Answered step by step

Verified Expert Solution

Question

1 Approved Answer

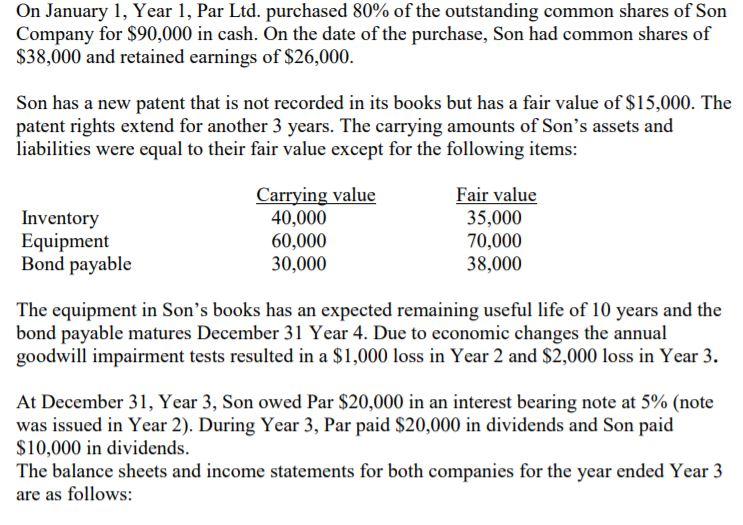

On January 1, Year 1, Par Ltd. purchased 80% of the outstanding common shares of Son Company for $90,000 in cash. On the date

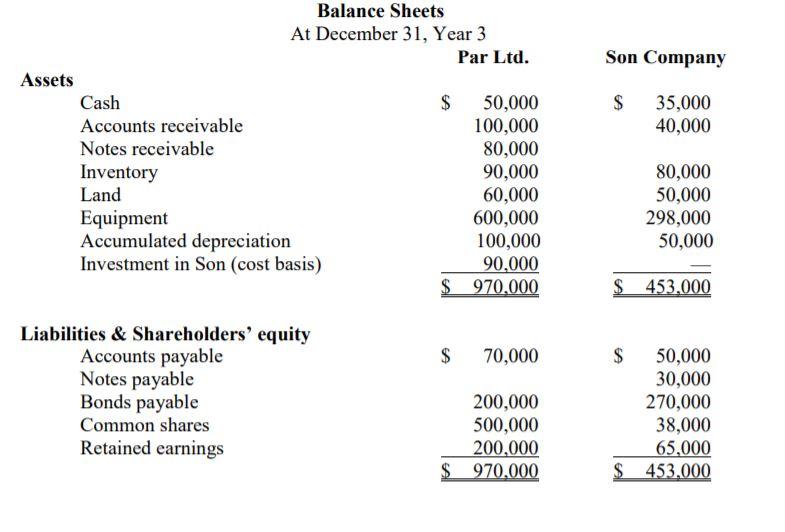

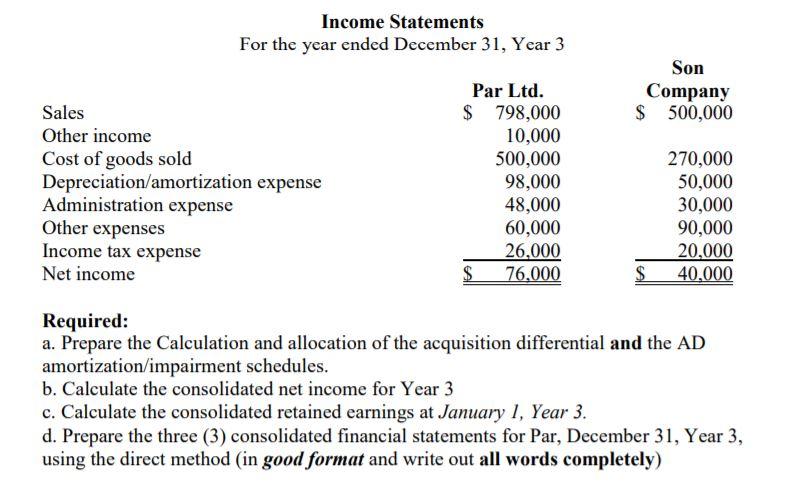

On January 1, Year 1, Par Ltd. purchased 80% of the outstanding common shares of Son Company for $90,000 in cash. On the date of the purchase, Son had common shares of $38,000 and retained earnings of $26,000. Son has a new patent that is not recorded in its books but has a fair value of $15,000. The patent rights extend for another 3 years. The carrying amounts of Son's assets and liabilities were equal to their fair value except for the following items: Inventory Equipment Bond payable Carrying value 40,000 60,000 30,000 Fair value 35,000 70,000 38,000 The equipment in Son's books has an expected remaining useful life of 10 years and the bond payable matures December 31 Year 4. Due to economic changes the annual goodwill impairment tests resulted in a $1,000 loss in Year 2 and $2,000 loss in Year 3. At December 31, Year 3, Son owed Par $20,000 in an interest bearing note at 5% (note was issued in Year 2). During Year 3, Par paid $20,000 in dividends and Son paid $10,000 in dividends. The balance sheets and income statements for both companies for the year ended Year 3 are as follows: Assets Cash Accounts receivable Notes receivable Inventory Land Balance Sheets At December 31, Year 3 Equipment Accumulated depreciation Investment in Son (cost basis) Liabilities & Shareholders' equity Par Ltd. Son Company $ 50,000 $ 35,000 100,000 40,000 80,000 90,000 80,000 60,000 50,000 600,000 298,000 100,000 50,000 90,000 $ 970,000 $ 453.000 Accounts payable Notes payable Bonds payable Common shares Retained earnings $ 70,000 $ 50,000 30,000 200,000 270,000 500,000 38,000 200,000 65,000 $ 970.000 $ 453.000 Sales Other income Income Statements For the year ended December 31, Year 3 Par Ltd. $ 798,000 Son Company $ 500,000 Cost of goods sold Depreciation/amortization expense Administration expense Other expenses Income tax expense Net income Required: 10,000 500,000 270,000 98,000 50,000 48,000 30,000 60,000 90,000 26,000 20,000 $ 76,000 S 40,000 a. Prepare the Calculation and allocation of the acquisition differential and the AD amortization/impairment schedules. b. Calculate the consolidated net income for Year 3 c. Calculate the consolidated retained earnings at January 1, Year 3. d. Prepare the three (3) consolidated financial statements for Par, December 31, Year 3, using the direct method (in good format and write out all words completely)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Question 1 To determine the total number of cases the company needs to sell to earn 50000 after tax we can follow these steps 1 Determine the pretax net operating income required to achieve the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started