Answered step by step

Verified Expert Solution

Question

1 Approved Answer

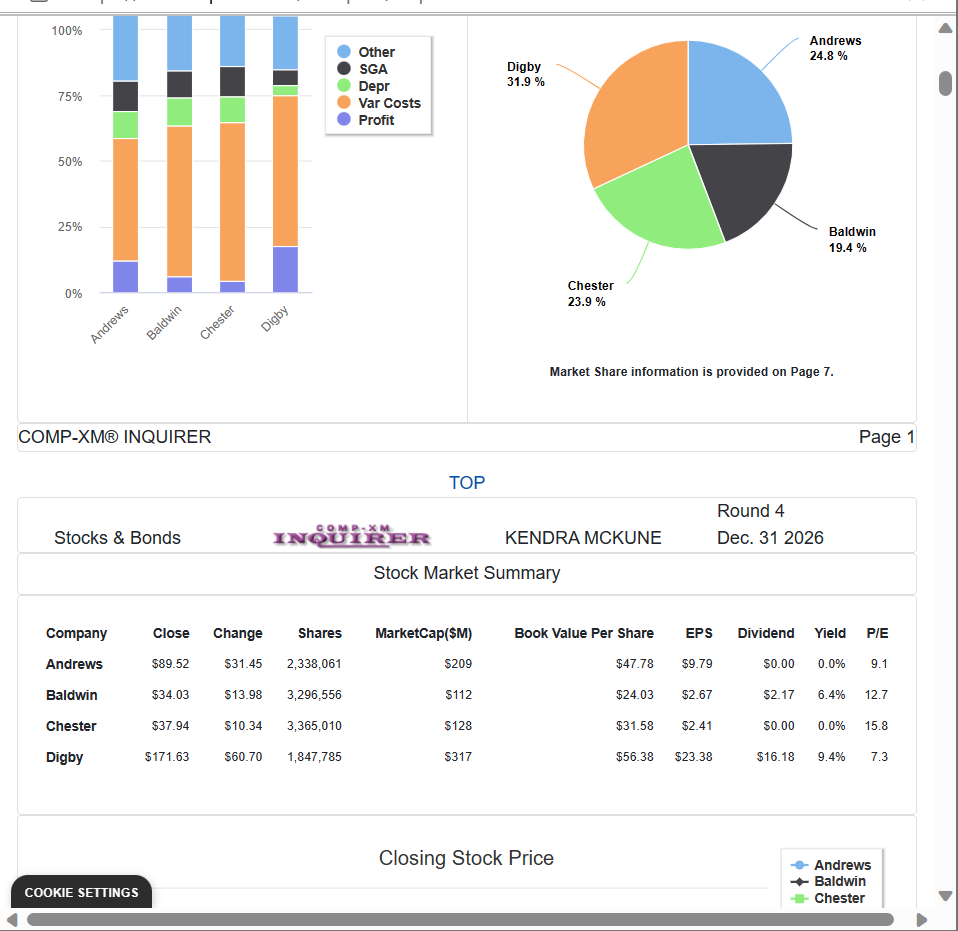

Currently Digby is paying a dividend of $16.18 (per share). If this dividend were raised by $3.64, given its current stock price what would be

Currently Digby is paying a dividend of $16.18 (per share). If this dividend were raised by $3.64, given its current stock price what would be the Dividend Yield?

