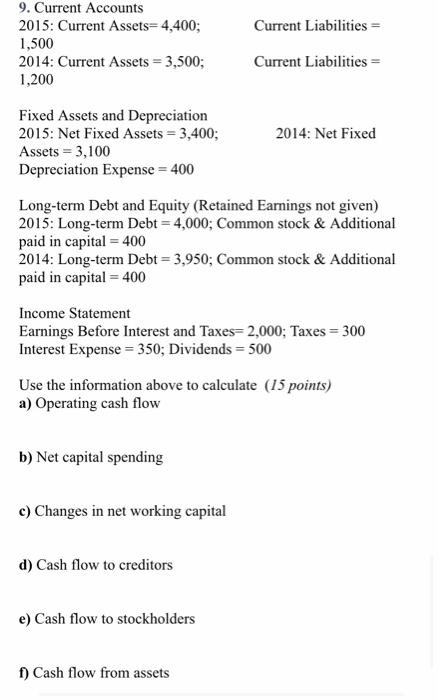

Question: Current Liabilities 9. Current Accounts 2015: Current Assets=4,400; 1,500 2014: Current Assets = 3,500; 1,200 Current Liabilities = Fixed Assets and Depreciation 2015: Net Fixed

Current Liabilities 9. Current Accounts 2015: Current Assets=4,400; 1,500 2014: Current Assets = 3,500; 1,200 Current Liabilities = Fixed Assets and Depreciation 2015: Net Fixed Assets = 3,400; 2014: Net Fixed Assets = 3,100 Depreciation Expense = 400 Long-term Debt and Equity (Retained Earnings not given) 2015: Long-term Debt = 4,000; Common stock & Additional paid in capital = 400 2014: Long-term Debt=3,950; Common stock & Additional paid in capital = 400 Income Statement Earnings Before Interest and Taxes= 2,000; Taxes = 300 Interest Expense = 350; Dividends = 500 Use the information above to calculate (15 points) a) Operating cash flow b) Net capital spending c) Changes in net working capital d) Cash flow to creditors e) Cash flow to stockholders f) Cash flow from assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts