Answered step by step

Verified Expert Solution

Question

1 Approved Answer

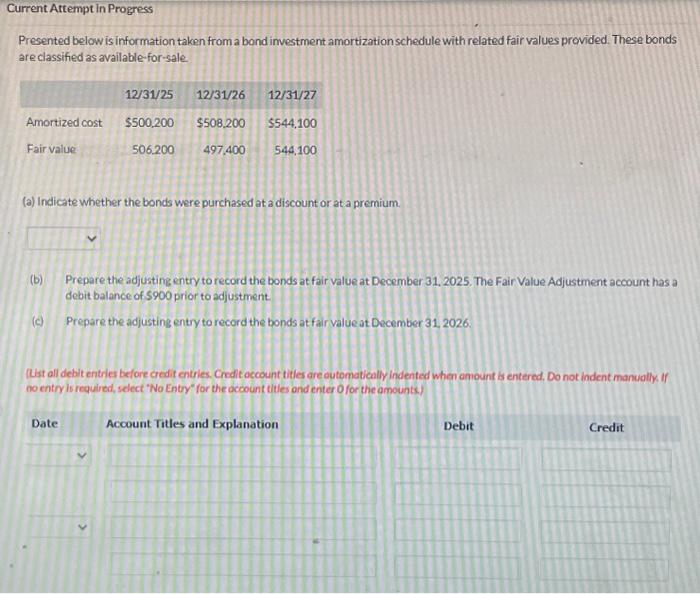

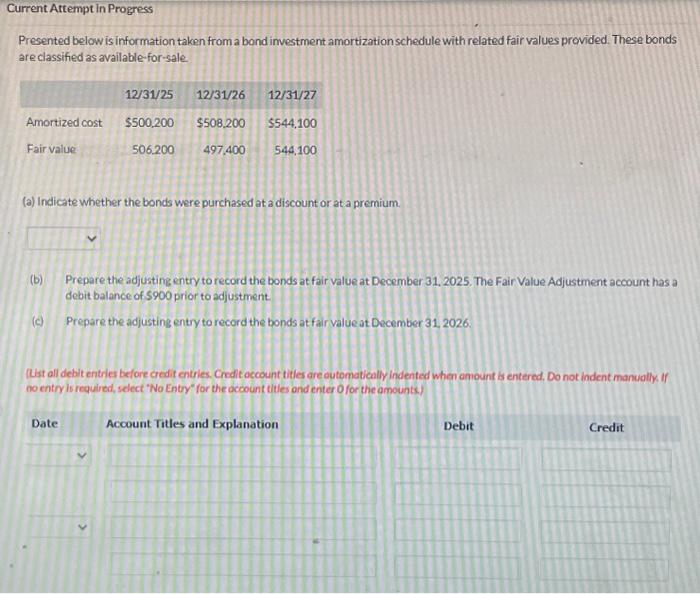

Current Attempt in Progress Presented below is information taken from a bond investment amortization schedule with related fair values provided. These bonds are classified as

Current Attempt in Progress Presented below is information taken from a bond investment amortization schedule with related fair values provided. These bonds are classified as available-for-sale. Amortized cost Fair value (b) (c) 12/31/25 $500,200 506,200 Date 12/31/26 12/31/27 (a) Indicate whether the bonds were purchased at a discount or at a premium. $508,200 $544,100 497,400 544,100 Prepare the adjusting entry to record the bonds at fair value at December 31, 2025. The Fair Value Adjustment account has a debit balance of $900 prior to adjustment. Prepare the adjusting entry to record the bonds at fair value at December 31, 2026. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit  Presented below is information taken from a bond investment amortization schedule with related fair values provided. These bonds are classified as available-for-sale (a) Indicate whether the bonds were purchased at a discount or at a premium. (b) Prepare the adjusting entry to record the bonds at fair value at December 31,2025. The Fair Value Adjustment account has a debit balance of 5900 prior to adjustment. (c) Prepare the adjusting entry to record the bonds at fair value at December 31, 2026. (Ust all debit entries before credit entries. Credit occount titles are automatically indented when amount is entered, Do not indent manually if no entry is required, select "No Entry" for the occount titles and enter of for the amounts.)

Presented below is information taken from a bond investment amortization schedule with related fair values provided. These bonds are classified as available-for-sale (a) Indicate whether the bonds were purchased at a discount or at a premium. (b) Prepare the adjusting entry to record the bonds at fair value at December 31,2025. The Fair Value Adjustment account has a debit balance of 5900 prior to adjustment. (c) Prepare the adjusting entry to record the bonds at fair value at December 31, 2026. (Ust all debit entries before credit entries. Credit occount titles are automatically indented when amount is entered, Do not indent manually if no entry is required, select "No Entry" for the occount titles and enter of for the amounts.)

Current Attempt in Progress Presented below is information taken from a bond investment amortization schedule with related fair values provided. These bonds are classified as available-for-sale. Amortized cost Fair value (b) (c) 12/31/25 $500,200 506,200 Date 12/31/26 12/31/27 (a) Indicate whether the bonds were purchased at a discount or at a premium. $508,200 $544,100 497,400 544,100 Prepare the adjusting entry to record the bonds at fair value at December 31, 2025. The Fair Value Adjustment account has a debit balance of $900 prior to adjustment. Prepare the adjusting entry to record the bonds at fair value at December 31, 2026. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started