Answered step by step

Verified Expert Solution

Question

1 Approved Answer

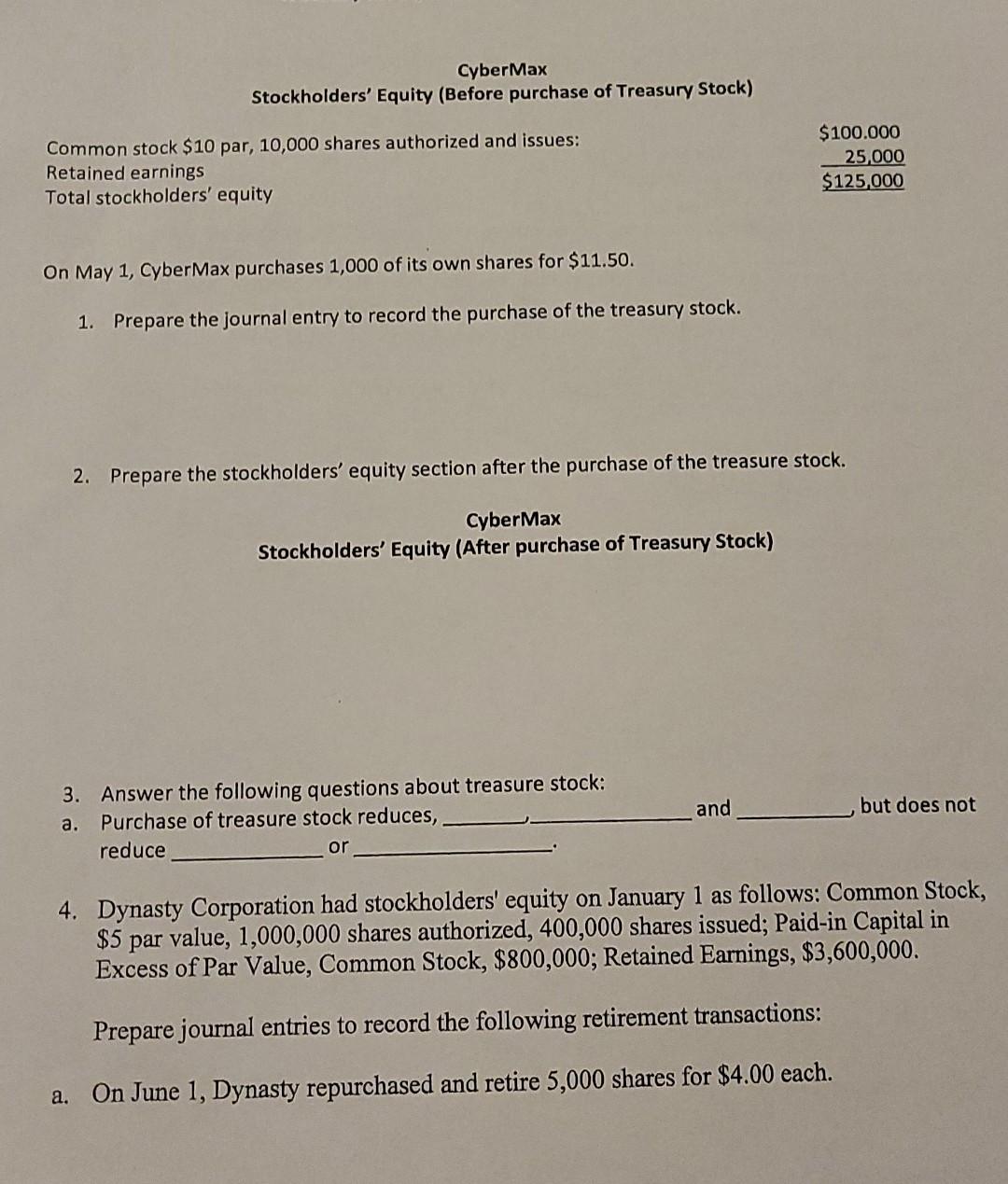

CyberMax Stockholders' Equity (Before purchase of Treasury Stock) Common stock $10 par, 10,000 shares authorized and issues: Retained earnings Total stockholders' equity $100.000 25,000 $125,000

