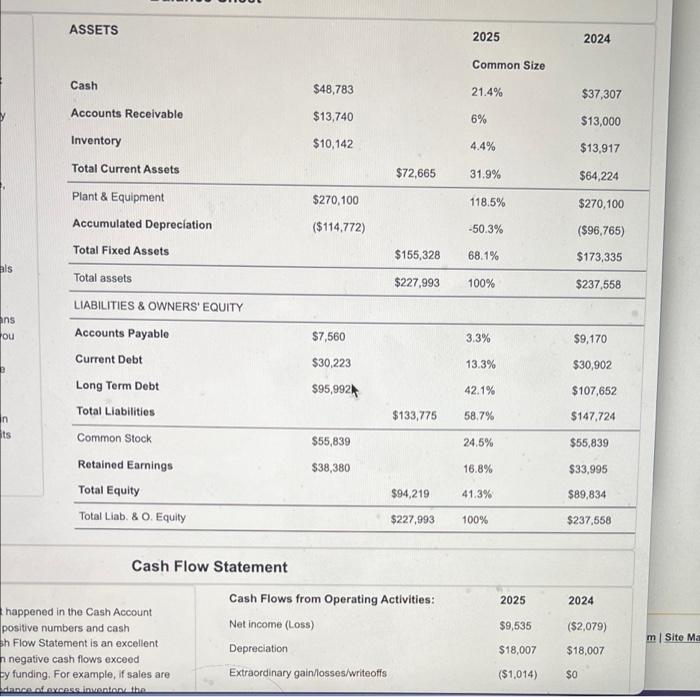

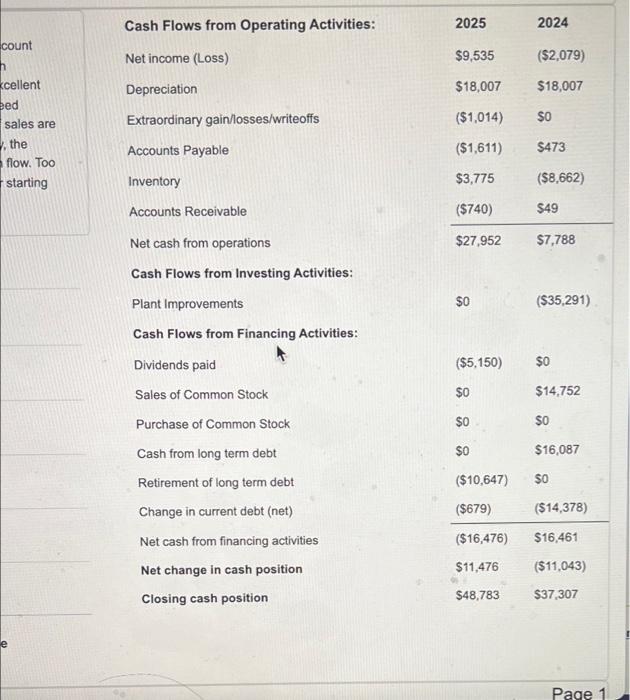

Currently Chester is paying a dividend of $1.50 (per share). If this dividend stayed the same, but the stock price rose by 10% what would be the dividend yield? Select: 1 Save Answer 03.03% 3.78% 4.92% 26.44% ASSETS 2025 2024 Common Size Cash $48,783 21.4% $37,307 Accounts Receivable $13,740 6% $13,000 Inventory $10,142 4.4% $13,917 Total Current Assets $72,665 31.9% $64,224 $270,100 118.5% $270, 100 ($114.772) -50.3% ($96,765) $155,328 68.1% $173,335 als $227,993 100% $237,558 ans You Plant & Equipment Accumulated Depreciation Total Fixed Assets Total assets LIABILITIES & OWNERS' EQUITY Accounts Payable Current Debt Long Term Debt Total Liabilities Common Stock $7,560 3.3% $9,170 $30,223 13.3% $30,902 $95,992 42.1% $107,652 $133,775 58.7% $147,724 In ts $55,839 24.5% $55,839 $38,380 16.8% $33,995 Retained Earnings Total Equity Total Liab & Equity $94,219 41.3% $89,834 $227,993 100% $237,558 Cash Flow Statement 2025 2024 $9,535 ($2,079) Cash Flows from Operating Activities: Net income (L055) Depreciation Extraordinary gain/losses/writeoffs happened in the Cash Account positive numbers and cash sh Flow Statement is an excellent n negative cash flows exceed Fy funding. For example, if sales are dance of excessinenter the m | Site Ma $18,007 $18,007 ($1,014) SO count h xcellent eed sales are the flow. Too starting Cash Flows from Operating Activities: Net income (Loss) Depreciation Extraordinary gain/losses/writeoffs Accounts Payable Inventory Accounts Receivable Net cash from operations Cash Flows from Investing Activities: Plant Improvements Cash Flows from Financing Activities: Dividends paid Sales of Common Stock Purchase of Common Stock Cash from long term debt Retirement of long term debt Change in current debt (net) Net cash from financing activities Net change in cash position Closing cash position 2025 2024 $9,535 ($2,079) $18,007 $18,007 ($1,014) $0 ($1,611) $473 $3,775 ($8,662) ($740) $49 $27,952 $7,788 $0 ($35,291) ($5,150) $0 $0 $14,752 $0 $0 $0 $16,087 ($10,647) $0 ($679) ($14,378) ($16,476) $16,461 $11,476 ($11,043) $48,783 $37,307 Page 1 Currently Chester is paying a dividend of $1.50 (per share). If this dividend stayed the same, but the stock price rose by 10% what would be the dividend yield? Select: 1 Save Answer 03.03% 3.78% 4.92% 26.44%