Answered step by step

Verified Expert Solution

Question

1 Approved Answer

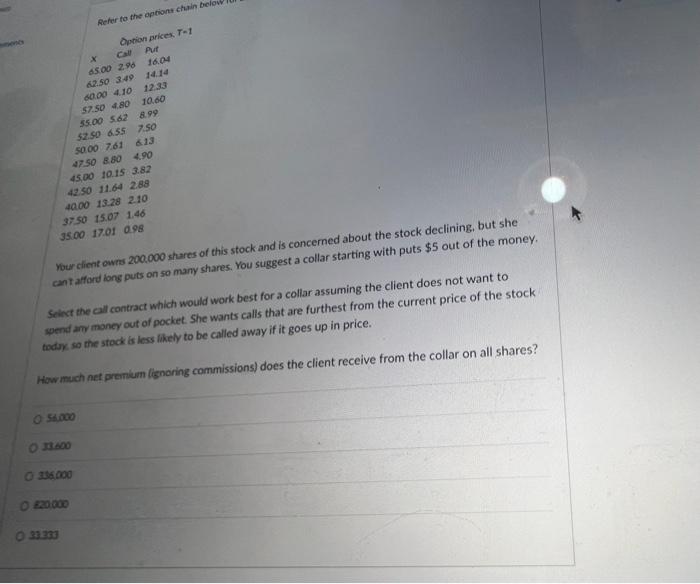

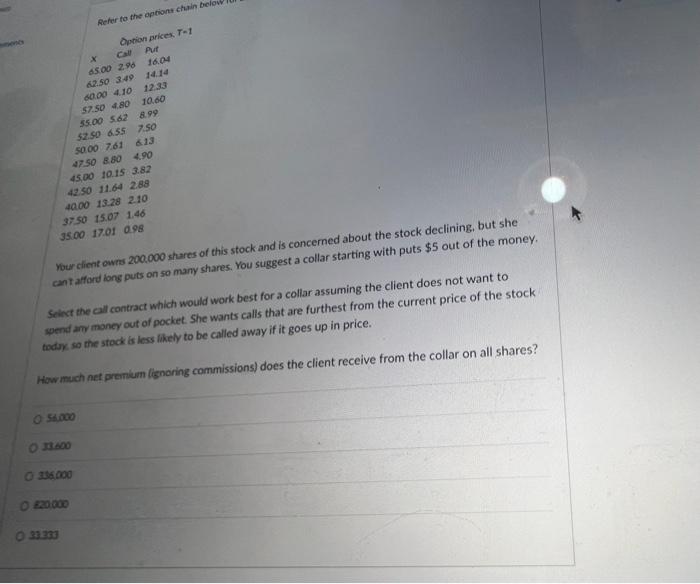

current price of $50 Your chent owns 200.000 shares of this stock and is concerned about the stock declining, but she cant afford long puts

current price of $50

Your chent owns 200.000 shares of this stock and is concerned about the stock declining, but she cant afford long puts on so many shares. You suggest a collar starting with puts $5 out of the money. seinct the oll contract which would work best for a collar assuming the client does not want to spend am mancy out of pocket. She wants calls that are furthest from the current price of the stock today so the stock is less likely to be called away if it goes up in price. How mich net prenim lignoring commissions) does the client receive from the collar on all shares? 3600 uscoo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started