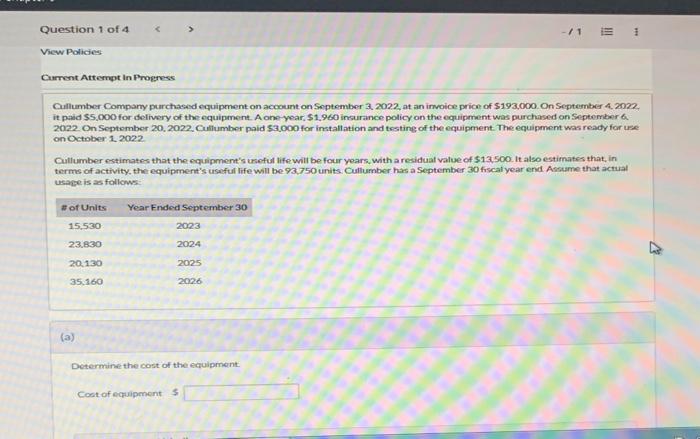

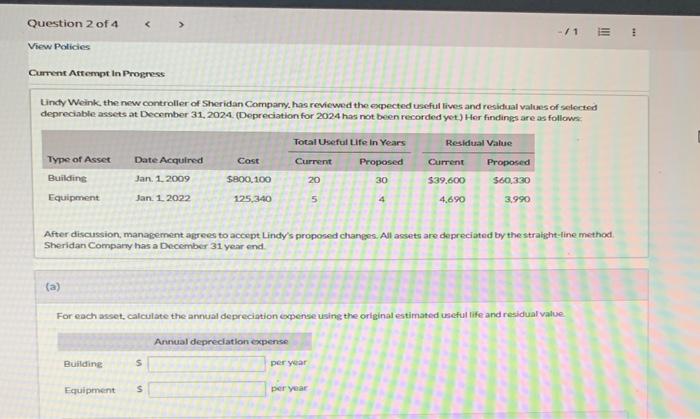

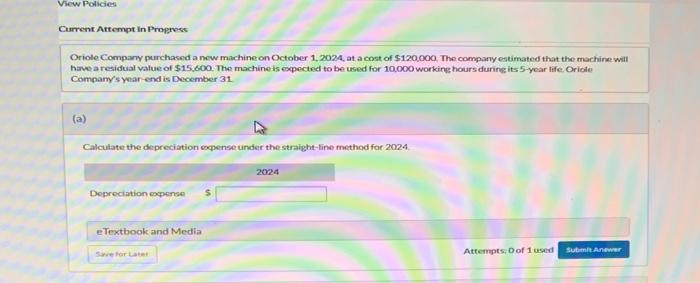

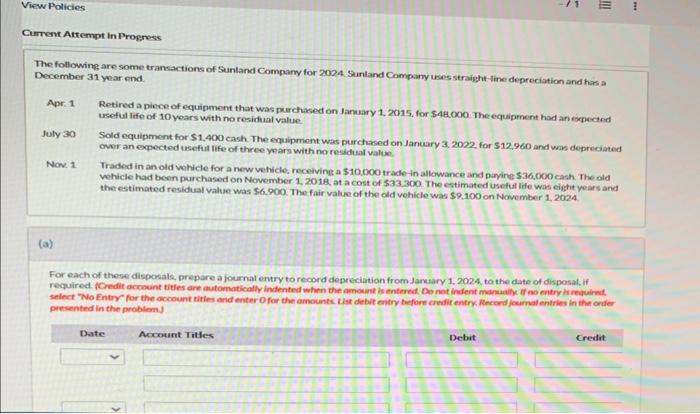

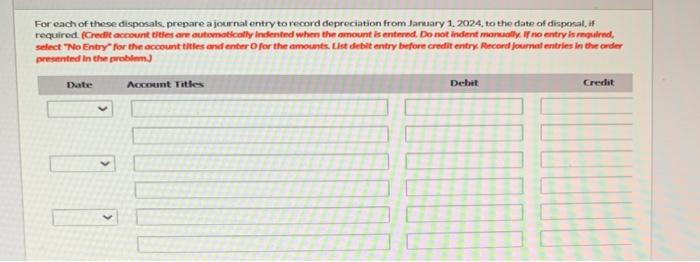

Cullumber Compamy purchaced equipenent on account on September 3. 202.2, at an imvoice price of 5193,000 . On September 4. 2022. it paid $5,000 for delivery of the equipment. A one-year, $1.960 insurance policy on the equipment was purchased on September 6 . 2022 On September 20, 2022 . Cullumber paid 53.000 for installation and tssting of the equipment. The equipment was reacy for use on October 1. 2022 . Cullumber erstimates that the equipment's urseful life will be four years, with a residual value of 513 , 500 . It also estifnates that, in terms of activity, the equipment's useful life will be 93.750 units. Cullumber has a September 30 fiscal year end Assurme that actual usage is as follows: (a) Determine the cost of the equiprnent: Cost of equipenent 5 Cumtent Affernpt in Progress Wincty Weink, the nwew controlier of Sheridan Compary, has reviewed the expected useful lives and residual valuns of selected depreciable assets at December 31, 2024 . (Depreciation for 2024 hass not been recorded yet.) Her fifidings are as follows: After discussion, managemant agrees, to accept Lindy's proposed chapgers. All assets are depreciated by the straight-tine method Sheridar Comparyy has a Decomber 31 year end. (a) For each asset, calculate the anrual depreciation expense using the original estimated useful life and residual value. Oriole Ciompary purchased a new machine on October 1, 2024, at a cost of 5120,000 , The comparyy estimated that the machirne will have a residual value of $15.600. The machine is expected to be used for 10.000 working hours during its 5 -year tife. Oriofe Compary's youar-end is December 31 . (a) Calculate the depreciation expense urder the stralght-line method for 2024. e Textbook arsd Mecdia The following are some transactions of Sunland Compary for 2004 . Sunland Compary uses straight-line depreciation and hars a Deceember 31 year end. Apr: 1 Retired a piece of equipment that was purchased on Jaruary 1, 2015, for \$4t.000 The equiprnent had an expected useful life of 10 years with no residual value. July 30 Scld equipment for $1,400cash. The equipment was purchused on January 3 , 2022 , for 512,960 and was depreciated ower an expected useful life of three years with no residual value. Non. 1. Traded in an old wehicle for a new whicle, receiving a 510.000 trade in allewance and payires 536,000 cach. The old Whicle had beon purchased on Novernber 1, 2018, at a cost of 533 , 300. The estimated useftal life was eight years and the estimated residual value was $6,900. The fair value of the old vehicle was $9,109 on November 1,20224. (a) For each of these disposals, prepare a fournal entry to record depreciation from lanuary 1,2024 , to the date of disposat, if required. Fredit accocant titles are automatically indented when the amount is entered. Do not indent milraaily. If no entry is requirne. select "No Entry" for the accoount titles and enter O for the armounts. Lis debit entry bicfore credit entry, Recend journat entries in that oriler presented in the problem) For each of these disporsals, prepare a journal entry to record depreciation from lanuary 1, 2024 , to the dite of disperal, if required. fCredit account titles are autiomatically indenfed when the amount is eniternd. Do not indent mansally If no entry is reculrnd. selest. "No Entry" for the aceount titles and enter 0 for the amounts. Llet defil entry before credit entry. Receret journut entries in the order presinted in the problems