Cullen/Frost Bankers, Inc. (NYSE: CFR)

Based on all of the Information below, do you predict that Cullen/Frost Bankers, Inc. company's stock will rise or fall in the succeeding week? Why?

Please share observations

There is no defined methodology to arrive at a prediction. This is solely opinion based on the attached information and also taking into account the current real world economic climate. Thanks

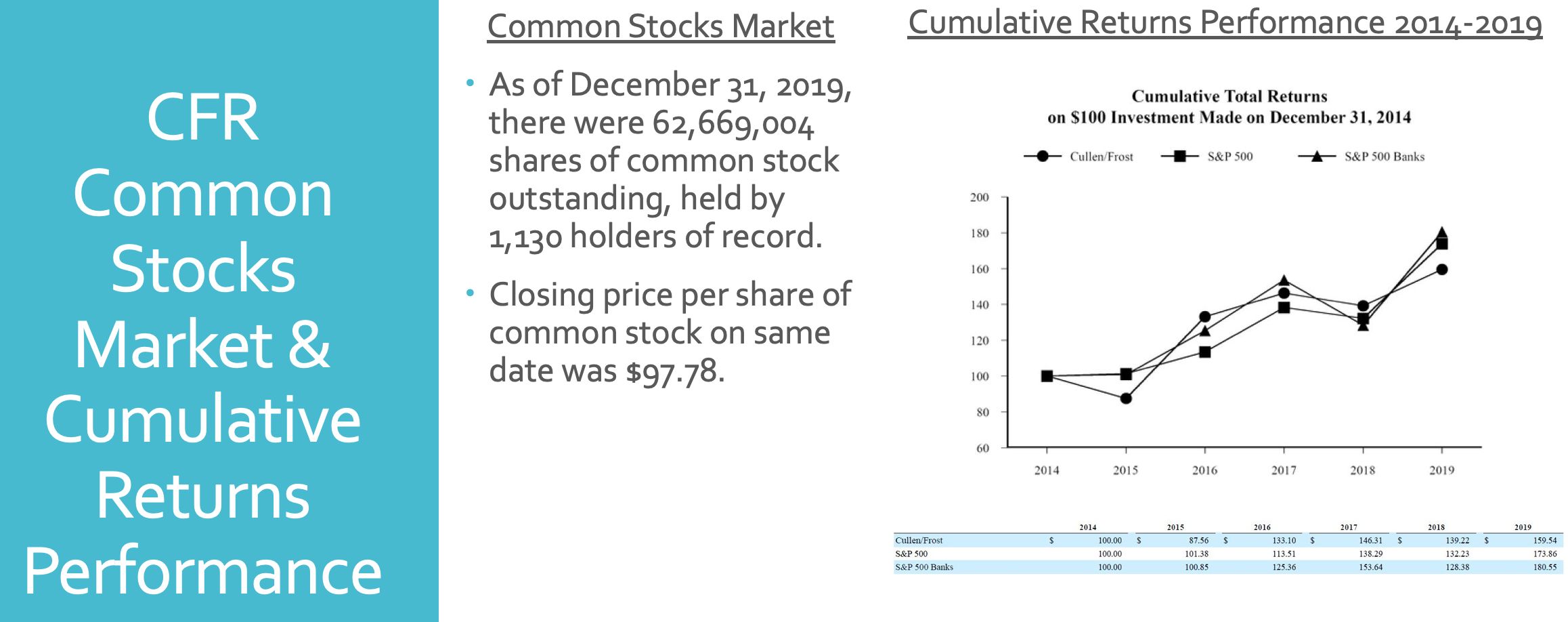

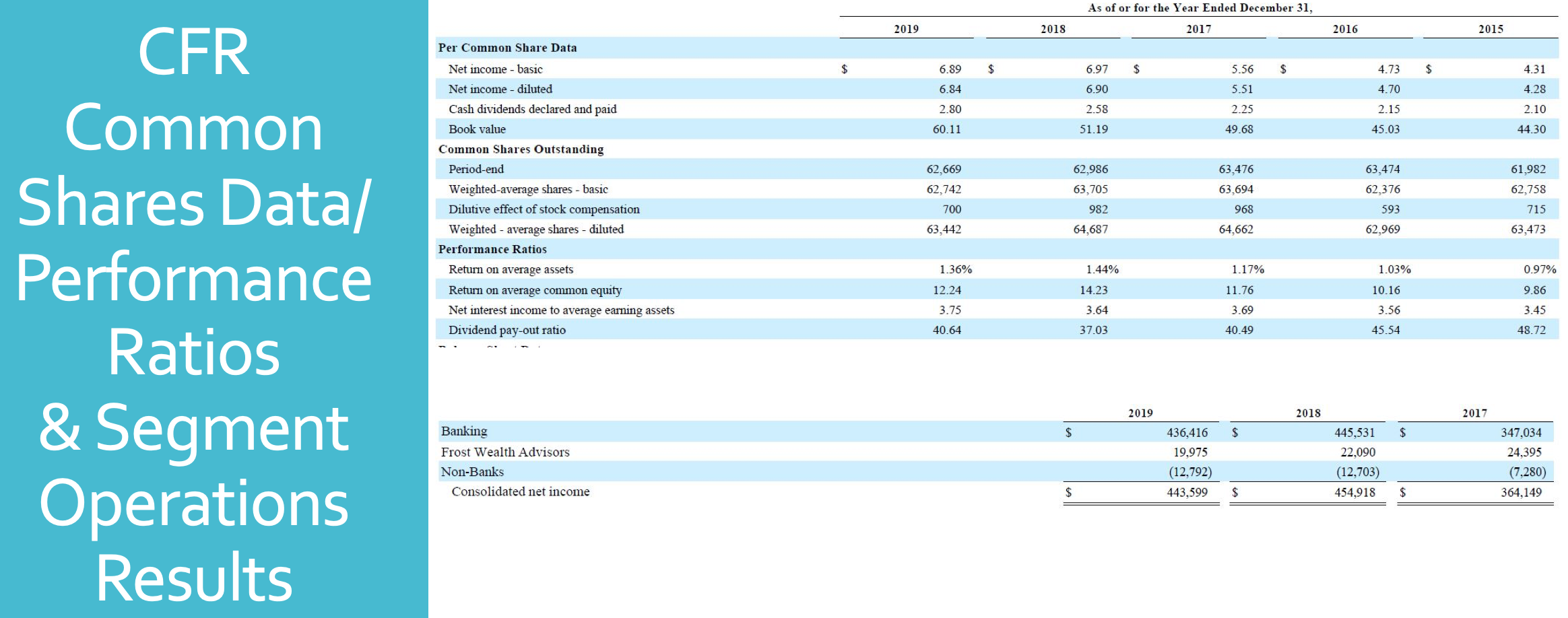

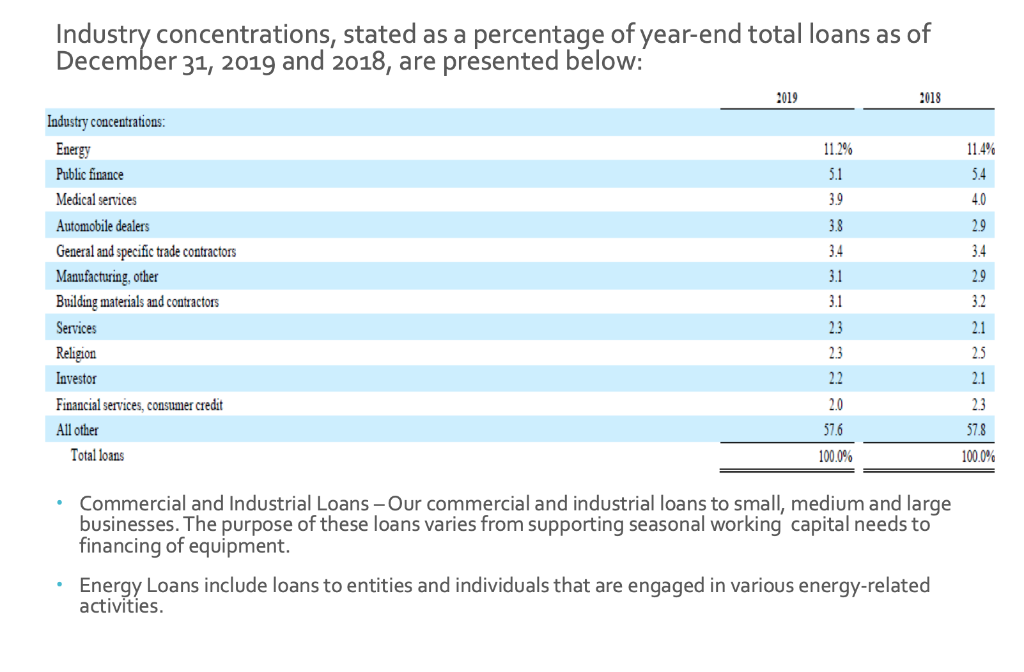

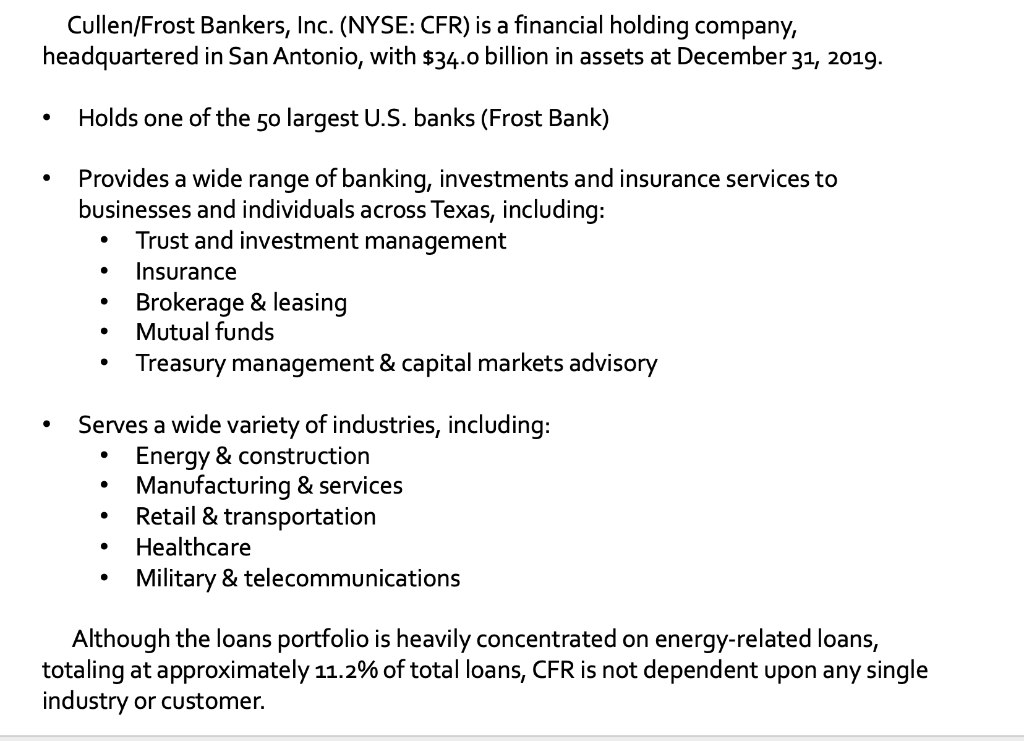

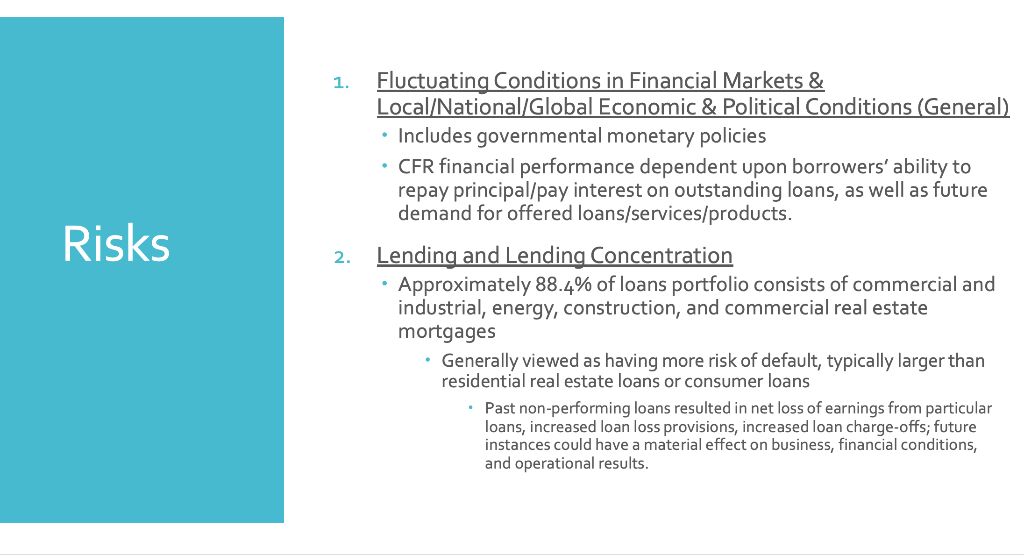

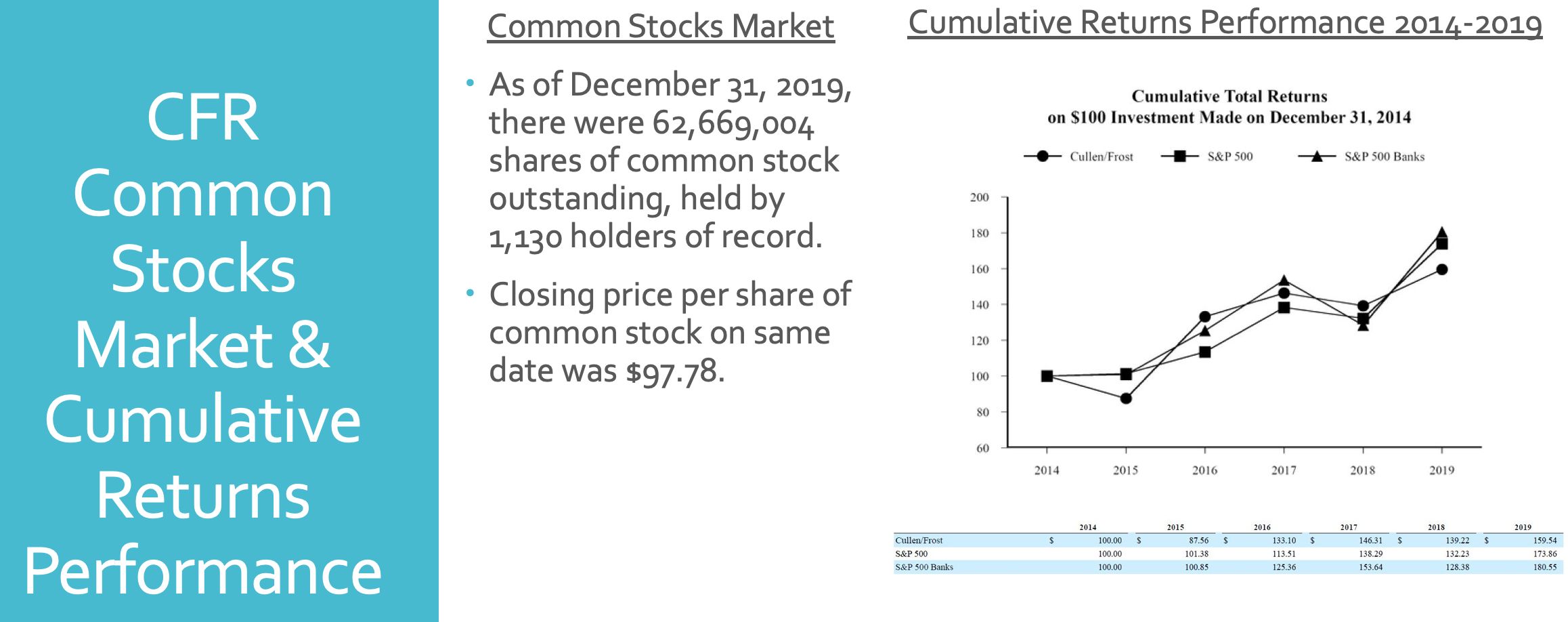

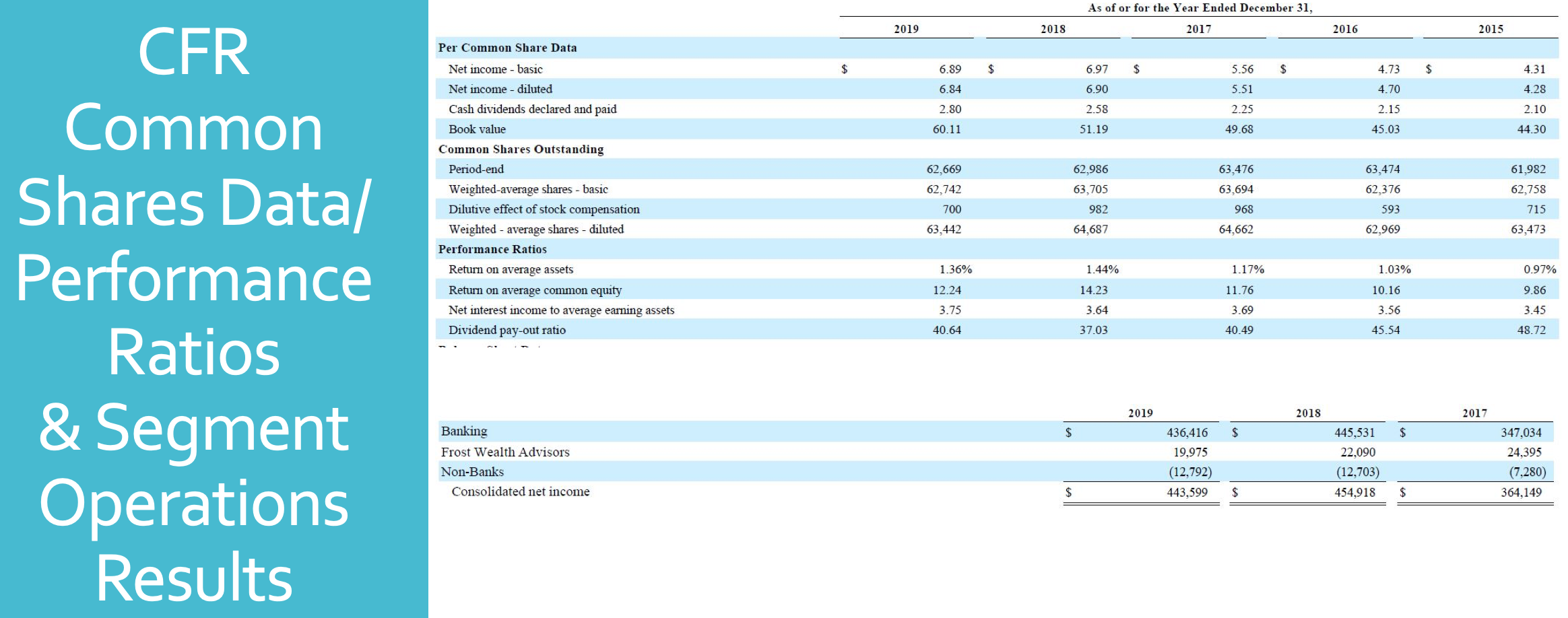

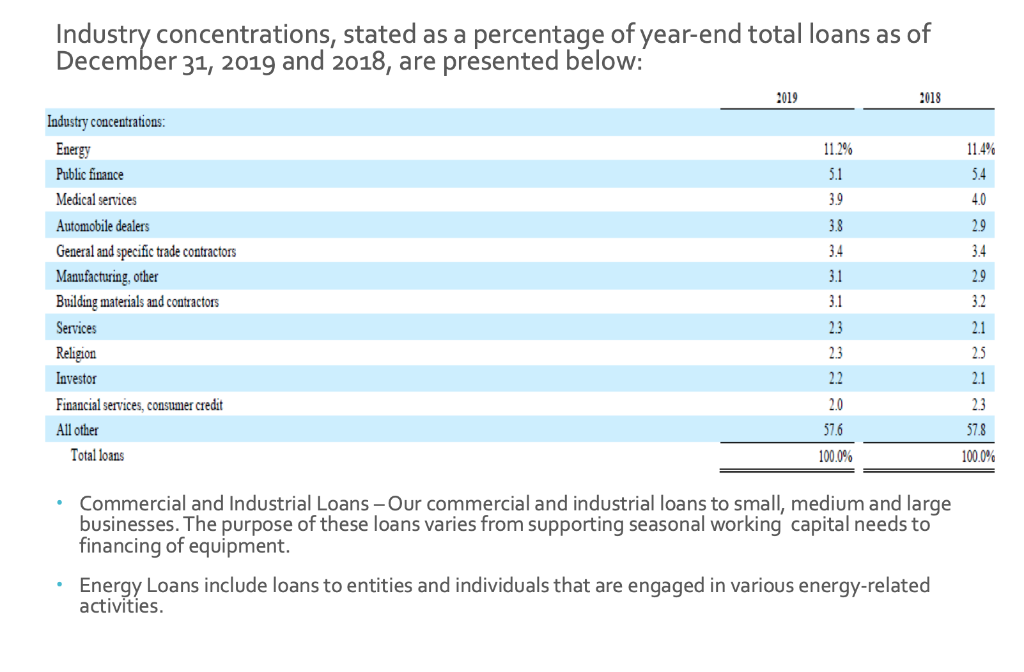

Cullen/Frost Bankers, Inc. (NYSE: CFR) is a financial holding company, headquartered in San Antonio, with $34.0 billion in assets at