Answered step by step

Verified Expert Solution

Question

1 Approved Answer

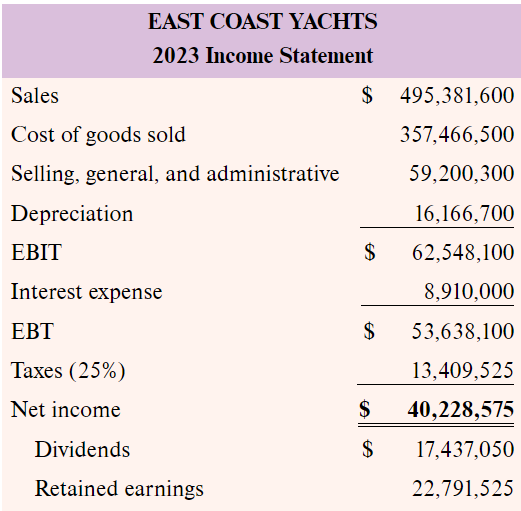

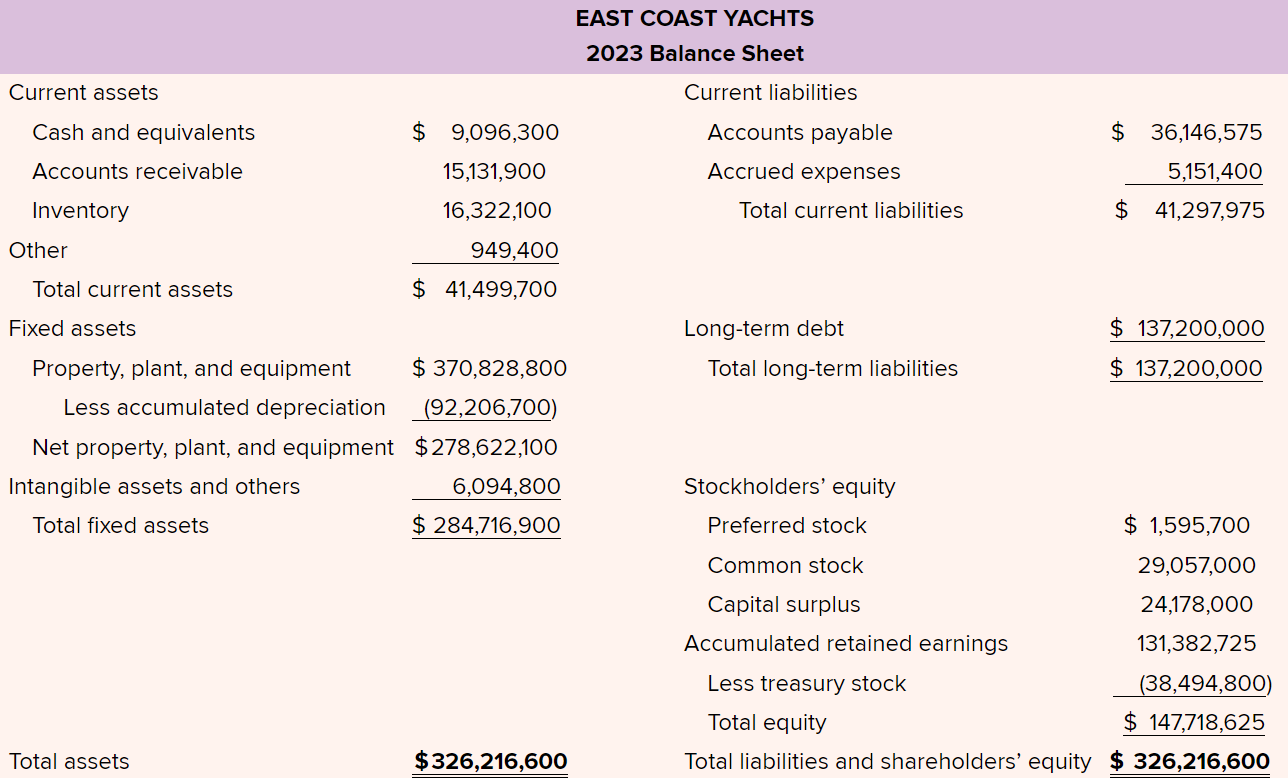

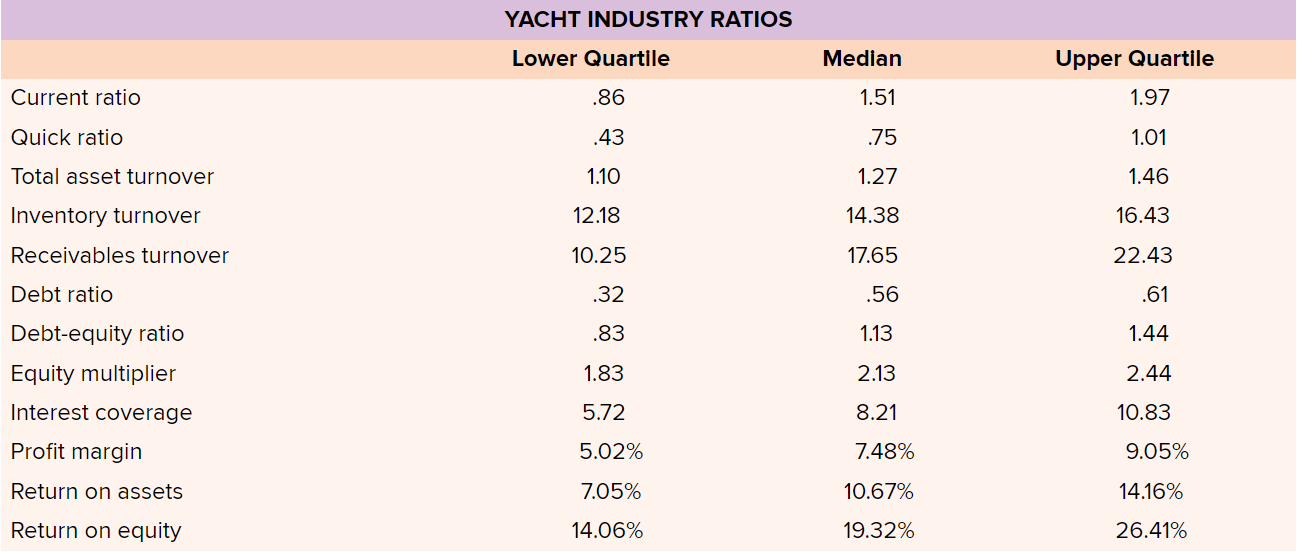

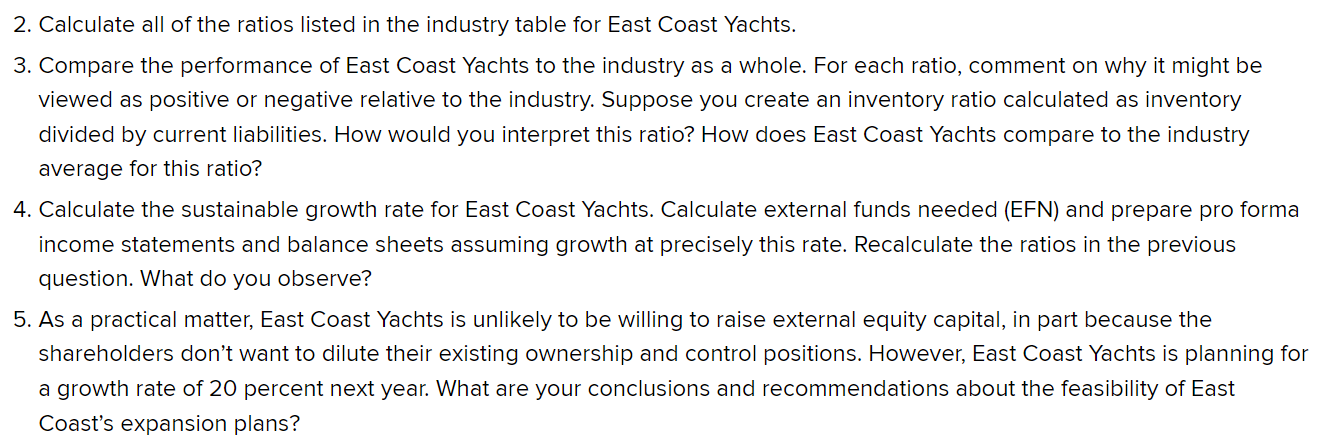

CurrentratioQuickratioTotalassetturnoverInventoryturnoverReceivablesturnoverDebtratioDebt-equityratioEquitymultiplierInterestcoverageProfitmarginReturnonassetsReturnonequityYACHTINDUSTRYRATIOSLowerQuartile.86.431.1012.1810.25.32.831.835.725.02%7.05%14.06%Median1.51.751.2714.3817.65.561.132.138.217.48%10.67%19.32%UpperQuartile1.971.011.4616.4322.431.442.4410.839.05% 2. Calculate all of the ratios listed in the industry table for East Coast Yachts. 3. Compare the performance of East Coast Yachts to

CurrentratioQuickratioTotalassetturnoverInventoryturnoverReceivablesturnoverDebtratioDebt-equityratioEquitymultiplierInterestcoverageProfitmarginReturnonassetsReturnonequityYACHTINDUSTRYRATIOSLowerQuartile.86.431.1012.1810.25.32.831.835.725.02%7.05%14.06%Median1.51.751.2714.3817.65.561.132.138.217.48%10.67%19.32%UpperQuartile1.971.011.4616.4322.431.442.4410.839.05% 2. Calculate all of the ratios listed in the industry table for East Coast Yachts. 