1. If Indian River Citrus, does not have the opportunity to lease the space, does this mean that space is free or costless, from the

1. If Indian River Citrus, does not have the opportunity to lease the space, does this mean that space is “free” or costless, from the standpoint of the lite product project?

2. Should the erosion of profit from regular orange sales be charged to the lite orange project? What if it were believed that if Indian River did not introduce the lite product, a competing firm would very likely do so so that regular juice sales would be adversely affected regardless of whether or not the project in question is accepted?

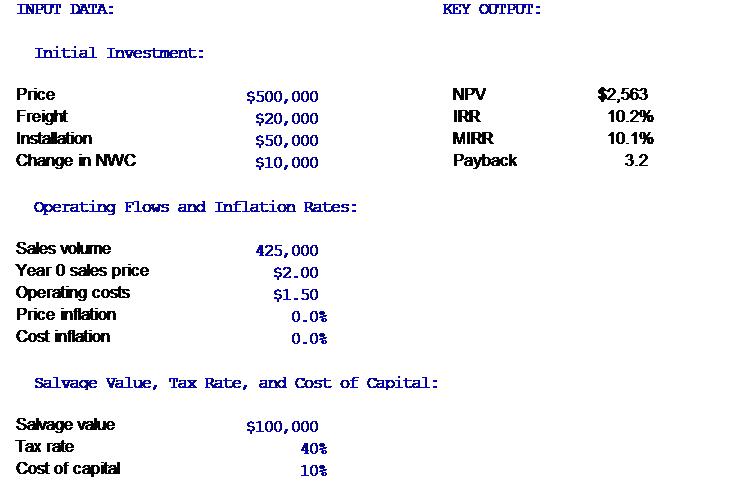

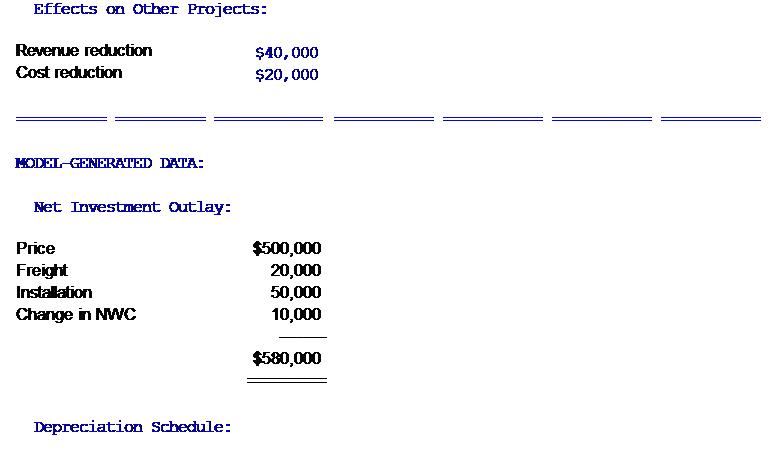

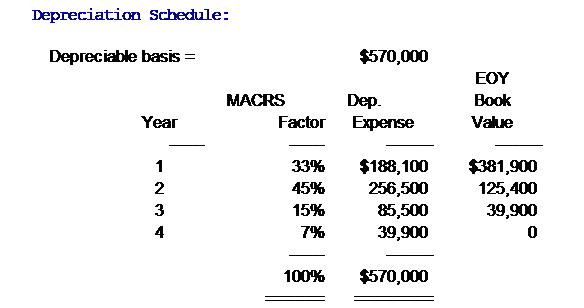

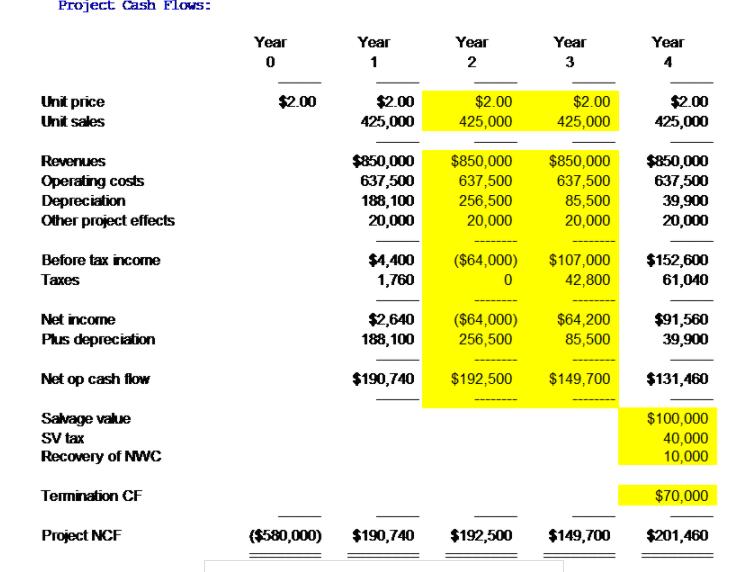

3. What is the Year 0 net investment outlay on this project? What is the expected nonoperating cash flow when the project is terminated at year 4? Hint: Use a spreadsheet

4. Estimate the projects operating cash flows inclusive of cannibalization effects. ( Hint: Use spreadsheet as a guide). What are the project’s NPV, IRR, and Modified Internal Rate of Return, and Payback? Should the project be undertaken?.

5. Now assume that the sales price will increase by the 5% inflation rate beginning after year 0. However, cash operating costs will increase only by 2% annually from the initial cost estimate, because over half of the costs are either depreciation or are fixed by long-term contracts. For simplicity, assume that no other cash flows ( net cannibalization costs, salvage value, or networking capital) are affected by inflation. Find the project's NPV, IRR, MIRR, and Payback with inflation taken into account.( Hint: Use the spreadsheet and change the percent for price and cost inflation)

6. How would the projects NPV change if :

Sales prices and operating cost per unit increased at the same rate, at 5% per year?

Sales price increases only by 2%, but costs increase by 5% per year? .( Hint: Use the spreadsheet and change the percent for price and cost inflation)

7. The second capital budgeting analysis involved choosing between two mutually exclusive projects, S & L.

What is each project’s single cycle NPV? Now apply the replacement chain approach, and then repeat the analysis using the EAA approach. Which project should be chosen? Why?

8. Analyze the third project and calculate the NPV assuming the trucks were operated for full three years. What if the trucks were abandoned at the end of year 2 or at the end of year 1? What is the economic life of the project?

12. What are your overall recommendations for all the projects? Would recommend that the project be accepted, rejected, or studied further? Justify your answer?

INFUT DATA: KEY OUTFUT: Initial Investment: rice $500,000 NPV $2,563 Freight $20,000 IRR 10.2% Instalation $50,000 MIRR 10.1% Change in NWC $10,000 Payback 3.2 Operating Flows and Inflation Rates: Sales volume 425,000 Year O sales price $2.00 Operating costs $1.50 Price inflation 0.0% Cost inflation 0.0% Salvage Value, Tax Rate, and Cost of Capital: Salvage value $100,000 Tax rate 40% Cost of capital 10%

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 If Indian River Citrus does not have the opportunity to lease the space does this mean that the space isfree or costless from the standpoint of the lite product project Yes because the sitting fee f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started