Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $6,700,

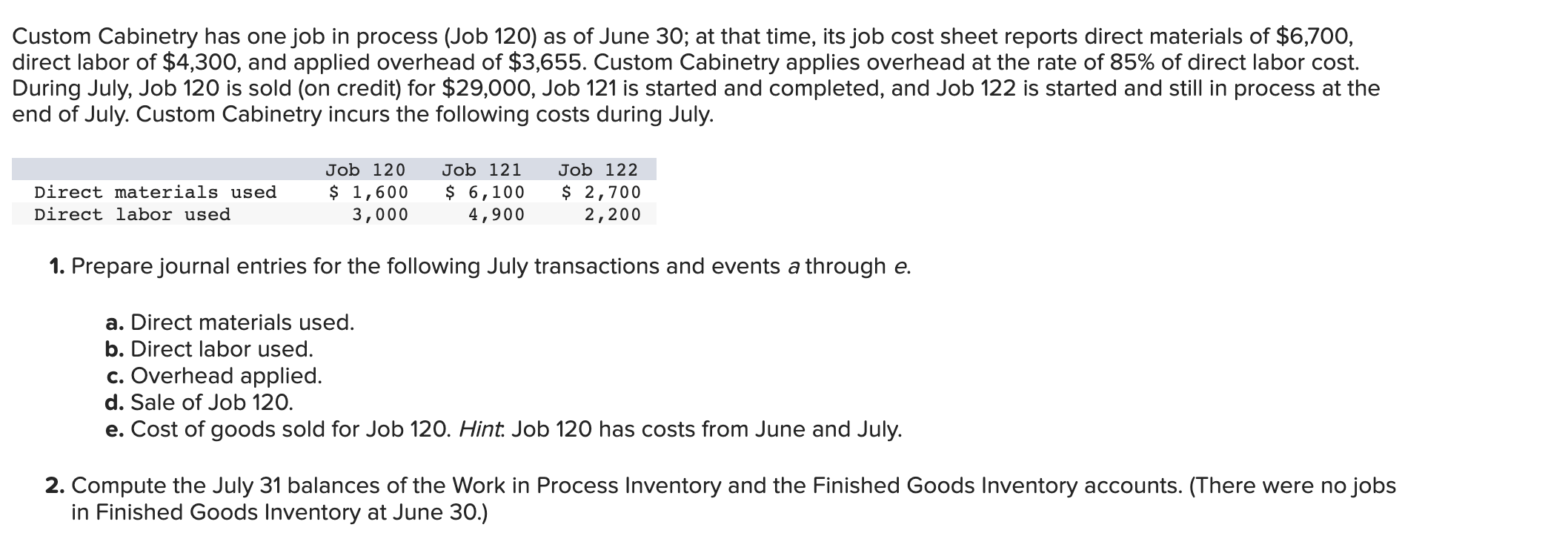

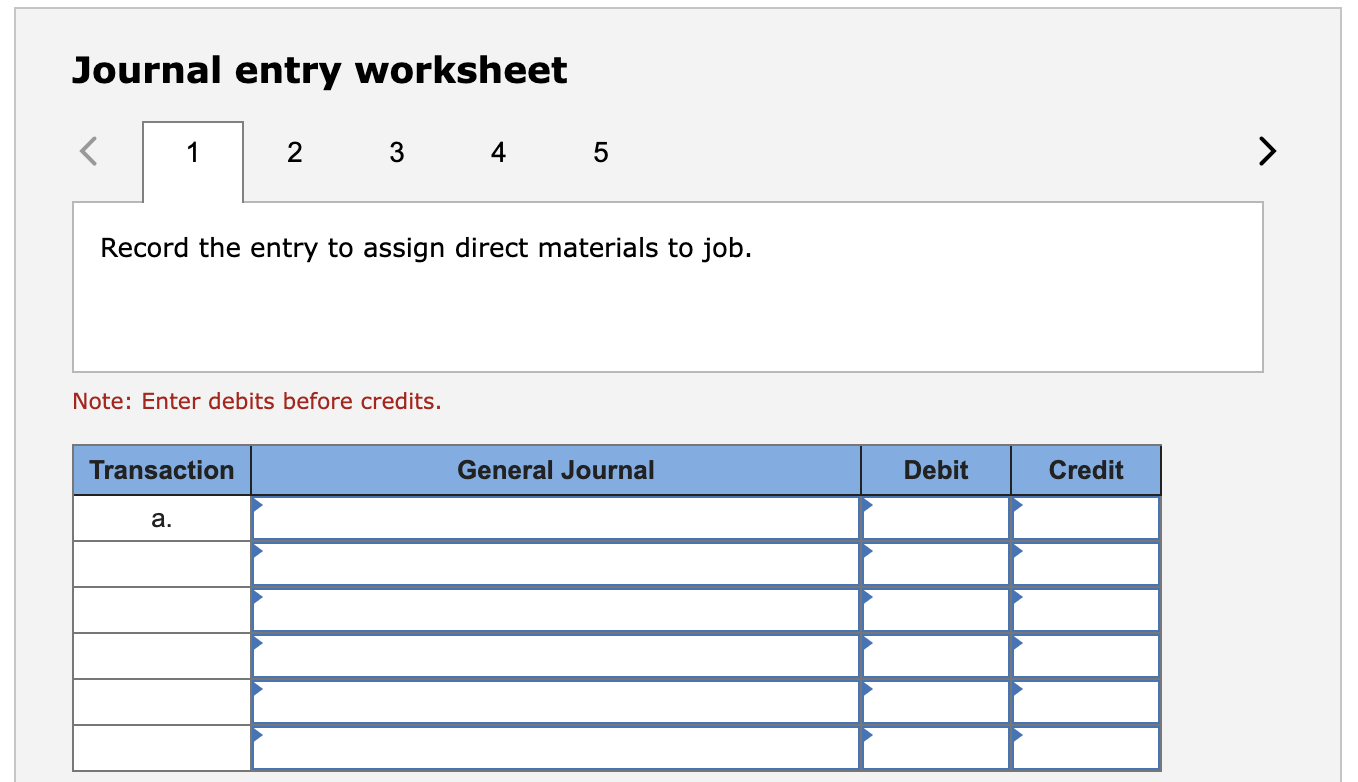

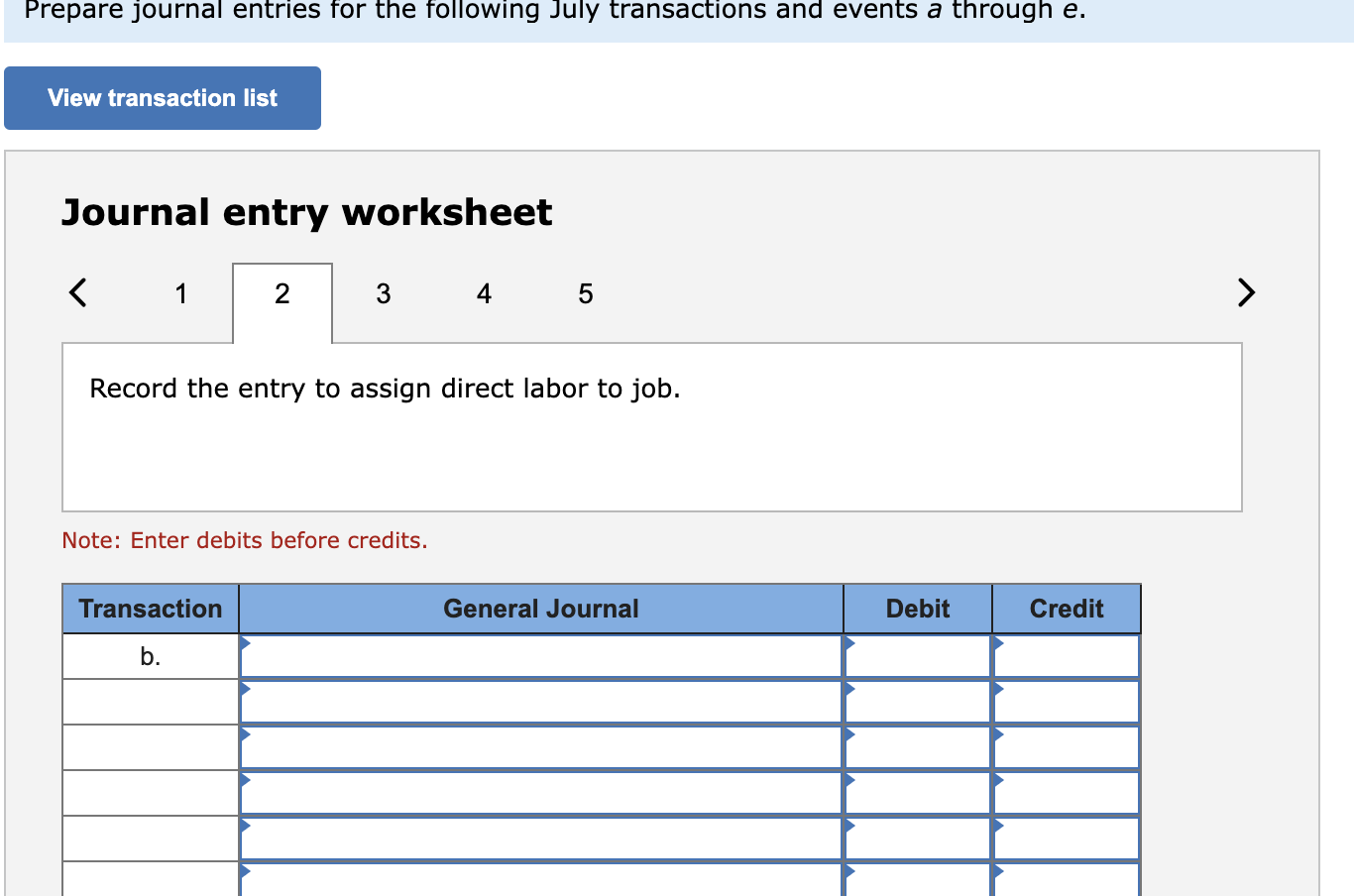

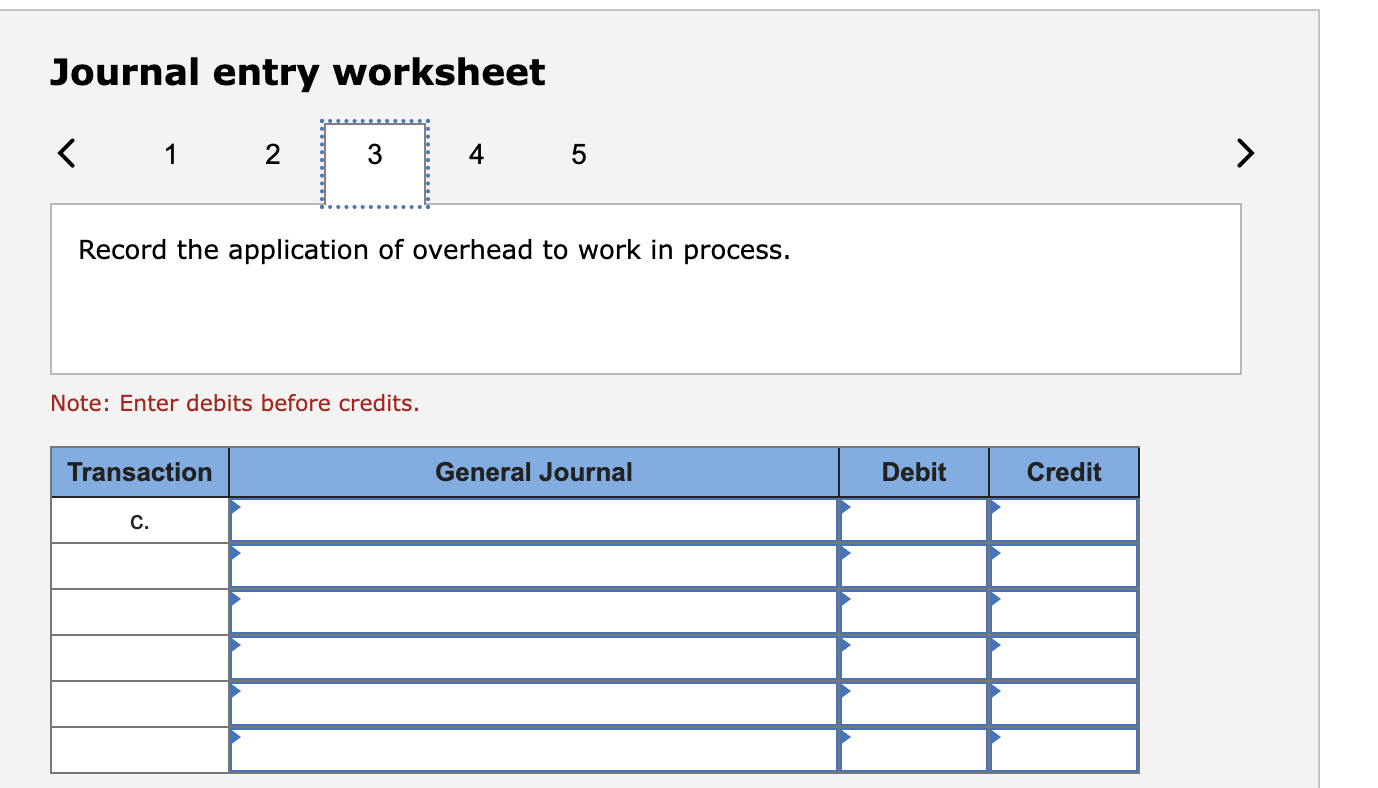

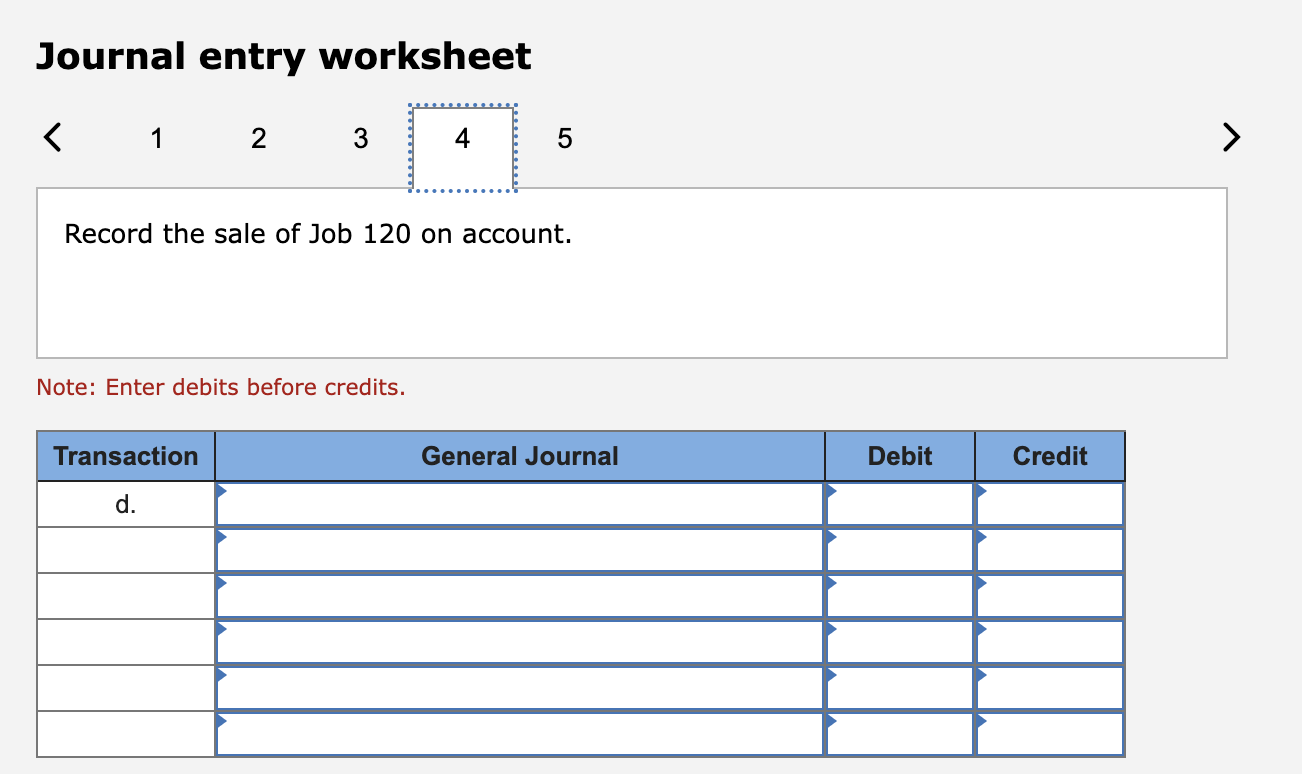

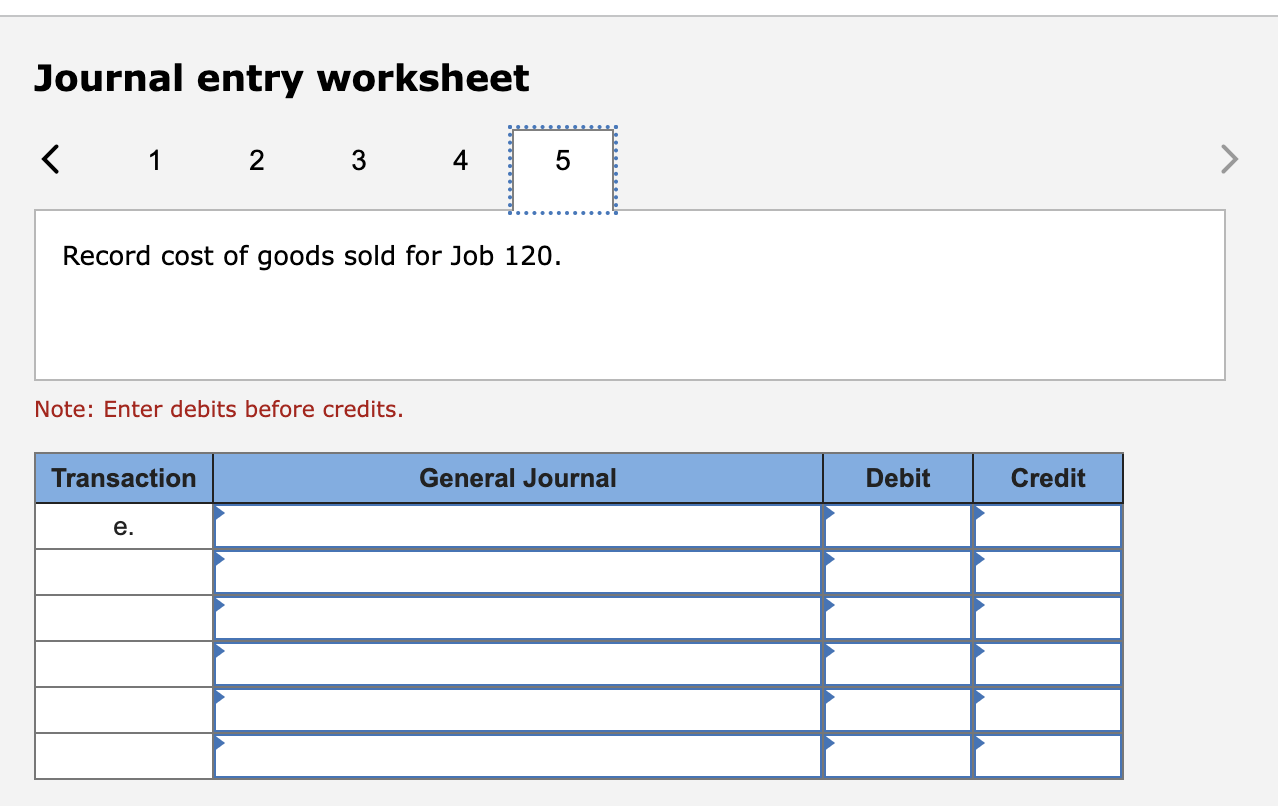

