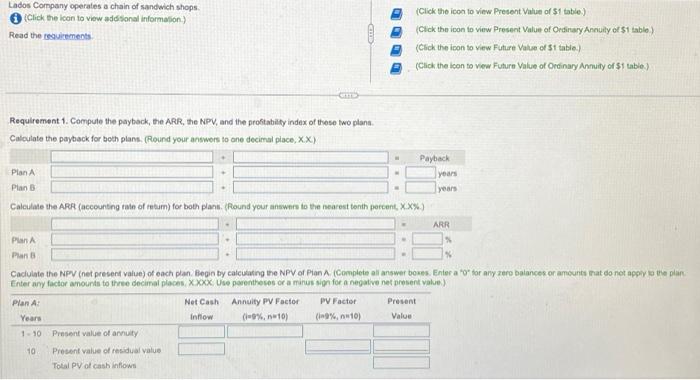

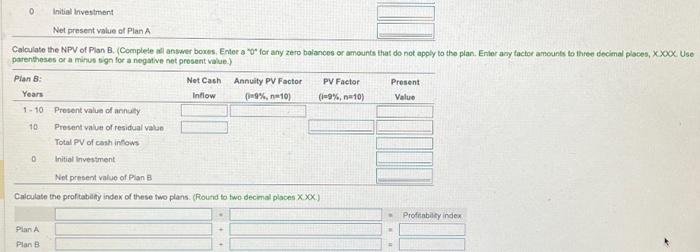

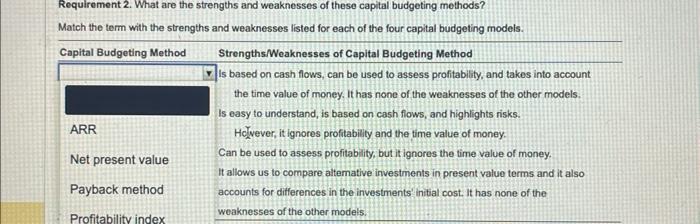

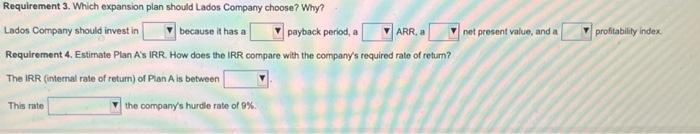

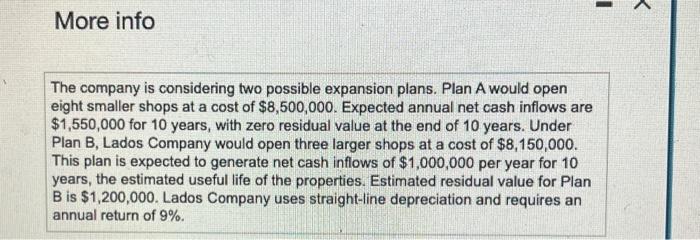

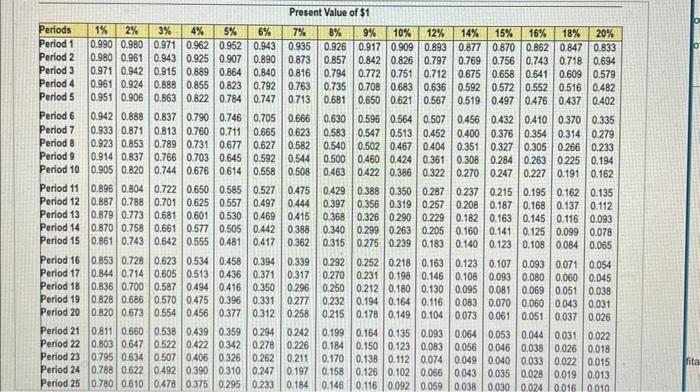

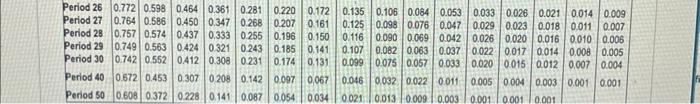

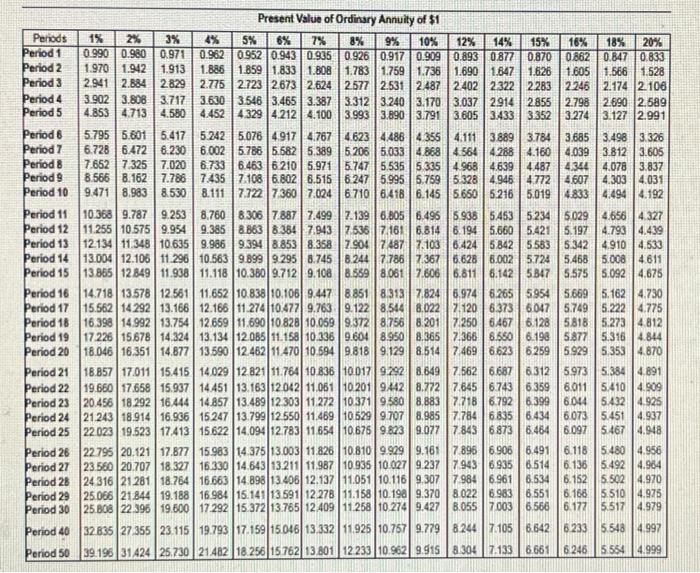

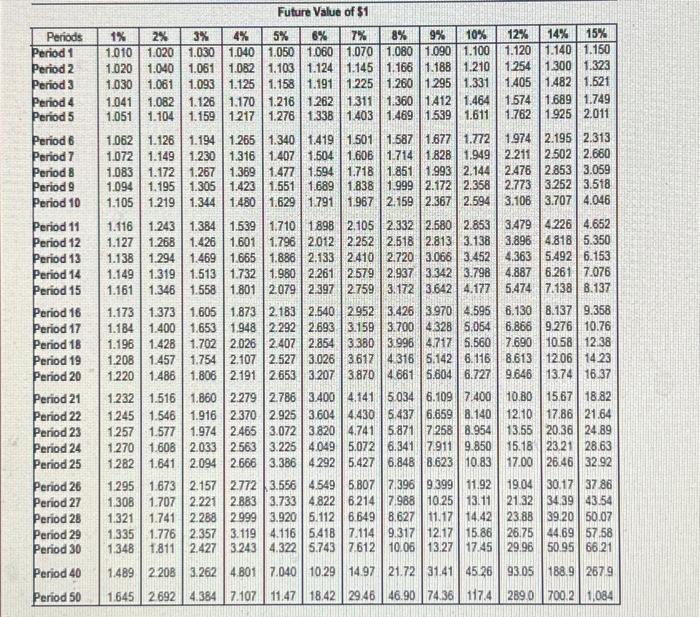

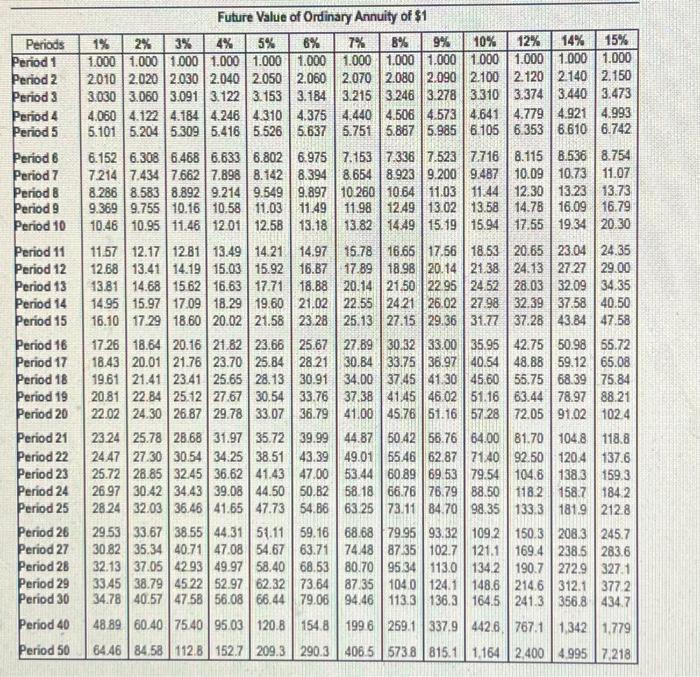

Lados Company operates a chain of sandwich shops (Click the icon to viow addsonal informafion) Read the tequirements (Click the icon to view Present Value of \$1 table) (Clck the icon to view Present Value of Ordinary Annuly of \$1 table) (Click the icon to view Future Vatue of $1 tabie) (Click the icon to vea Future Value of Ordinary/Annuly of \$1 tabie) Requirement 1. Compule the payback, the ARR, the NPV, and the profitabily index of these two plana Caloulate the payback for beth plans. Round your answers to one decimal piace, x ) 0. Initial Investment Net present value of Plan A parentheses or a minus sign for a negative net prosent value.) Cilculate the