel Interest in semiannual payments. On the issue dete, the ennual merket rate for the bonds is 87 (TatieBL Tble LL Tatteaa, ard Tatie.(A9 (u se Bpproprlate factor) from the tables provided.) L What is the amount of each semiannuel Interest payment for these bonds? 2. How many semiannual interest payments will be mede on these bonds over their life? 3.Use the rterest rates given to select whether the bonds are issued per, at a discount, or at a premum. 4.Compute the price ofthe bonds 85 oftheir Issue date. 5 Prepare the journal entry to record he bonds issuance Complete this question by entering your answers in the tabs below Req 1 to Reg 4 Req 5 What is the amount of each semiannual interest payment for these bonds? How many semiannual interest payments will be made on these bonds over their life? Use the interest rates given to select whether the bonds are issued at par, at a discount, or at a premium Show less cash interest Rate Number of Whether the bonds are isaued at par, at a disoount, or at a premium? Req 4 > (Prev 7 or 7 Ctywide Compeny issues bonds with a per value of $65,000 on their stated Iissue date. The bonds meture in nine years and pay 0% anual interest in semiannual payments on the issue date, the annual mereet for the 8% Table 8.1 Table 8.2. Table B.3, and Table B.49 (Use sppropriate factor) from the tables provided) 1 What is the amount of each semiannuel Interest payment for these bonds? 2. How many semiannual Iinterest payments will be mede on these bonds over their life? 3. Use the Interest rates given to select whether the bonds are Issued at par, at a discount, or at a premlum. compute the price ofthe bonds as ofthelr issue date. S. Prepare the journal entry to record the bonds' issuance. Complete this question by entering your answers in the tabs below. Req 1 to Reg 4Req 5 the price of the bonds as of their issue date. (Round intermediate calculations to he nearest dollar amount. Flow value Interest Price of bonds Req 1 to 3 Req 5 and pay 10% anuel Interest in semianal pryments. On the issue dete, the annual merket rate for the bonds .veut ltithearno nt of each sermannana merest paymentfor these bonds? 2 How meny semianual interest payments will be mede on these bonds over their life? 4 Compute the prioe of the bonds as of their haue dete S Prepare the yournal entry to record the bonds tsuance Complete this question by entering your answers in the tabs below Req 1 to Reg 4 Req 5 are the yournal entry to record the bonds liesuance. (Round Intermediate caiculations to the dollar View transaction list Journal entry worksheet Record the issue of bonds with a par value of $65,000 Note: Enter debits before credits. Record entry View general journal Clear entry CPrey 707 3