Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following to answer questions 10-18: On January 1, 2000, Ready acquired 80 percent of the outstanding common stock of Nelson Company at

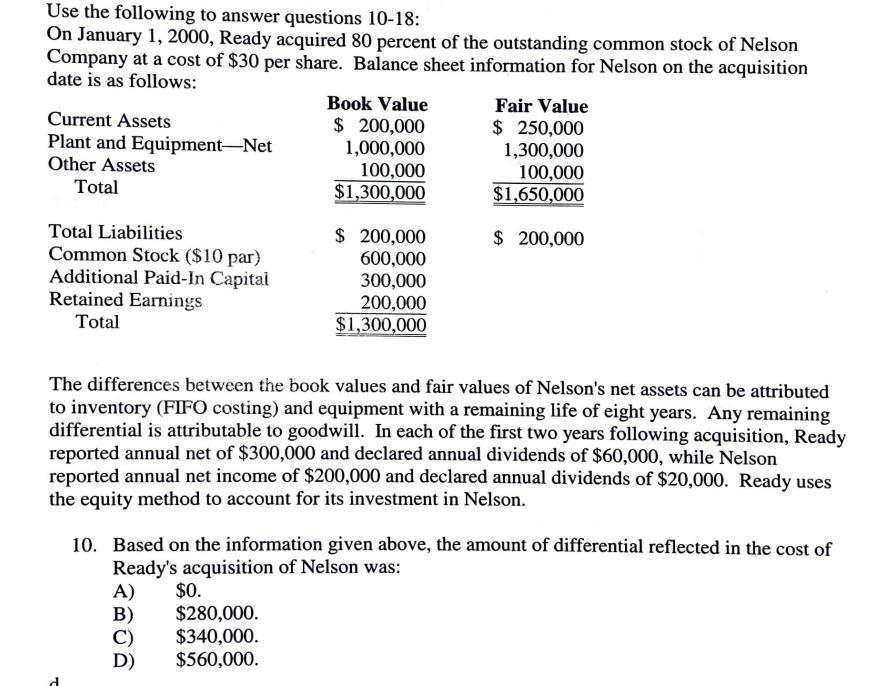

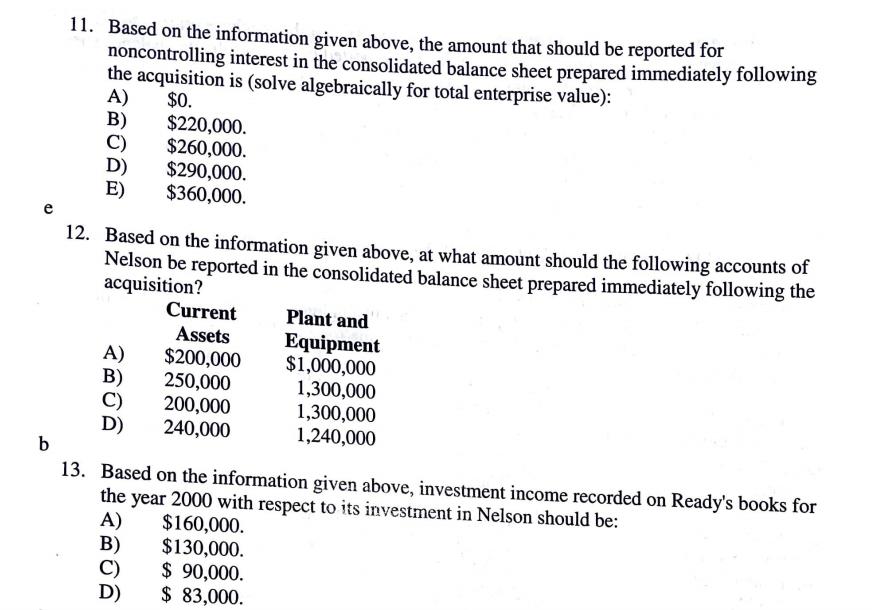

Use the following to answer questions 10-18: On January 1, 2000, Ready acquired 80 percent of the outstanding common stock of Nelson Company at a cost of $30 per share. Balance sheet information for Nelson on the acquisition date is as follows: Current Assets Plant and Equipment-Net Other Assets Total Total Liabilities Common Stock ($10 par) Additional Paid-In Capital Retained Earnings Total Book Value $ 200,000 1,000,000 100,000 $1,300,000 A) $0. B) C) D) $ 200,000 600,000 300,000 200,000 $1,300,000 The differences between the book values and fair values of Nelson's net assets can be attributed to inventory (FIFO costing) and equipment with a remaining life of eight years. Any remaining differential is attributable to goodwill. In each of the first two years following acquisition, Ready reported annual net of $300,000 and declared annual dividends of $60,000, while Nelson reported annual net income of $200,000 and declared annual dividends of $20,000. Ready uses the equity method to account for its investment in Nelson. $280,000. $340,000. $560,000. Fair Value $ 250,000 1,300,000 100,000 $1,650,000 $ 200,000 10. Based on the information given above, the amount of differential reflected in the cost of Ready's acquisition of Nelson was: 11. Based on the information given above, the amount that should be reported for noncontrolling interest in the consolidated balance sheet prepared immediately following the acquisition is (solve algebraically for total enterprise value): A) $0. C) D) E) 12. Based on the information given above, at what amount should the following accounts of Nelson be reported in the consolidated balance sheet prepared immediately following the acquisition? A) B) C) D) $220,000. $260,000. $290,000. $360,000. B) C) D) Current Assets $200,000 250,000 200,000 240,000 Plant and Equipment $1,000,000 b 13. Based on the information given above, investment income recorded on Ready's books for the year 2000 with respect to its investment in Nelson should be: A) $160,000. $130,000. $ 90,000. $ 83,000. 1,300,000 1,300,000 1,240,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 10 Correct option is B 280000 Goodwill Purchase consideration Fair value of net assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started