Question

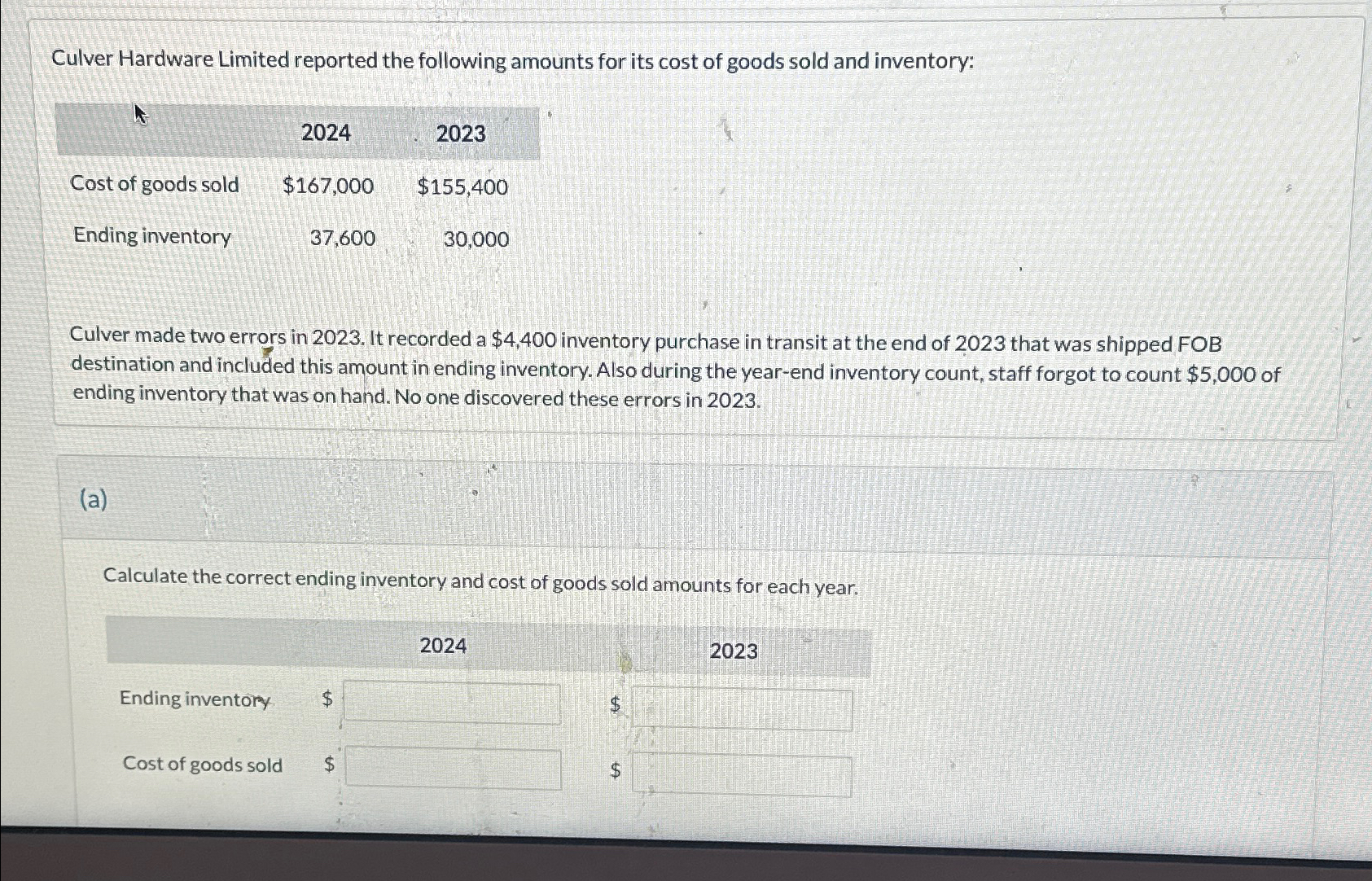

Culver Hardware Limited reported the following amounts for its cost of goods sold and inventory: 2024 2023 Cost of goods sold $167,000 $155,400 Ending

Culver Hardware Limited reported the following amounts for its cost of goods sold and inventory: 2024 2023 Cost of goods sold $167,000 $155,400 Ending inventory 37,600 30,000 Culver made two errors in 2023. It recorded a $4,400 inventory purchase in transit at the end of 2023 that was shipped FOB destination and included this amount in ending inventory. Also during the year-end inventory count, staff forgot to count $5,000 of ending inventory that was on hand. No one discovered these errors in 2023. (a) Calculate the correct ending inventory and cost of goods sold amounts for each year. Ending inventory $ Cost of goods sold $ 2024 2023 $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles Volume 1

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

9th Canadian Edition

978-1119786818, 1119786819

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App