Answered step by step

Verified Expert Solution

Question

1 Approved Answer

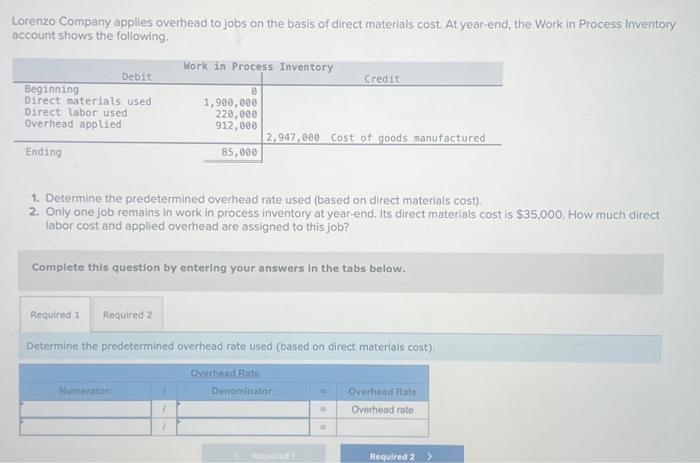

Lorenzo Company applies overhead to jobs on the basis of direct materials cost. At year-end, the Work in Process Inventory account shows the following.

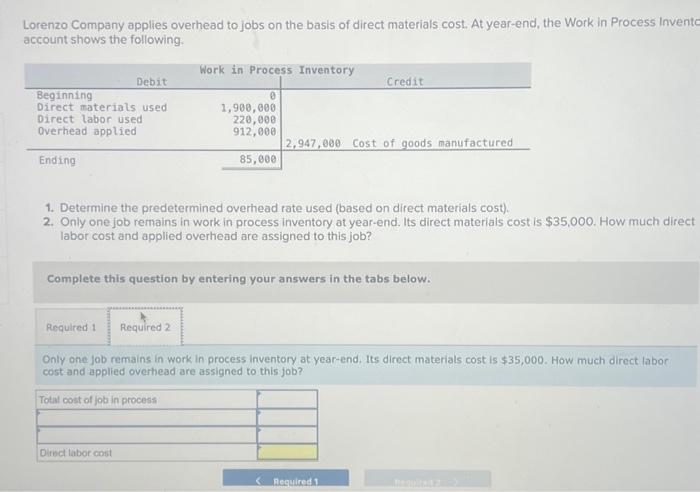

Lorenzo Company applies overhead to jobs on the basis of direct materials cost. At year-end, the Work in Process Inventory account shows the following. Work in Process Inventory Debit Credit Beginning Direct materials used Direct labor used Overhead applied 0 1,900,000 220,000 912,000 Ending 2,947,000 Cost of goods manufactured 85,000 1. Determine the predetermined overhead rate used (based on direct materials cost). 2. Only one job remains in work in process inventory at year-end. Its direct materials cost is $35,000. How much direct labor cost and applied overhead are assigned to this job? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the predetermined overhead rate used (based on direct materials cost). Numerator T Overhead Rate Denominator Overhead Rate Overhead rate Required 2 > Lorenzo Company applies overhead to jobs on the basis of direct materials cost. At year-end, the Work in Process Invento account shows the following. Beginning Work in Process Inventory Debit Credit Direct materials used Direct labor used Overhead applied Ending 0 1,900,000 220,000 912,000 2,947,000 Cost of goods manufactured 85,000 1. Determine the predetermined overhead rate used (based on direct materials cost). 2. Only one job remains in work in process inventory at year-end. Its direct materials cost is $35,000. How much direct labor cost and applied overhead are assigned to this job? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Only one job remains in work in process inventory at year-end. Its direct materials cost is $35,000. How much direct labor cost and applied overhead are assigned to this job? Total cost of job in process Direct labor cost Required 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started