Question

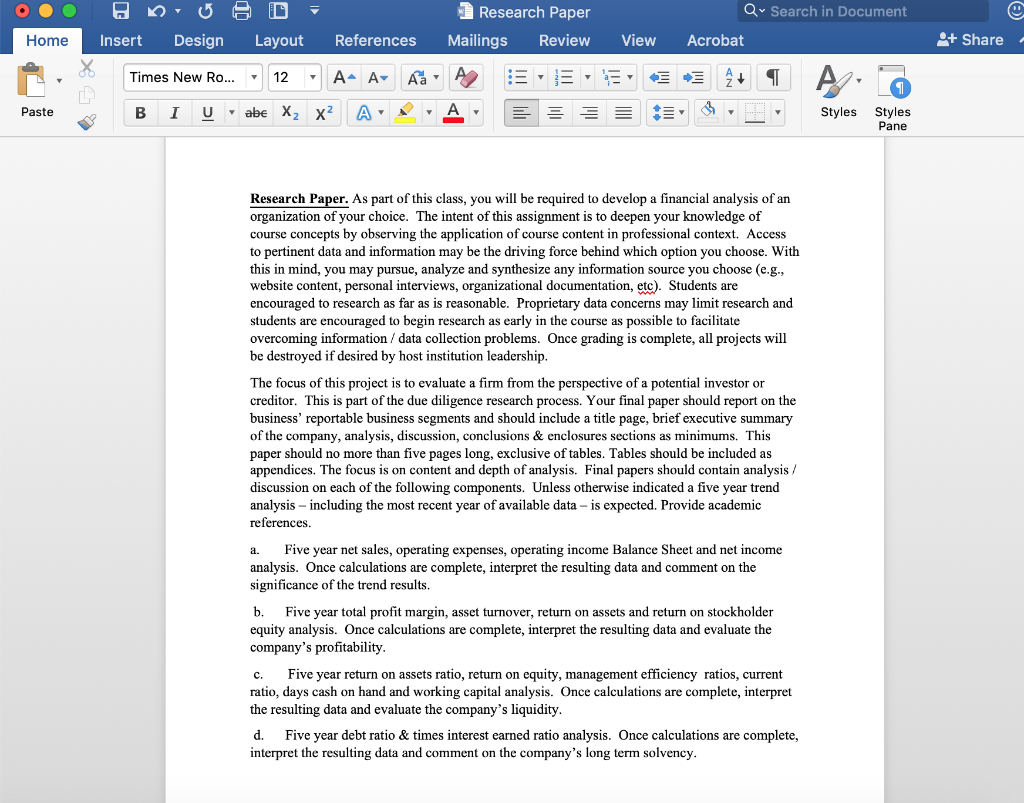

current analysis about Nike from the last 5 years I need help with the a. Five year net sales, operating expenses, operating income Balance Sheet