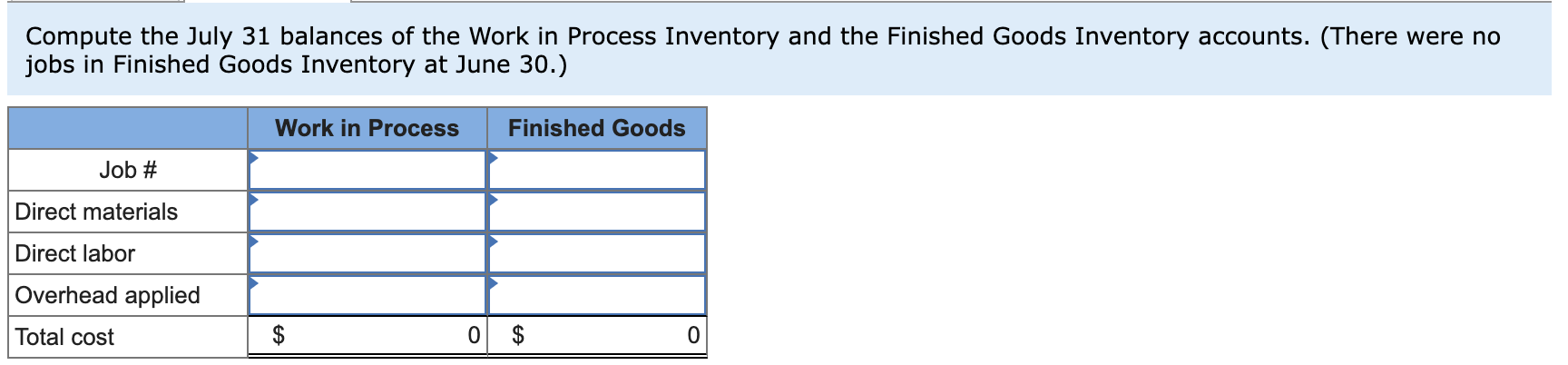

Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $6,700, direct labor of $4,300, and applied overhead of $3,655. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on credit) for $29,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June 30.) Journal entry worksheet Record the entry to assign direct materials to job. Note: Enter debits before credits. Journal entry worksheet Record the entry to assign direct labor to job. Note: Enter debits before credits. Journal entry worksheet Record the application of overhead to work in process. Note: Enter debits before credits. Journal entry worksheet Record the sale of Job 120 on account. Note: Enter debits before credits. Journal entry worksheet

Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $6,700, direct labor of $4,300, and applied overhead of $3,655. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on credit) for $29,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June 30.) Journal entry worksheet Record the entry to assign direct materials to job. Note: Enter debits before credits. Journal entry worksheet Record the entry to assign direct labor to job. Note: Enter debits before credits. Journal entry worksheet Record the application of overhead to work in process. Note: Enter debits before credits. Journal entry worksheet Record the sale of Job 120 on account. Note: Enter debits before credits. Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started