proftabafify index of these two plans. (Round to two decimal places x ). Requirement 2. What are the strengths and weaknesses of these capital budgeting methods? Match the term with the strengths and weaknesses listed for each of the four capital budgeting model Requirement 3. Which expansion plan should Lados Company choose? Why? Lados Company should invest in because it has a payback period, a ARR, a net present value, and a profitability index Requirement 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of retum? The IRR (internal rate of return) of Plan A is between This rate the company/s hurdle rate of 9%. More info The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,500,000. Expected annual net cash inflows are $1,550,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Lados Company would open three larger shops at a cost of $8,150,000. This plan is expected to generate net cash inflows of $1,000,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $1,200,000. Lados Company uses straight-line depreciation and requires an annual return of 9%. Prosent Value of $1 \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|l|l|l|l|l|} Period 26 & 0.772 & 0.598 & 0.464 & 0.361 & 0.281 & 0.220 & 0.172 & 0.135 & 0.106 & 0.064 & 0.053 & 0.033 & 0.026 & 0.021 & 0.014 & 0.009 \\ Period 27 & 0.764 & 0.586 & 0.450 & 0.347 & 0.268 & 0.207 & 0.161 & 0.125 & 0.098 & 0.076 & 0.047 & 0.029 & 0.023 & 0.018 & 0.011 & 0.007 \\ Period 28 & 0.757 & 0.574 & 0.437 & 0.333 & 0.255 & 0.196 & 0.150 & 0.116 & 0.090 & 0.069 & 0.042 & 0.026 & 0.020 & 0.016 & 0.010 & 0.006 \\ Period 29 & 0.749 & 0.563 & 0.424 & 0.321 & 0.243 & 0.185 & 0.141 & 0.107 & 0.082 & 0.063 & 0.037 & 0.022 & 0.017 & 0.014 & 0.008 & 0.005 \\ Period 30 & 0.742 & 0.552 & 0.412 & 0.308 & 0.231 & 0.174 & 0.131 & 0.099 & 0.075 & 0.057 & 0.033 & 0.020 & 0.015 & 0.012 & 0.007 & 0.004 \\ Period 40 & 0.572 & 0.453 & 0.307 & 0.208 & 0.142 & 0.097 & 0.067 & 0.046 & 0.032 & 0.022 & 0.011 & 0.005 & 0.004 & 0.003 & 0.001 & 0.001 \\ \hline Period 50 & 0.608 & 0.372 & 0.228 & 0.141 & 0.087 & 0.054 & 0.034 & 0.021 & 0.013 & 0.009 & 0.003 & 0.001 & 0.001 & 0.001 & & & \end{tabular} Future Value of \$1