current analysis about Nike from the last 5 years

I need help with the

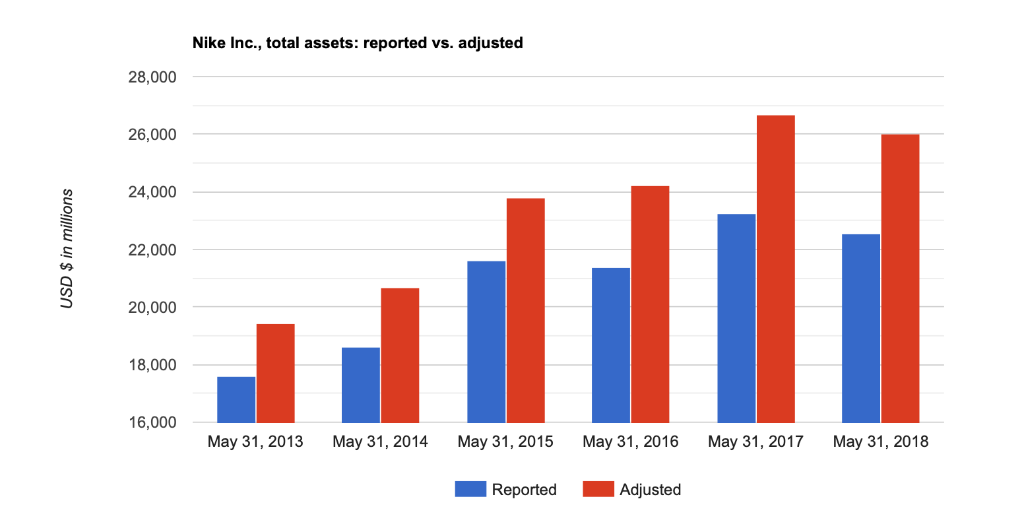

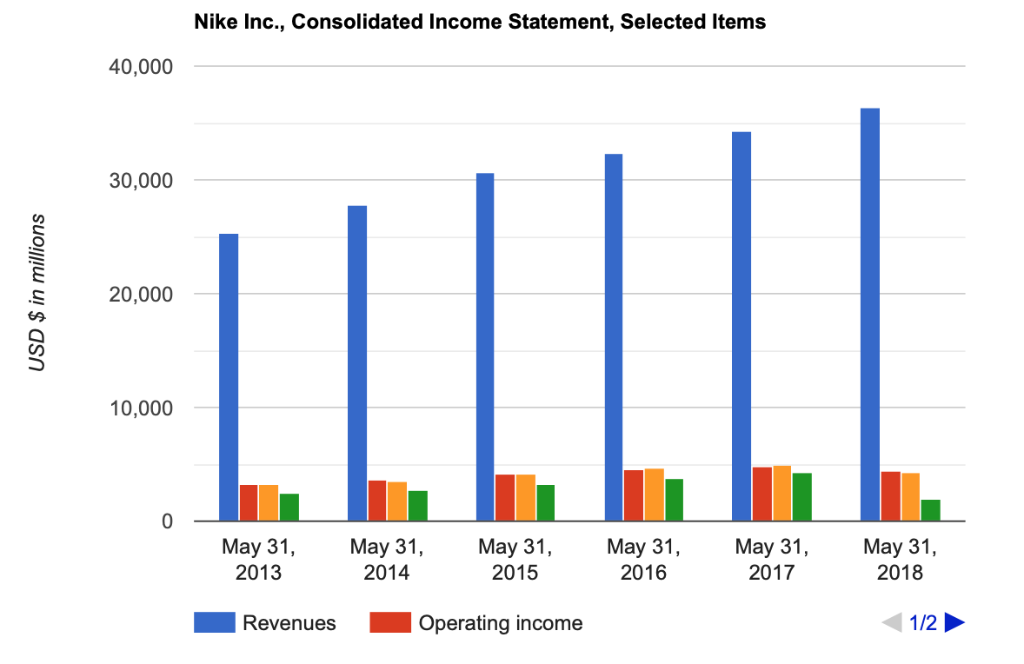

a. Five year net sales, operating expenses, operating income Balance Sheet and net income analysis. Once calculations are complete, interpret the resulting data and comment on the significance of the trend results.

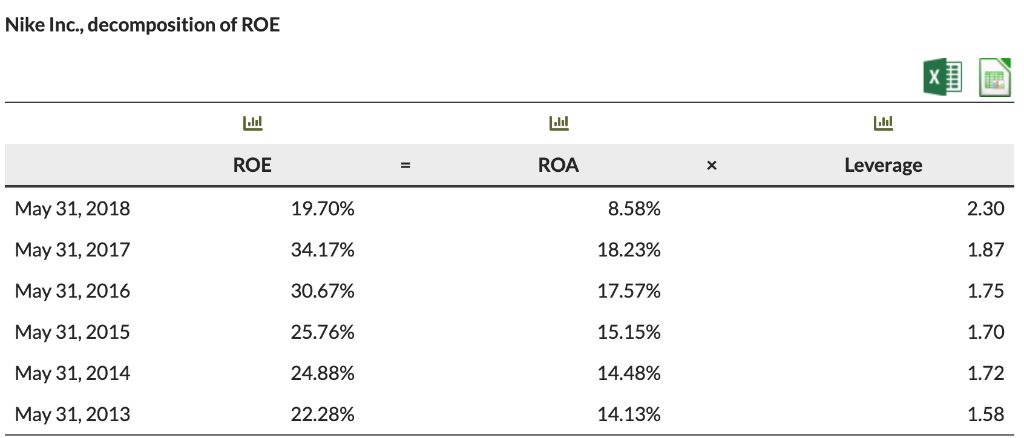

b. Five year total profit margin, asset turnover, return on assets and return on stockholder equity analysis. Once calculations are complete, interpret the resulting data and evaluate the companys profitability.

c. Five year return on assets ratio, return on equity, management efficiency ratios, current ratio, days cash on hand and working capital analysis. Once calculations are complete, interpret the resulting data and evaluate the companys liquidity.

d. Five year debt ratio & times interest earned ratio analysis. Once calculations are complete, interpret the resulting data and comment on the companys long term solvency.

e. Complete a Du Pont Analysis for each of the five most recent years. Once calculations are complete, interpret the resulting data and comment on the companys individual Du Pont characteristics (e.g., Total Margin, Total Asset Turnover & Equity Multiplier) and trends across the analysis period.

f. What is the name of the companys independent auditors? What type of opinion did the independent auditors issue on the financial statements (unqualified, qualified, adverse or disclaimer)? What does this opinion mean?

g. Ultimately a decision has to be madewould you invest and/or lend money to this company? A comparison needs to be made between your company and its competitor to decide whether to invest in this company or its competitor. Why or why not?

