Answered step by step

Verified Expert Solution

Question

1 Approved Answer

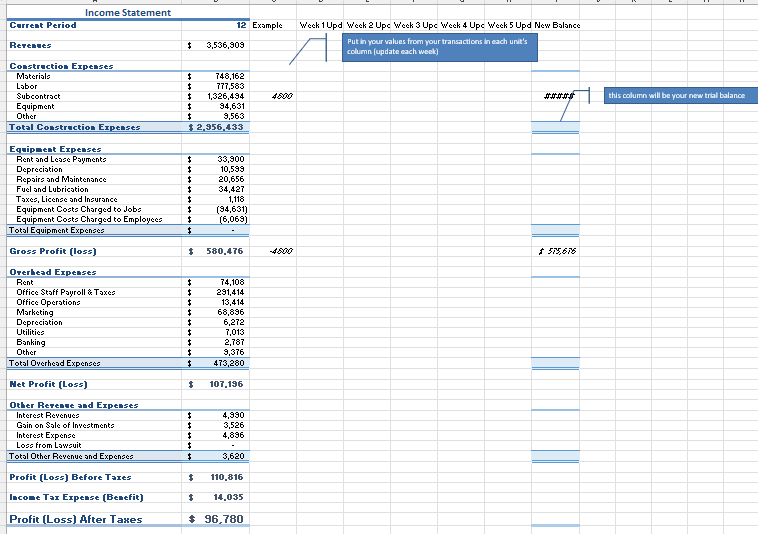

Current Period Revenues Construction Expenses Materials Labor Subcontract Equipment Income Statement Other Total Construction Expenses Equipment Expenses Rent and Lease Payments Depreciation Repairs and

