Answered step by step

Verified Expert Solution

Question

1 Approved Answer

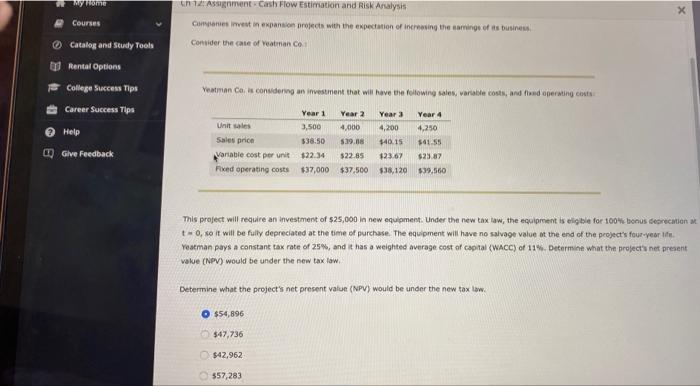

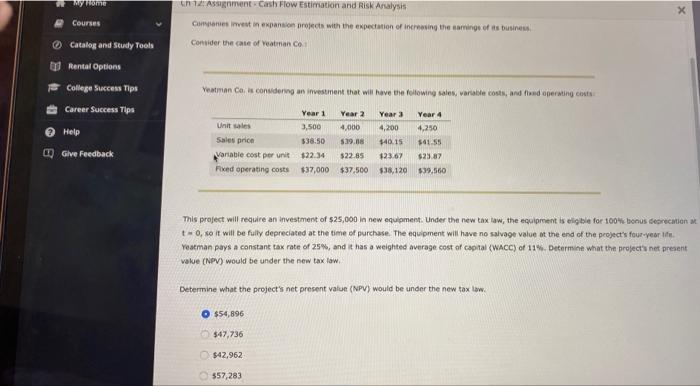

Cumsiaries imvest in expantion nrojects with the expectation of increasing the earrings of as business. Conkider the kate of Vatinan Co : Veatman Coi is

