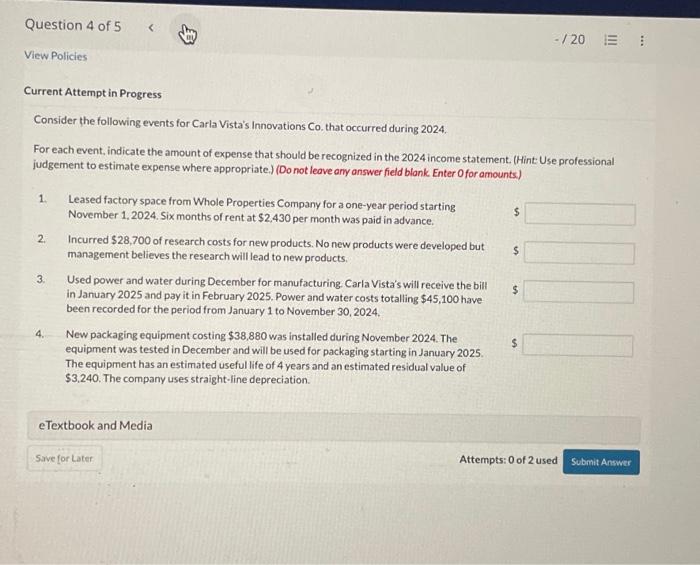

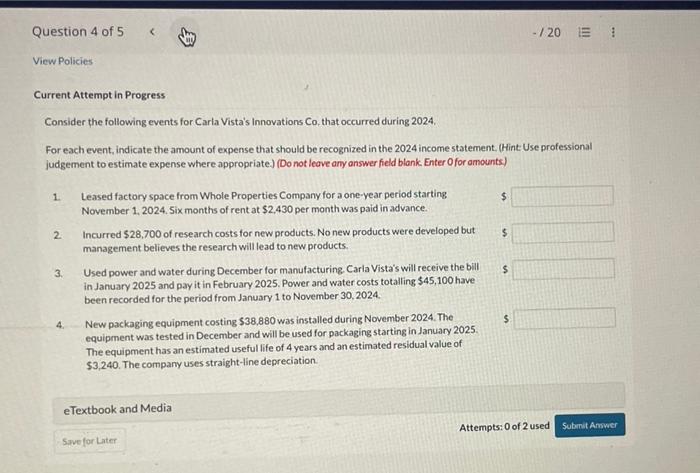

Current Attempt in Progress Consider the following events for Carla Vista's Innovations Co. that occurred during 2024. For each event, indicate the amount of expense that should be recognized in the 2024 income statement. (Hint Use professional judgement to estimate expense where appropriate.) (Do not leave ary answer field blank. Enter 0 for amounts.) 1. Leased factory space from Whole Properties Company for a one-year period starting November 1,2024 . Six months of rent at $2,430 per month was paid in advance. 2. Incurred $28,700 of research costs for new products. No new products were developed but management believes the research will lead to new products. 3. Used power and water during December for manufacturing. Carla Vista's will receive the bill in January 2025 and pay it in February 2025. Power and water costs totalling $45,100 have been recorded for the period from January 1 to November 30, 2024. 4. New packaging equipment costing $38,880 was installed during November 2024 . The equipment was tested in December and will be used for packaging starting in January 2025. The equipment has an estimated useful life of 4 years and an estimated residual value of $3,240. The company uses straight-line depreciation. Current Attempt in Progress Consider the following events for Carla Vista's Innovations Co, that occurred during 2024. For each event, indicate the amount of expense that should be recognized in the 2024 income statement, (Hint Use professional judgement to estimate expense where appropriate). (Do not leave any answer field blank. Enter Ofor amounts) 1. Leased factory space from Whole Properties Company for a one-year period starting November 1, 2024. Six months of rent at $2,430 per month was paid in advance. 2. Incurred $28,700 of research costs for new products. No new products were developed but management believes the research will lead to new products. 3. Used power and water during December for manufacturing Carla Vista's will receive the bill in January 2025 and pay it in February 2025. Power and water costs totalling $45,100 have been recorded for the period from January 1 to November 30,2024 . 4. New packaging equipment costing $38,880 was installed during November 2024 . The equipment was tested in December and will be used for packaging starting in January 2025. The equipment has an estimated useful life of 4 years and an estimated residual value of $3,240. The company uses straight-line depreciation