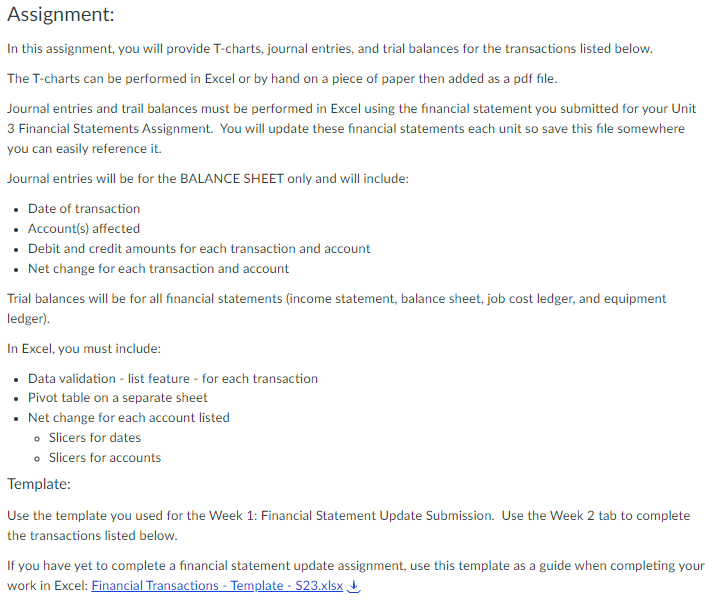

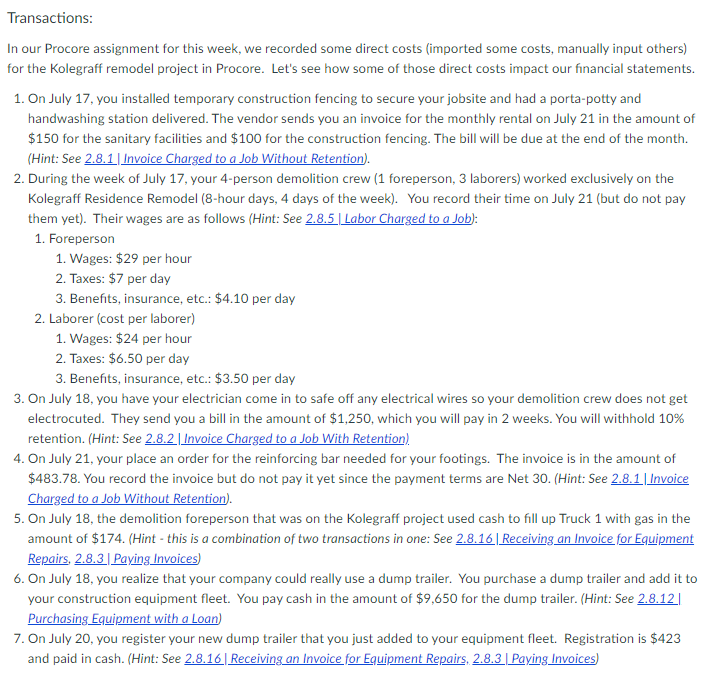

Current Period Revenues Construction Expenses Materials Labor Subcontract Equipment Income Statement Other Total Construction Expenses Equipment Expenses Rent and Lease Payments Depreciation Repairs and Maintenance Fuel and Lubrication Taxes, License and Insurance Equipment Costs Charged to Jobs Equipment Costs Charged to Employees Total Equipment Expenses Gross Profit (loss) Overhead Expenses Rent Office Staff Payroll & Taxes Office Operations Marketing Depreciation Utilities Banking Other Total Overhead Expenses Het Profit (Loss) Other Revenue and Expenses Interest Revenues Gain on Sale of Investments Interest Expense Loss from Lawsuit Total Other Revenue and Expenses Profit (Loss) Before Taxes Income Tax Expense (Benefit) Profit (Loss) After Taxes $ 3,536,909 $ $ $ $ $ $ 2,956,433 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 12 Example $ $ $ $ $ 748,162 777,583 1,326,494 94,631 9,563 $ $ 33,900 10,593 20,656 34,427 1,118 (94,631) (6,069) 580,476 13,414 68,896 6,272 7,013 2,787 9,376 473,280 $ 107,196 74,108 291,414 4,990 3,526 4,896 3,620 110,816 14,035 $ 96,780 -4800 Week 1 Upd Week 2 Upc Week 3 Upc Week 4 Upc Week 5 Upd New Balance Put in your values from your transactions in each unit's column (update each week) ***** $575,676 this column will be your new trial balance Assignment: In this assignment, you will provide T-charts, journal entries, and trial balances for the transactions listed below. The T-charts can be performed in Excel or by hand on a piece of paper then added as a pdf file. Journal entries and trail balances must be performed in Excel using the financial statement you submitted for your Unit 3 Financial Statements Assignment. You will update these financial statements each unit so save this file somewhere you can easily reference it. Journal entries will be for the BALANCE SHEET only and will include: Date of transaction Account(s) affected Debit and credit amounts for each transaction and account Net change for each transaction and account Trial balances will be for all financial statements (income statement, balance sheet, job cost ledger, and equipment ledger). In Excel, you must include: Data validation - list feature - for each transaction Pivot table on a separate sheet Net change for each account listed o Slicers for dates Slicers for accounts Template: Use the template you used for the Week 1: Financial Statement Update Submission. Use the Week 2 tab to complete the transactions listed below. If you have yet to complete a financial statement update assignment, use this template as a guide when completing your work in Excel: Financial Transactions - Template - $23.xlsx Transactions: In our Procore assignment for this week, we recorded some direct costs (imported some costs, manually input others) for the kolegraff remodel project in Procore. Let's see how some of those direct costs impact our financial statements. 1. On July 17, you installed temporary construction fencing to secure your jobsite and had a porta-potty and handwashing station delivered. The vendor sends you an invoice for the monthly rental on July 21 in the amount of $150 for the sanitary facilities and $100 for the construction fencing. The bill will be due at the end of the month. (Hint: See 2.8.1 | Invoice Charged to a Job Without Retention). 2. During the week of July 17, your 4-person demolition crew (1 foreperson, 3 laborers) worked exclusively on the Kolegraff Residence Remodel (8-hour days, 4 days of the week). You record their time on July 21 (but do not pay them yet). Their wages are as follows (Hint: See 2.8.5 | Labor Charged to a Job): 1. Foreperson 1. Wages: $29 per hour 2. Taxes: $7 per day 3. Benefits, insurance, etc.: $4.10 per day 2. Laborer (cost per laborer) 1. Wages: $24 per hour 2. Taxes: $6.50 per day 3. Benefits, insurance, etc.: $3.50 per day 3. On July 18, you have your electrician come in to safe off any electrical wires so your demolition crew does not get electrocuted. They send you a bill in the amount of $1,250, which you will pay in 2 weeks. You will withhold 10% retention. (Hint: See 2.8.2 | Invoice Charged to a Job With Retention). 4. On July 21, your place an order for the reinforcing bar needed for your footings. The invoice is in the amount of $483.78. You record the invoice but do not pay it yet since the payment terms are Net 30. (Hint: See 2.8.1 | Invoice Charged to a Job Without Retention). 5. On July 18, the demolition foreperson that was on the Kolegraff project used cash to fill up Truck 1 with gas in the amount of $174. (Hint - this is a combination of two transactions in one: See 2.8.16 Receiving an Invoice for Equipment Repairs, 2.8.3 Paying Invoices) 6. On July 18, you realize that your company could really use a dump trailer. You purchase a dump trailer and add it to your construction equipment fleet. You pay cash in the amount of $9,650 for the dump trailer. (Hint: See 2.8.12 | Purchasing Equipment with a Loan) 7. On July 20, you register your new dump trailer that you just added to your equipment fleet. Registration is $423 and paid in cash. (Hint: See 2.8.16| Receiving an Invoice for Equipment Repairs, 2.8.3 | Paying Invoices)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

TCharts Journal Entries and Trial Balances Based on the provided income statement and your request heres a breakdown of the required information TCharts Materials Debit 748162 Week 1 Credit 0 Week 2 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started