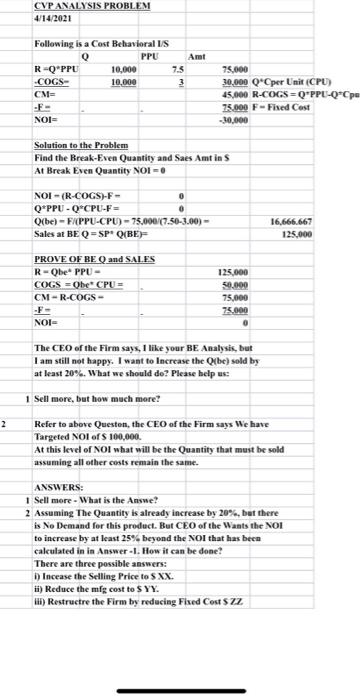

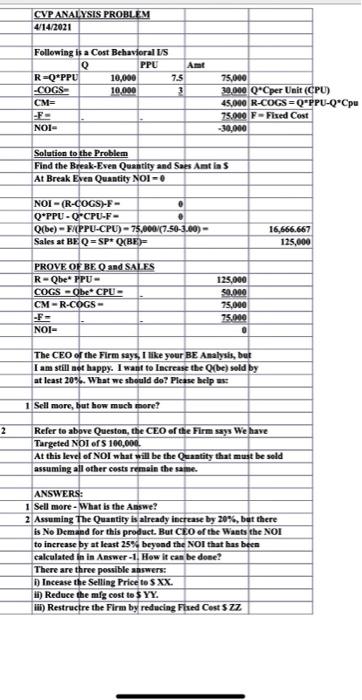

CVP ANALYSIS PROBLEM 4/14/2021 Following is a Cost Behavioral IS PPU Amt R-Q"PPU 10.000 7.5 -COGS 10.000 CM 75.000 30,000 Q' per Unit (CPU) 45,000 R-COGSO'PPL-Q pe 75.000 F- Fixed Cost -30.000 NOI Solution to the Problem Find the Break-Even Quantity and Saes Amt in S At Break Even Quantity NOI NOI - (R-COGS)-F- 0 Q*PPU - Q CPU-F= O(be) - FXPPU-CPU) -75,0007.50-3.00) - Sales at BE Q - SP Q(BE) 16,666.667 125.000 PROVE OF BEQ and SALES R-Obe PPU- COGS = Obe CPU CM-R-COGS - 125.000 50,000 75,000 75.000 0 NOI 2 The CEO of the Firm says, I like your BE Analysis, but I am still not happy. I want to Increase the Q{be) sold by at least 20%. What we should do? Please help us 1 Sell more, but how much more! Refer to above Questen, the CEO of the Firm says We have Targeted NOI of S100,000. At this level of Not what will be the Quantity that must be sold assuming all other costs remain the same. ANSWERS: 1 Sell more - What is the Answe? 2 Assuming The Quantity is already increase by 20%, but there is No Demand for this product. But CEO of the Wants the NOI to increase by at least 25% beyond the NOI that has been calculated in in Answer - I. How it can be done! There are three possible answers: b) Incease the Selling Price to s XX. ii) Reduce the mfg cost to SYY. I) Restructre the Firm by reducing Fixed Cost SZZ CVP ANALYSIS PROBLEM 4/14/2021 Following is a Cost Behavioral LS Q PPU Amt R-Q*PPU 10,000 7.5 -COGS 10.000 3 CM= 75,000 30.000 Q* per Unit (CPU) 45,000 R-COGS=Q PPU-O'Cpu 75.000 F-Fixed Cost -30,000 --- NOI Solution to the Problem Find the Break-Even Quantity and Saes Amt las At Break Even Quantity NOI - 0 NOI - (R-COGS)-F- . Q'PPU - Q CPU-F- Q(be) - FAPPU-CPU) - 75,000/(7-50-3.00) - Sales at BEQ SPO(BE) 16,666.667 125.000 PROVE OF BE Q and SALES R-Qbe PPU- COGS -Obe* CPU- CM-R-COGS -F- NOI- 125,000 50.000 75,000 25.000 The CEO of the Firm says, I like your BE Analysis, but I am still not happy. I want to Increase the Q/be) sold by at least 20%. What we should do? Please help us: 1 Sell more, but how much more? 2 Refer to above Queston, the CEO of the Firm says We have Targeted NOI of $ 100,000 At this level of NOI what will be the Quantity that must be sold assuming all other costs remain the same. ANSWERS: 1 Sell more. What is the Answe? 