Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Culver Corporation, a publicly-traded company, agreed to loan money to another company. On July 1, 2023, the company received a five-year promissory note with a

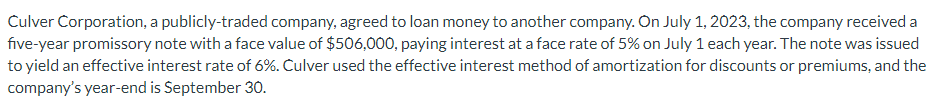

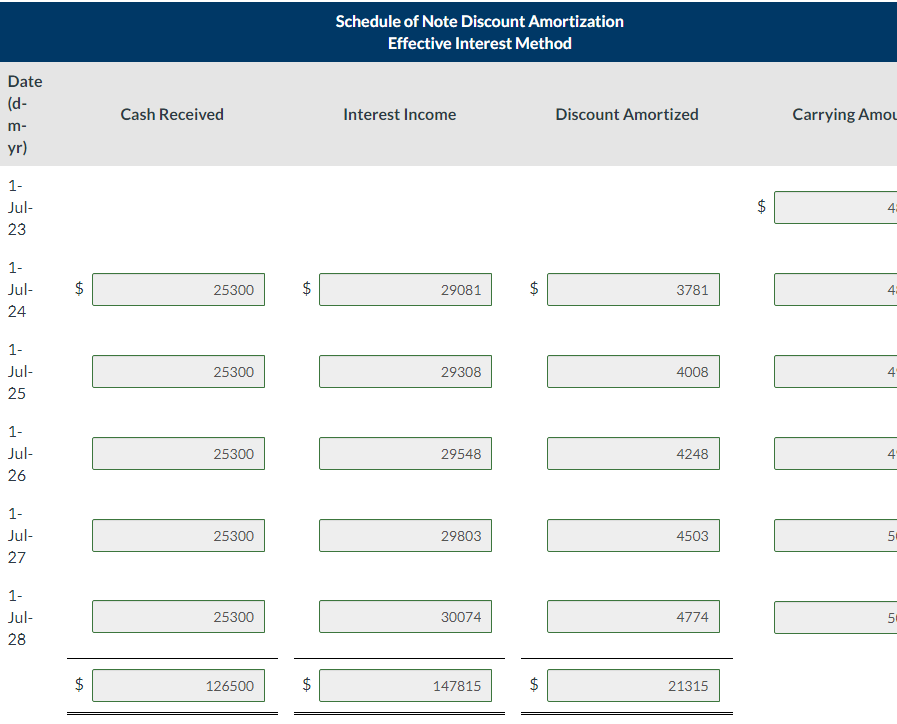

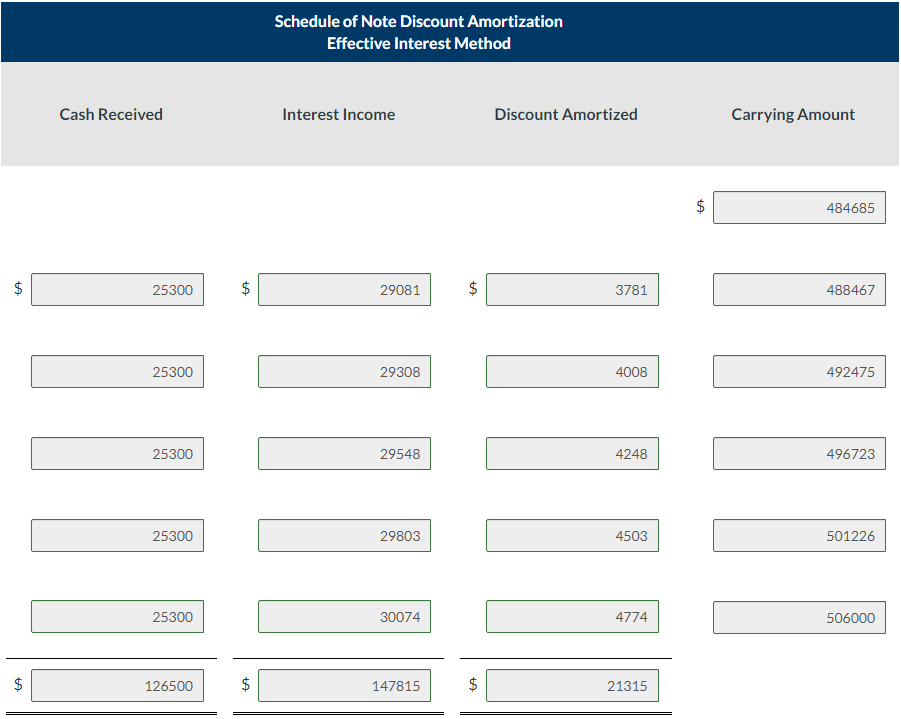

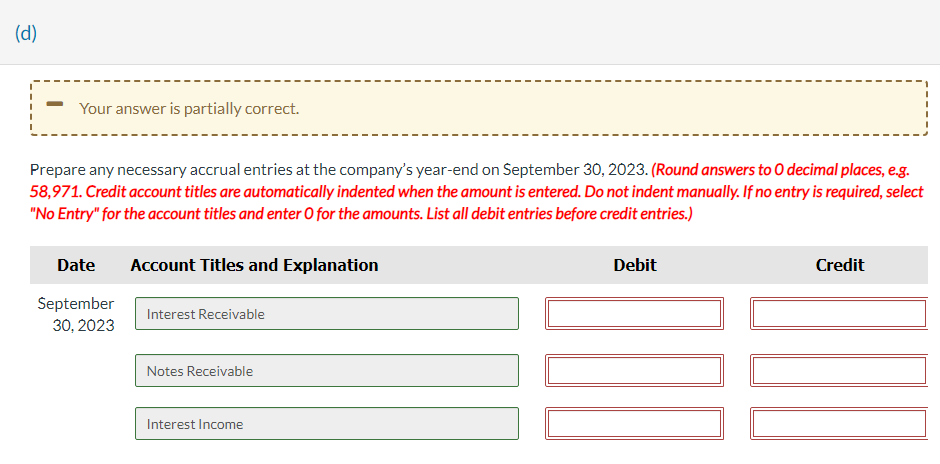

Culver Corporation, a publicly-traded company, agreed to loan money to another company. On July 1, 2023, the company received a five-year promissory note with a face value of $506,000, paying interest at a face rate of 5% on July 1 each year. The note was issued to yield an effective interest rate of 6%. Culver used the effective interest method of amortization for discounts or premiums, and the company's year-end is September 30. Schedule of Note Discount Amortization Effective Interest Method Date (d- Cash Received Interest Income Discount Amortized Carrying Amo yr) 1 Jul- 23 1 Jul- 25300 25300 25300 25300 $ 3781 $ 4 1 Jul- 26 1 Jul- 27 1- Jul- 28 Schedule of Note Discount Amortization Effective Interest Method Cash Received Interest Income 29803 Discount Amortized $ Carrying Amount 501226 506000 Your answer is correct. Prepare the journal entries to record the issue of the note on July 1, 2023. (Round answers to 0 decimal places, e.g. 58,971. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Prepare any necessary accrual entries at the company's year-end on September 30, 2023. (Round answers to 0 decimal places, e.g. 58,971 . Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Culver Corporation, a publicly-traded company, agreed to loan money to another company. On July 1, 2023, the company received a five-year promissory note with a face value of $506,000, paying interest at a face rate of 5% on July 1 each year. The note was issued to yield an effective interest rate of 6%. Culver used the effective interest method of amortization for discounts or premiums, and the company's year-end is September 30. Schedule of Note Discount Amortization Effective Interest Method Date (d- Cash Received Interest Income Discount Amortized Carrying Amo yr) 1 Jul- 23 1 Jul- 25300 25300 25300 25300 $ 3781 $ 4 1 Jul- 26 1 Jul- 27 1- Jul- 28 Schedule of Note Discount Amortization Effective Interest Method Cash Received Interest Income 29803 Discount Amortized $ Carrying Amount 501226 506000 Your answer is correct. Prepare the journal entries to record the issue of the note on July 1, 2023. (Round answers to 0 decimal places, e.g. 58,971. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Prepare any necessary accrual entries at the company's year-end on September 30, 2023. (Round answers to 0 decimal places, e.g. 58,971 . Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started