Answered step by step

Verified Expert Solution

Question

1 Approved Answer

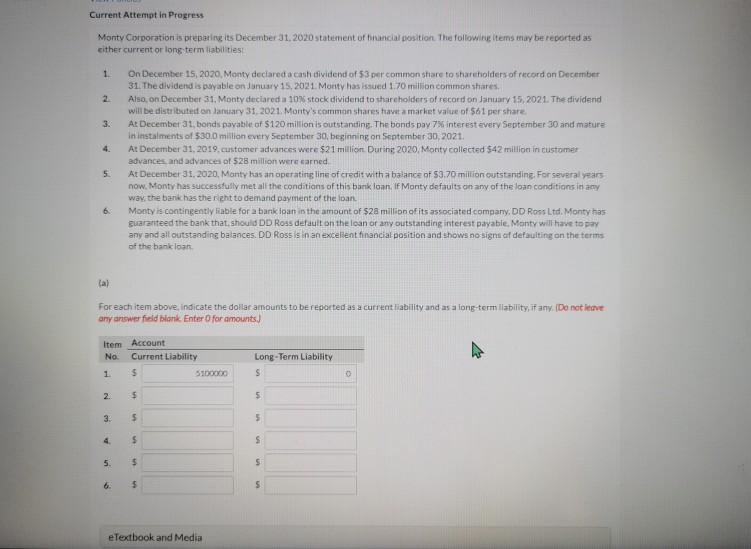

Current Attempt in Progress Monty Corporation is preparing its December 31, 2020 statement of hinancial position. The following items may be reported as cither current

Current Attempt in Progress Monty Corporation is preparing its December 31, 2020 statement of hinancial position. The following items may be reported as cither current or long term liabilities 1 2 3. 4. On December 15, 2020 Monty declared a canh dividend of $3 par common share to shareholders of record on December 31. The dividend is payable on January 15, 2021 Monty has issued 1.70 million common shares Also on December 31, Monty declared a 10% stock dividend to shareholders of record on January 15, 2021. The dividend will be distributed on January 31, 2021. Monty's common shares have a market value of $61 per share At December 31 bonds pavable of $120 million is outstanding. The bonds pay 7% interest every September 30 and mature in instalments of 5300 million every September 30, beginning on September 30, 2021. At December 31, 2019. customer advances were $21 million During 2020 Monty collected $42 million in customer advances and advances of 528 million were earned At December 31, 2020, Monty has an operating line of credit with a balance of 53.70 million outstanding. For several years now. Monty has successfully met all the conditions of this bank loan. If Monty defaults on any of the loan conditions in any way, the bank has the right to demand payment of the loan. Monty is contingently fiable for a bank loan in the amount of 528 million of its associated company, DD Ross Ltd. Monty has guaranteed the bank that should DD Ross default on the loan or any outstanding interest payable. Monty will have to pay any and all outstanding balances. DD Ross is in an excellent financial position and shows no signs of defaulting on the terms of the bank loan 5. 6 a) For each item above, indicate the dollar amounts to be reported as a current liability and as a long-termilability, if any. Do not leave any answer field blonk Enter for amounts.) Item Account No Current Liability 1 5 51000 Long-Term Liability S 2. $ 5 $ 5 4 $ S 5. $ 5 6. $ 5 eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started