Nike Inc., total assets: reported vs. adjusted 28,000 26,000 24,000 22,000 20,000 18,000 16,000 May 31, 2013 May 31, 2014 May 31, 2015 May 31, 2016 May 31, 2017 May 31, 2018 Reported Adjusted Research Paper Q Search in Document Home Insert Design Layout References Mailings Review View Acrobat +Share :- Styles Styles Pane Paste Research Paper. As part of this class, you will be required to develop a financial analysis of an organization of your choice. The intent of this assignment is to deepen your knowledge of course concepts by observing the application of course content in professional context. Access to pertinent data and information may be the driving force behind which option you choose. With this in mind, you may pursue, analyze and synthesize any information source you choose (e.g., website content, personal interviews, organizational documentation, etc). Students are encouraged to research as far as is reasonable. Proprietary data concerns may limit research and students are encouraged to begin research as early in the course as possible to facilitate overcoming information / data collection problems. Once grading is complete, all projects will be destroyed if desired by host institution leadership. The focus of this project is to evaluate a firm from the perspective of a potential investor or creditor. This is part of the due diligence research process. Your final paper should report on the business' reportable business segments and should include a title page, brief executive summary of the company, analysis, discussion, conclusions & enclosures sections as minimums. This paper should no more than five pages long, exclusive of tables. Tables should be included as appendices. The focus is on content and depth of analysis. Final papers should contain analysis/ discussion on each of the following components. Unless otherwise indicated a five year trend analysis- including the most recent year of available data - is expected. Provide academic references a. Five year net sales, operating expenses, operating income Balance Sheet and net income analysis. Once calculations are complete, interpret the resulting data and comment on the significance of the trend results. b. Five year total profit margin, asset turnover, return on assets and return on stockholder equity analysis. Once calculations are complete, interpret the resulting data and evaluate the company's profitability c. Five year return on assets ratio, return on equity, management efficiency ratios, current ratio, days cash on hand and working capital analysis. Once calculations are complete, interpret the resulting data and evaluate the company's liquidity d. Five year debt ratio & times interest earned ratio analysis. Once calculations are complete, interpret the resulting data and comment on the company's long term solvency. Nike Inc., total assets: reported vs. adjusted 28,000 26,000 24,000 22,000 20,000 18,000 16,000 May 31, 2013 May 31, 2014 May 31, 2015 May 31, 2016 May 31, 2017 May 31, 2018 Reported Adjusted Research Paper Q Search in Document Home Insert Design Layout References Mailings Review View Acrobat +Share :- Styles Styles Pane Paste Research Paper. As part of this class, you will be required to develop a financial analysis of an organization of your choice. The intent of this assignment is to deepen your knowledge of course concepts by observing the application of course content in professional context. Access to pertinent data and information may be the driving force behind which option you choose. With this in mind, you may pursue, analyze and synthesize any information source you choose (e.g., website content, personal interviews, organizational documentation, etc). Students are encouraged to research as far as is reasonable. Proprietary data concerns may limit research and students are encouraged to begin research as early in the course as possible to facilitate overcoming information / data collection problems. Once grading is complete, all projects will be destroyed if desired by host institution leadership. The focus of this project is to evaluate a firm from the perspective of a potential investor or creditor. This is part of the due diligence research process. Your final paper should report on the business' reportable business segments and should include a title page, brief executive summary of the company, analysis, discussion, conclusions & enclosures sections as minimums. This paper should no more than five pages long, exclusive of tables. Tables should be included as appendices. The focus is on content and depth of analysis. Final papers should contain analysis/ discussion on each of the following components. Unless otherwise indicated a five year trend analysis- including the most recent year of available data - is expected. Provide academic references a. Five year net sales, operating expenses, operating income Balance Sheet and net income analysis. Once calculations are complete, interpret the resulting data and comment on the significance of the trend results. b. Five year total profit margin, asset turnover, return on assets and return on stockholder equity analysis. Once calculations are complete, interpret the resulting data and evaluate the company's profitability c. Five year return on assets ratio, return on equity, management efficiency ratios, current ratio, days cash on hand and working capital analysis. Once calculations are complete, interpret the resulting data and evaluate the company's liquidity d. Five year debt ratio & times interest earned ratio analysis. Once calculations are complete, interpret the resulting data and comment on the company's long term solvencyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started