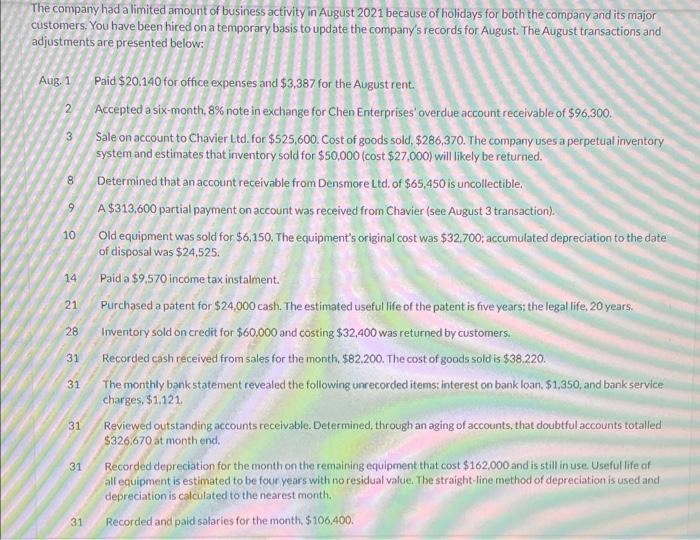

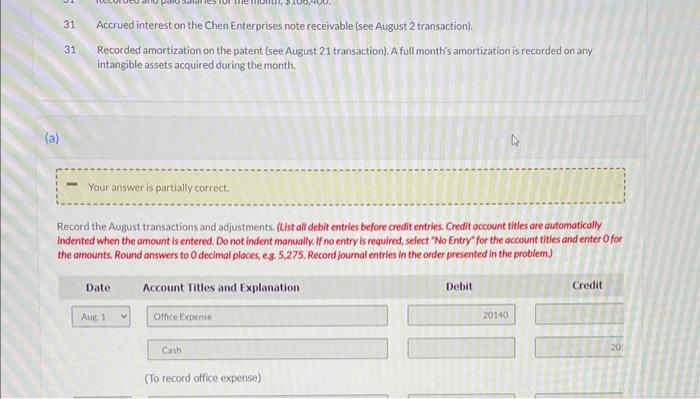

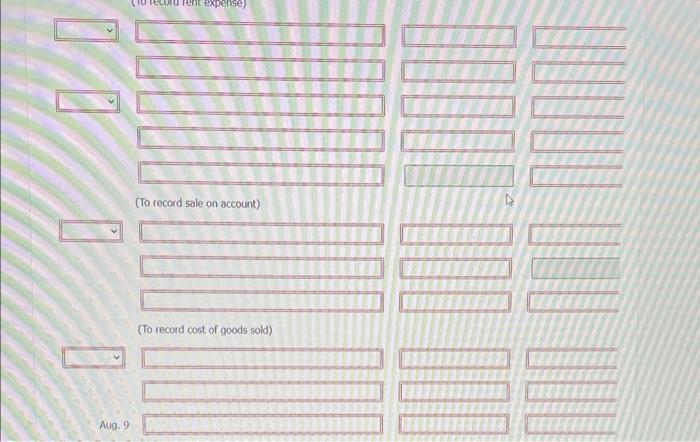

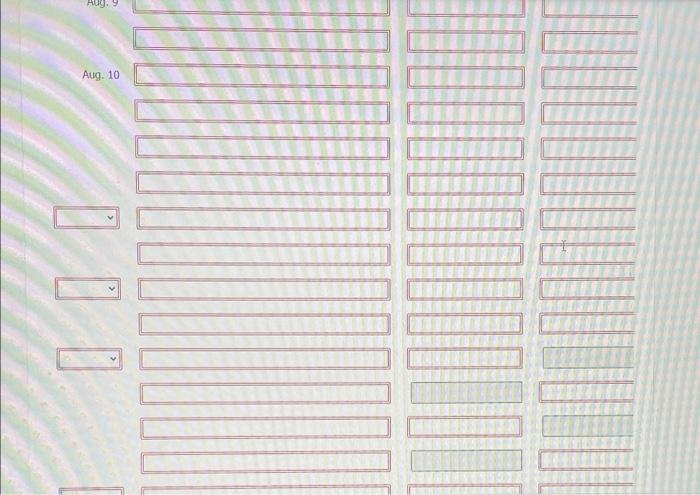

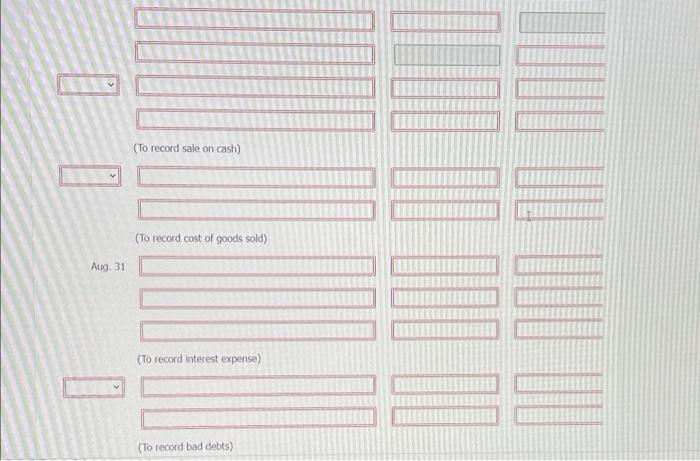

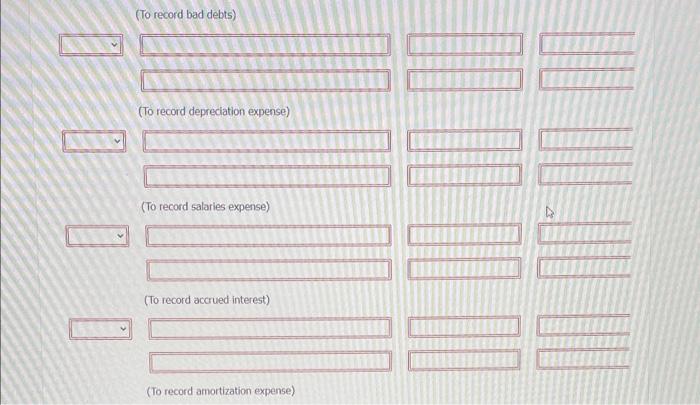

customers. You have been hired on a temporary basis to update the company's records for August. The August transactions and adjustments are presented below: Aug. 1 Paid $20.140 for office expenses and $3,387 for the August rent. 2 Accepted a six-month, 8% note in exchange for Chen Enterprises' overdue account receivable of $96,300. 3 Sale on account to Chavier Ltd. for $525,600. Cost of goods sold, $286,370. The company uses a perpetual inventory system and estimates that inventory sold for $50,000 (cost $27,000 ) will likely be returned. 8 Determined that an account receivable from Densmore Ltd. of $65,450 is uncollectible. 9. A $313,600 partial payment on account was received from Chavier (see August 3 transaction). 10 Old equipment was sold for $6,150. The equipment's original cost was $32.700; accumulated depreciation to the date of disposal was $24,525. 14 Paida $9.570 income tax instalment. 21 Purchased a patent for $24,000 cash. The estimated useful life of the patent is five years: the legal life, 20 years. 28 Inventory sold on credit for $60.000 and costing $32,400 was returned by customers. 31 Recorded cash received from sales for the month, $82.200. The cost of goods sold is $38.220. 31 The monthly bank statement revealed the following unrecorded items: interest on bank loan, $1,350, and bank service charges, $1,121. 31 Reviewed outstanding accounts receivable. Determined, through an aging of accounts, that doubtfulaccounts totalled $326,670 at month end. 31 Recorded depreciation for the month on the remaining equipment that cost $162,000 and is still in use Useful life of all equipment is estimated to be four years with no residual value. The straight-line method of depreciation is used and depreciation is calculated to the nearest month. 31 Recorded and paid salaries for the month, $106,400. 31 Accrued interest on the Chen Enterprises note receivable (see August 2 transaction). 31 Recorded amortization on the patent (see August 21 transaction). A full month's amortization is recorded on any intangible assets acquired during the month. Record the August transactions and adjustments. (List all debit entries before credit entries, Credit account titles are outomatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter O for the amounts. Round answers to Odecimal places, eg. 5.275. Record joumal entries in the order presented in the problem. (To record sale on account) (To record cost of goods sold) Aug. 9 Aug. 10 (To record sale on cash) (To record cost of goods sold) Aug. 31 (To record interest expense) (To record bad debts)