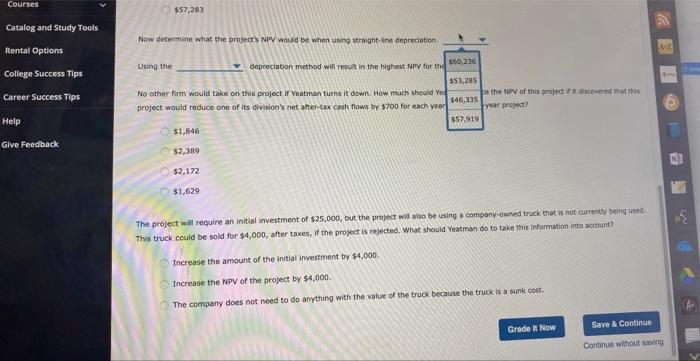

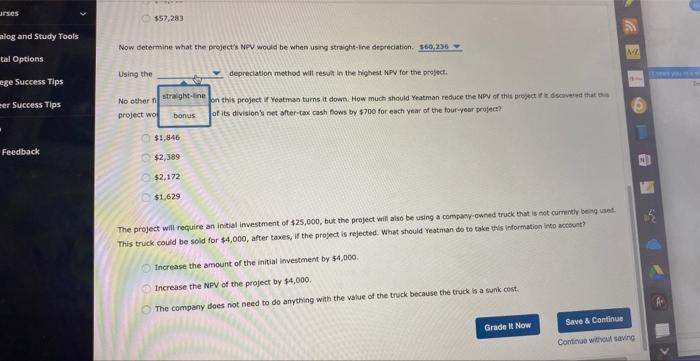

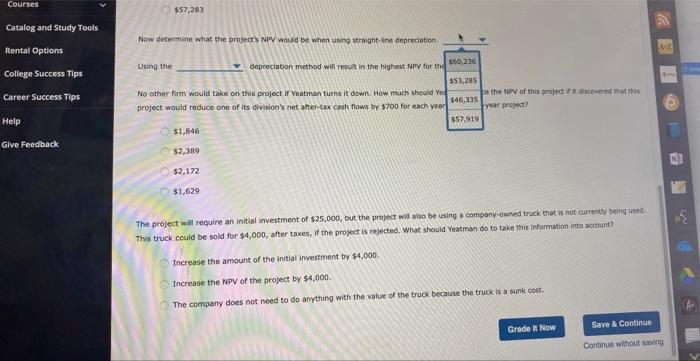

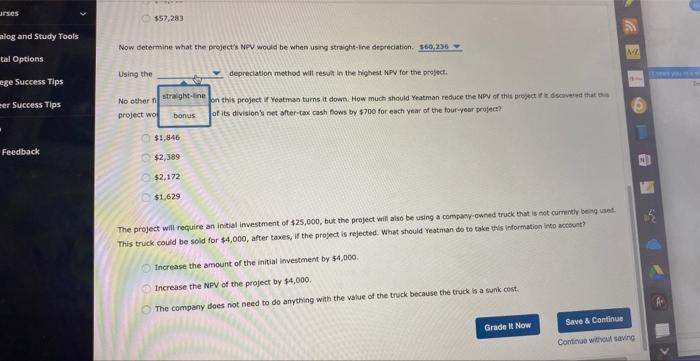

Cumsiaries imvest in expantion nrojects with the expectation of increasing the earrings of as business. Conkider the kate of Vatinan Co : Veatman Coi is consdering an investiment that will have the folowing sales, waratie costs, and fiased operating chsts This profect will realire an investment of $25,000 in new equipment. Under the new tax taw, the ecuiproent is eichthe for toots bonus esestecilien ak. t=0, so it will be fuliy depreciated at the time of purchase. The equipment will have no salvage value ot the end of the peoject's fourvyear hie. Yeatman pays a constant tax rate of 25%, and it has a weighted average cost of capial \{WACC) of I1 wh. Determint what the projecti net preaent value (NPr) would be under the nen tax law, Determine what the project's net present value (NPV) would be under the new fax law. 454,896 $474736 $42,962 457,283 The project will require an inital investrment of $25,000, but the project will aiso be using a company-owried trock that it not curtentiy being uaed. This truck could be sold for $4,000, after taxes, if the project is rejected. What should veatrinan do to take this information into account? Tncrease the amount of the initial investment by $4,000. Increase the NPV of the project by $4,000. The company does not need to do anything with the value of the truck because the truck is a sunk cost. Feedback Now determine what the project's NPV would be when using stright-ine desteciation. The project will require an inital imvestment of $25,000, buk the project will also be using a compacy-owned truck that is not currenty be-g uas? This truck could be sold for $4,000, after taxes, if the project is rejected. What should yeatman do to take this information trito account? Increase the amount of the initial investment by $4,000. Increase the NFV of the project by $4,000. The company does not need to do anything with the value of the truck because the truck is a sunik cest

Cumsiaries imvest in expantion nrojects with the expectation of increasing the earrings of as business. Conkider the kate of Vatinan Co : Veatman Coi is consdering an investiment that will have the folowing sales, waratie costs, and fiased operating chsts This profect will realire an investment of $25,000 in new equipment. Under the new tax taw, the ecuiproent is eichthe for toots bonus esestecilien ak. t=0, so it will be fuliy depreciated at the time of purchase. The equipment will have no salvage value ot the end of the peoject's fourvyear hie. Yeatman pays a constant tax rate of 25%, and it has a weighted average cost of capial \{WACC) of I1 wh. Determint what the projecti net preaent value (NPr) would be under the nen tax law, Determine what the project's net present value (NPV) would be under the new fax law. 454,896 $474736 $42,962 457,283 The project will require an inital investrment of $25,000, but the project will aiso be using a company-owried trock that it not curtentiy being uaed. This truck could be sold for $4,000, after taxes, if the project is rejected. What should veatrinan do to take this information into account? Tncrease the amount of the initial investment by $4,000. Increase the NPV of the project by $4,000. The company does not need to do anything with the value of the truck because the truck is a sunk cost. Feedback Now determine what the project's NPV would be when using stright-ine desteciation. The project will require an inital imvestment of $25,000, buk the project will also be using a compacy-owned truck that is not currenty be-g uas? This truck could be sold for $4,000, after taxes, if the project is rejected. What should yeatman do to take this information trito account? Increase the amount of the initial investment by $4,000. Increase the NFV of the project by $4,000. The company does not need to do anything with the value of the truck because the truck is a sunik cest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started