December 31, 2019. Holds one of the 50 largest U.S. banks (Frost Bank) Provides a wide range of banking, investments and insurance services to businesses and individuals across Texas, including: Trust and investment management Insurance Brokerage & leasing Mutual funds Treasury management & capital markets advisory Serves a wide variety of industries, including: Energy & construction Manufacturing & services Retail & transportation Healthcare Military & telecommunications Although the loans portfolio is heavily concentrated on energy-related loans, totaling at approximately 11.2% of total loans, CFR is not dependent upon any single industry or customer. 1. Fluctuating Conditions in Financial Markets & Local/National/Global Economic & Political Conditions General) Includes governmental monetary policies CFR financial performance dependent upon borrowers' ability to repay principal/pay interest on outstanding loans, as well as future demand for offered loans/services/products. Risks Lending and Lending Concentration Approximately 88.4% of loans portfolio consists of commercial and industrial, energy, construction, and commercial real estate mortgages Generally viewed as having more risk of default, typically larger than residential real estate loans or consumer loans Past non-performing loans resulted in net loss of earnings from particular loans, increased loan loss provisions, increased loan charge offs; future instances could have a material effect on business, financial conditions, and operational results. Common Stocks Market Cumulative Returns Performance 2014-2019 CFR Cumulative Total Returns on $100 Investment Made on December 31, 2014 Cullen/Frost S&P 500 S&P 500 Banks Common Stocks Market & Cumulative Returns Performance As of December 