Select : 1

Save Answer

9.4%

$19.82

$3.64

11.5%

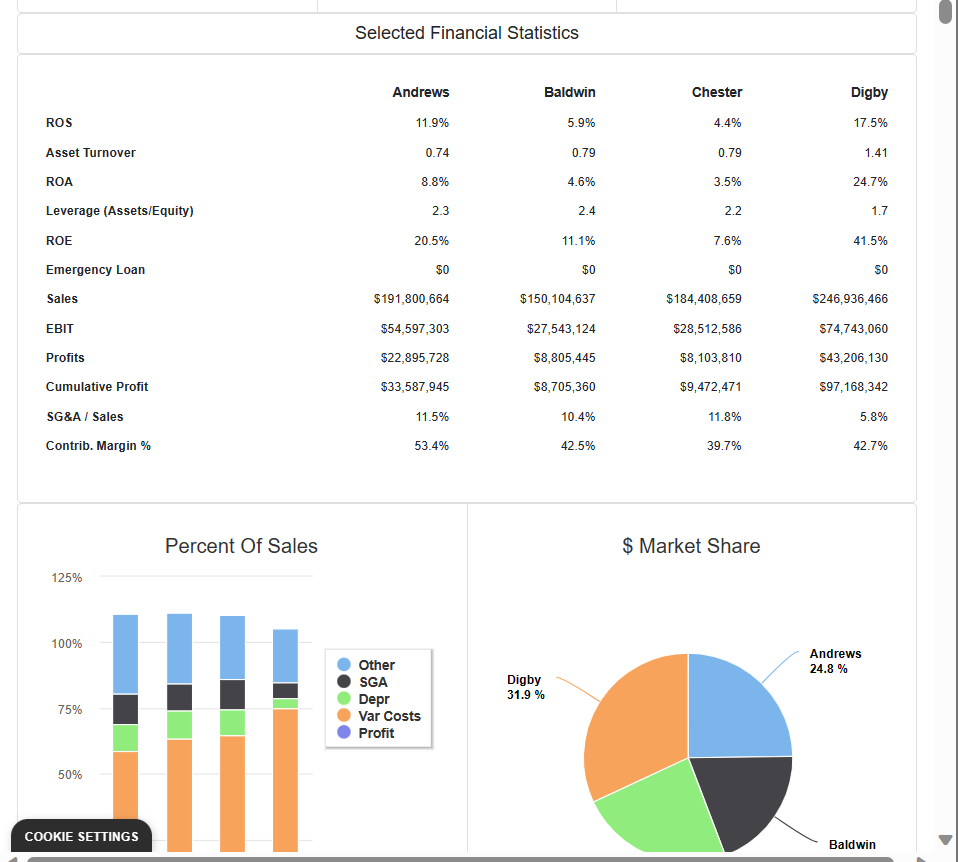

Selected Financial Statistics Andrews ROS Asset Turnover ROA Leverage (Assets/Equity) ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG\&A / Sales Contrib. Margin \% Baldwin 11.9% 0.74 8.8% 2.3 20.5% $0 $191,800,664 $54,597,303 $22,895,728 $33,587,945 11.5% 53.4% 5.9% 0.79 4.6% 2.4 11.1% $0 $150,104,637 $27,543,124 $8,805,445 $8,705,360 10.4% 42.5% Chester 4.4% 0.79 3.5% 2.2 7.6% $0 $184,408,659 $28,512,586 $8,103,810 $9,472,471 11.8% 39.7% Digby 17.5% 1.41 24.7% 1.7 41.5% $0 $246,936,466 $74,743,060 $43,206,130 $97,168,342 5.8% 42.7% Percent Of Sales 125% COOKIE SETTINGS \$ Market Share Market Share information is provided on Page 7. COMP-XM INQUIRER

Selected Financial Statistics Andrews ROS Asset Turnover ROA Leverage (Assets/Equity) ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG\&A / Sales Contrib. Margin \% Baldwin 11.9% 0.74 8.8% 2.3 20.5% $0 $191,800,664 $54,597,303 $22,895,728 $33,587,945 11.5% 53.4% 5.9% 0.79 4.6% 2.4 11.1% $0 $150,104,637 $27,543,124 $8,805,445 $8,705,360 10.4% 42.5% Chester 4.4% 0.79 3.5% 2.2 7.6% $0 $184,408,659 $28,512,586 $8,103,810 $9,472,471 11.8% 39.7% Digby 17.5% 1.41 24.7% 1.7 41.5% $0 $246,936,466 $74,743,060 $43,206,130 $97,168,342 5.8% 42.7% Percent Of Sales 125% COOKIE SETTINGS \$ Market Share Market Share information is provided on Page 7. COMP-XM INQUIRER Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started