Answered step by step

Verified Expert Solution

Question

1 Approved Answer

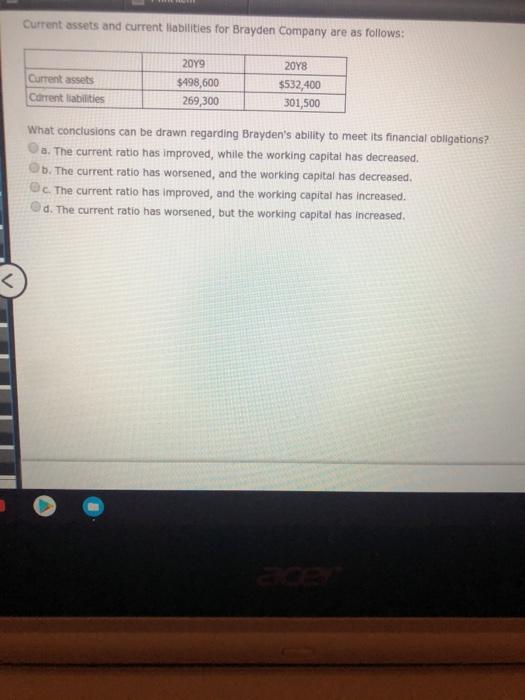

< Current assets and current liabilities for Brayden Company are as follows: Current assets Corrent liabilities 2019 $498,600 269,300 2018 $532,400 301,500 What conclusions

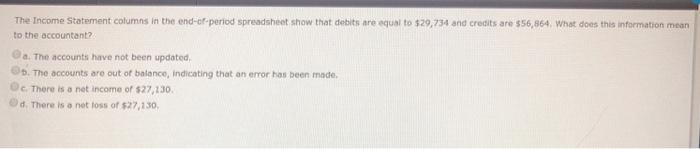

< Current assets and current liabilities for Brayden Company are as follows: Current assets Corrent liabilities 2019 $498,600 269,300 2018 $532,400 301,500 What conclusions can be drawn regarding Brayden's ability to meet its financial obligations? a. The current ratio has improved, while the working capital has decreased. b. The current ratio has worsened, and the working capital has decreased. c. The current ratio has improved, and the working capital has increased. d. The current ratio has worsened, but the working capital has increased. The Income Statement columns in the end-of-period spreadsheet show that debits are equal to $29,734 and credits are $56,864. What does this information mean to the accountant? a. The accounts have not been updated. D. The accounts are out of balance, indicating that an error has been made. Oc. There is a net income of $27,130. d. There is a net loss of $27,130,

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 a Current ratio has improved while the working capital has decreased Workings Cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started