2 Assuming The Quantity is already increase by 20%, but there is No Demand for this product. But CEO of the Wants the NOI to increase by at least 25%, beyond the NOI that has been calculated in in Answer-1. How it can be done? There are three possible answers: D) Incease the Selling Price to S XX. i Reduce the mfg cost to SYY. MIT) Restruetre the Firm by reducing Fixed Costs ZZ CVP ANALYSIS PROBLEM 4/14/2021 Following is a Cost Behavioral IS PPU Amt R-Q"PPU 10.000 7.5 -COGS 10.000 CM 75.000 30,000 Q' per Unit (CPU) 45,000 R-COGSO'PPL-Q pe 75.000 F- Fixed Cost -30.000 NOI Solution to the Problem Find the Break-Even Quantity and Saes Amt in S At Break Even Quantity NOI NOI - (R-COGS)-F- 0 Q*PPU - Q CPU-F= O(be) - FXPPU-CPU) -75,0007.50-3.00) - Sales at BE Q - SP Q(BE) 16,666.667 125.000 PROVE OF BEQ and SALES R-Obe PPU- COGS = Obe CPU CM-R-COGS - 125.000 50,000 75,000 75.000 0 NOI 2 The CEO of the Firm says, I like your BE Analysis, but I am still not happy. I want to Increase the Q{be) sold by at least 20%. What we should do? Please help us 1 Sell more, but how much more! Refer to above Questen, the CEO of the Firm says We have Targeted NOI of S100,000. At this level of Not what will be the Quantity that must be sold assuming all other costs remain the same. ANSWERS: 1 Sell more - What is the Answe? 2 Assuming The Quantity is already increase by 20%, but there is No Demand for this product. But CEO of the Wants the NOI to increase by at least 25% beyond the NOI that has been calculated in in Answer - I. How it can be done! There are three possible answers: b) Incease the Selling Price to s XX. ii) Reduce the mfg cost to SYY. I) Restructre the Firm by reducing Fixed Cost SZZ CVP ANALYSIS PROBLEM 4/14/2021 Following is a Cost Behavioral LS Q PPU Amt R-Q*PPU 10,000 7.5 -COGS 10.000 3 CM= 75,000 30.000 Q* per Unit (CPU) 45,000 R-COGS=Q PPU-O'Cpu 75.000 F-Fixed Cost -30,000 --- NOI Solution to the Problem Find the Break-Even Quantity and Saes Amt las At Break Even Quantity NOI - 0 NOI - (R-COGS)-F- . Q'PPU - Q CPU-F- Q(be) - FAPPU-CPU) - 75,000/(7-50-3.00) - Sales at BEQ SPO(BE) 16,666.667 125.000 PROVE OF BE Q and SALES R-Qbe PPU- COGS -Obe* CPU- CM-R-COGS -F- NOI- 125,000 50.000 75,000 25.000 The CEO of the Firm says, I like your BE Analysis, but I am still not happy. I want to Increase the Q/be) sold by at least 20%. What we should do? Please help us: 1 Sell more, but how much more? 2 Refer to above Queston, the CEO of the Firm says We have Targeted NOI of $ 100,000 At this level of NOI what will be the Quantity that must be sold assuming all other costs remain the same. ANSWERS: 1 Sell more. What is the Answe? 2 Assuming The Quantity is already increase by 20%, but there is No Demand for this product. But CEO of the Wants the NOI to increase by at least 25%, beyond the NOI that has been calculated in in Answer-1. How it can be done? There are three possible answers: D) Incease the Selling Price to S XX. i Reduce the mfg cost to SYY. MIT) Restruetre the Firm by reducing Fixed Costs ZZ