31, 2019, there were 62,669,004 shares of common stock outstanding, held by 1,130 holders of record. Closing price per share of common stock on same date was $97.78. 2014 2015 2016 2017 2018 2019 2019 $ $ $ $ $ $ Cullen Frost S&P 500 S&P 500 Banks 2014 100.00 100.00 100.00 2015 87.56 101.38 100.85 2016 133.10 113.51 125.36 2017 146.31 138.29 153.64 2018 139.22 132.23 128.38 159.54 173.86 180.55 As of or for the Year Ended December 31, 2017 2019 2018 2016 2015 6.89 $ $ $ $ Per Common Share Data Net income - basic Net income - diluted Cash dividends declared and paid Book value 6.97 6.90 6.84 5.56 5.51 2.25 49.68 4.73 4.70 2.15 45.03 4.31 4.28 2.10 44.30 2.58 2.80 60.11 51.19 Common Shares Outstanding 62,669 62,742 700 62,986 63,705 982 64,687 63,476 63,694 968 64,662 63,474 62,376 593 62,969 61,982 62,758 715 63,473 63.442 CFR Common Shares Data/ Performance Ratios & Segment Operations Results Period-end Weighted average shares - basic Dilutive effect of stock compensation Weighted - average shares - diluted Performance Ratios Return on average assets Return on average common equity Net interest income to average earning assets Dividend pay-out ratio 1.36% 12.24 3.75 40.64 1.44% 14.23 3.64 1.17% 11.76 3.69 40.49 1.03% 10.16 3.56 45.54 0.97% 9.86 3.45 37.03 48.72 2019 2018 2017 $ $ $ Banking Frost Wealth Advisors Non-Banks Consolidated net income 436,416 19,975 (12,792) 443,599 445,531 22,090 (12,703) 454,918 347,034 24,395 (7,280) 364,149 $ $ FORWARD-LOOKING STATEMENTS AND FACTORS THAT COULD AFFECT FUTURE RESULTS Local, regional, national and international economic conditions and the impact they may have on us and our customers and our assessment of that impact. Volatility and disruption in national and international financial and commodity