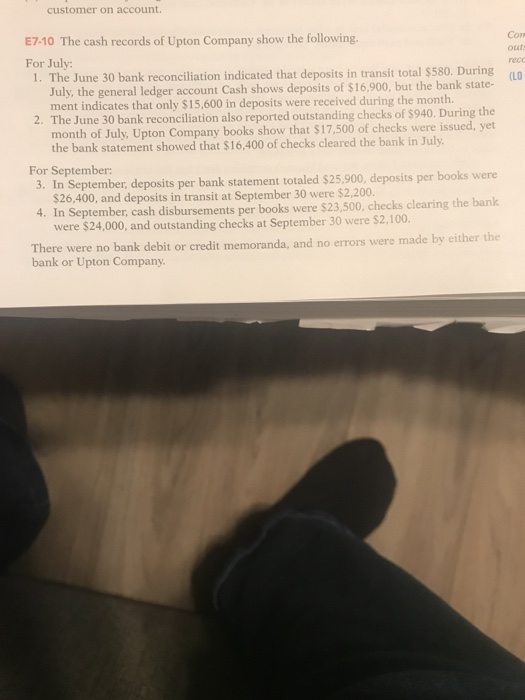

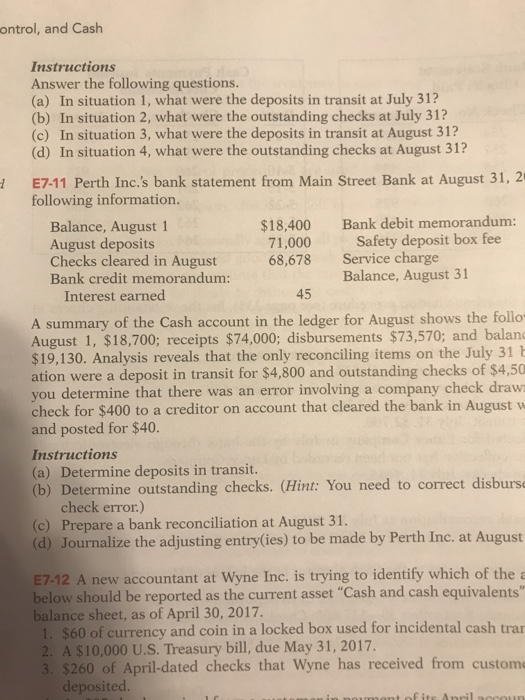

customer on account. E7-10 The cash records of Upton Company show the following. For July Com outs rec 1. The June 30 bank reconciliation indicated that deposits in transit total $580. During uly, the general ledger account Cash shows deposits of $16,900, but the bank state- ment indicates that only $15,600 in deposits were received during the month. The June 30 bank reconciliation also reported outstanding checks of $940. During the month of July, Upton Company books show that $17,500 of checks were issued, yet the bank statement showed that $16,400 of checks cleared the bank in July. For September: In September deposits per bank statement totaled $25,900, deposits per books were $26,400, and deposits in transit at September 30 were $2,200. 4. In September, cash disbursements per books were $23,500, checks clearing the bank were $24,000, and outstanding checks at September 30 were $2,100 ere were no bank debit or credit memoranda, and no errors were made by either the Th bank or Upton Company ontrol, and Cash Instructions Answer the following questions. (a) In situation 1, what were the deposits in transit at July 31? (b) In situation 2, what were the outstanding checks at July 31? (c) In situation 3, what were the deposits in transit at August 31? (d) In situation 4, what were the outstanding checks at August 31? E7-11 Perth Inc.'s bank statement from Main Street Bank at August 31, 2 following information. Bank debit memorandum: Balance, August 1 August deposits Checks cleared in August Bank credit memorandum: $18,400 71,000 68,678 Safety deposit box fee Service charge Balance, August 31 Interest earned 45 A summary of the Cash account in the ledger for August shows the follo August 1, $18,700; receipts $74,000; disbursements $73,570; and balan $19,130. Analysis reveals that the only reconciling items on the July 31 ation were a deposit in transit for $4,800 and outstanding checks of $4,50 you determine that there was an error involving a company check draw check for $400 to a creditor on account that cleared the bank in August w and posted for $40. Instructions (a) Determine deposits in transit. (b) Determine outstanding checks. (Hint: You need to correct disburse check erron.) (c) Prepare a bank reconciliation at August 31. (d) Journalize the adjusting entry(ies) to be made by Perth Inc. at August E7-12 A new accountant at Wyne Inc. is trying to identify which of the a below should be reported as the current asset "Cash and cash equivalents 1. $60 of currency and coin in a locked box used for incidental cash trar 3. $260 of April-dated checks that Wyne has received from custome balance sheet, as of April 30, 2017. A $10,000 U.S. Treasury bill, due May 31, 2017 deposited