3. Compare the performance of East Coast Yachts to the industry as a whole. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How would you interpret this ratio? How does East Coast Yachts compare to the industry average for this ratio? 4. Calculate the sustainable growth rate for East Coast Yachts. Calculate external funds needed (EFN) and prepare pro forma income statements and balance sheets assuming growth at precisely this rate. Recalculate the ratios in the previous question. What do you observe? 5. As a practical matter, East Coast Yachts is unlikely to be willing to raise external equity capital, in part because the shareholders don't want to dilute their existing ownership and control positions. However, East Coast Yachts is planning fo a growth rate of 20 percent next year. What are your conclusions and recommendations about the feasibility of East Coast's expansion plans

CurrentratioQuickratioTotalassetturnoverInventoryturnoverReceivablesturnoverDebtratioDebt-equityratioEquitymultiplierInterestcoverageProfitmarginReturnonassetsReturnonequityYACHTINDUSTRYRATIOSLowerQuartile.86.431.1012.1810.25.32.831.835.725.02%7.05%14.06%Median1.51.751.2714.3817.65.561.132.138.217.48%10.67%19.32%UpperQuartile1.971.011.4616.4322.431.442.4410.839.05% 2. Calculate all of the ratios listed in the industry table for East Coast Yachts. 3. Compare the performance of East Coast Yachts to the industry as a whole. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How would you interpret this ratio? How does East Coast Yachts compare to the industry average for this ratio? 4. Calculate the sustainable growth rate for East Coast Yachts. Calculate external funds needed (EFN) and prepare pro forma income statements and balance sheets assuming growth at precisely this rate. Recalculate the ratios in the previous question. What do you observe? 5. As a practical matter, East Coast Yachts is unlikely to be willing to raise external equity capital, in part because the shareholders don't want to dilute their existing ownership and control positions. However, East Coast Yachts is planning fo a growth rate of 20 percent next year. What are your conclusions and recommendations about the feasibility of East Coast's expansion plans Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started