markets. Government intervention in the U.S. financial system. Changes in the mis of loan geographies, sectors and types or the level of non-performing assets and charge-offs. Inflation, interest rate, securities market and monetary fluctuations. The soundness of other financial institutions. Political Instability Acts of God or of war or terrorism. Industry concentrations, stated as a percentage of year-end total loans as of December 31, 2019 and 2018, are presented below: 2019 2018 11.4% 11.2% 5.1 5.4 4.0 3.9 Industry concentrations: Energy Public finance Medical services Automobile dealers General and specific trade contractors Manufacturing, other Building materials and contractors Services Religion Investor Financial services, consumer credit All other Total loans 23 2.0 57.6 100.0% 57.8 100.0% Commercial and Industrial Loans - Our commercial and industrial loans to small, medium and large businesses. The purpose of these loans varies from supporting seasonal working capital needs to financing of equipment. Energy Loans include loans to entities and individuals that are engaged in various energy-related activities. CFR although in fair-weather conditions has historically proven to be a stable investment, they have begun to demonstrate some concerns in the value of their stock. With recent fluctuations in the Discount Rates and the feds buying up Mortgage Backed Securities blockages are created in lenders pipelines. CFR would normally be in good position because of a very diverse portfolio apart from energy investments but the global market is stressed, and a clear outcome is not yet in sight. We would expect that CFR will sustain its current value or rise slightly with in a week's time remaining between 69-72 per share. Conclusion