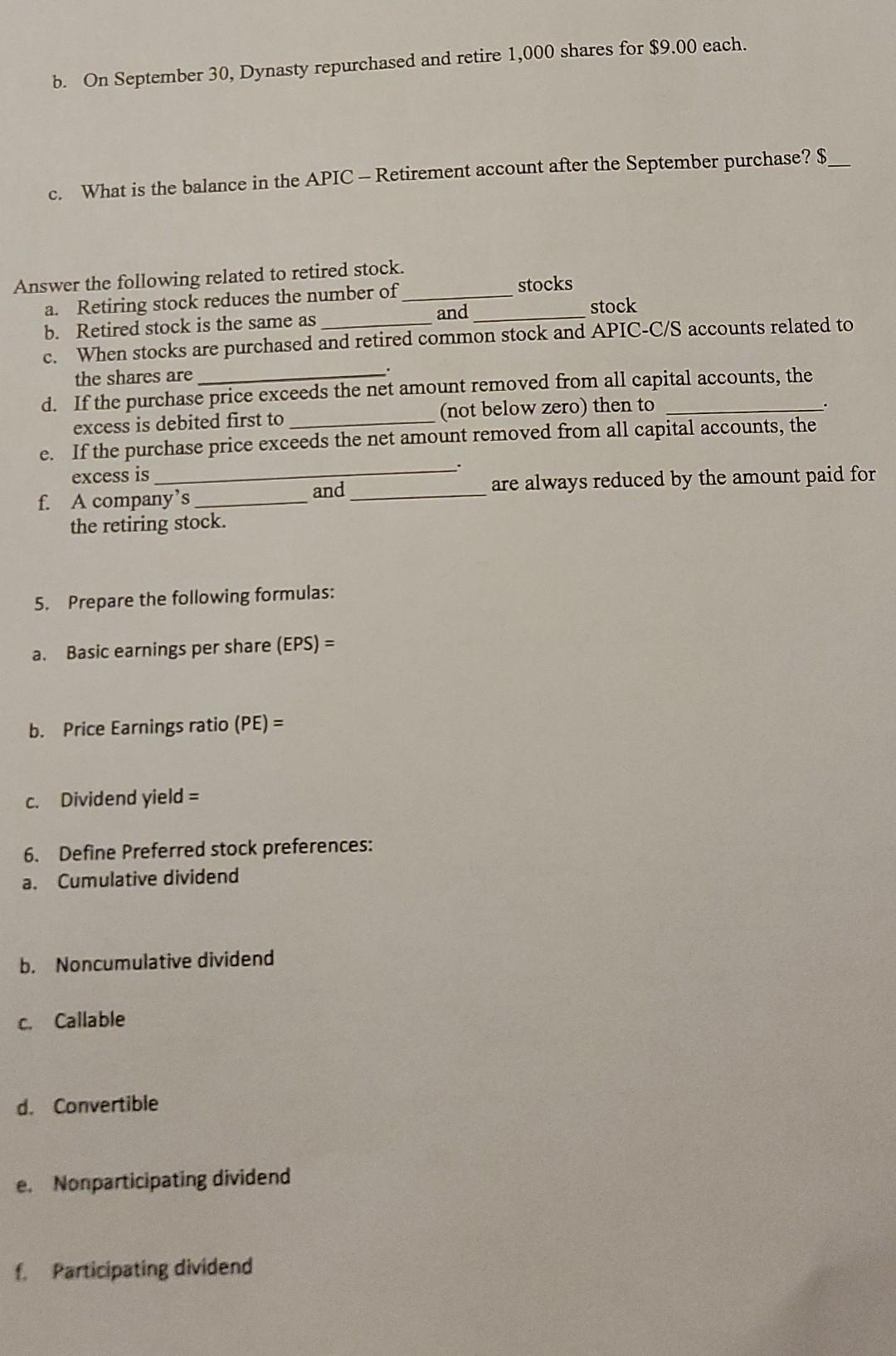

CyberMax Stockholders' Equity (Before purchase of Treasury Stock) Common stock $10 par, 10,000 shares authorized and issues: Retained earnings Total stockholders' equity $100.000 25,000 $125,000 On May 1, Cyber Max purchases 1,000 of its own shares for $11.50. 1. Prepare the journal entry to record the purchase of the treasury stock. 2. Prepare the stockholders' equity section after the purchase of the treasure stock. CyberMax Stockholders' Equity (After purchase of Treasury Stock) and but does not 3. Answer the following questions about treasure stock: a. Purchase of treasure stock reduces, reduce or 4. Dynasty Corporation had stockholders' equity on January 1 as follows: Common Stock, $5 par value, 1,000,000 shares authorized, 400,000 shares issued; Paid-in Capital in Excess of Par Value, Common Stock, $800,000; Retained Earnings, $3,600,000. Prepare journal entries to record the following retirement transactions: a. On June 1, Dynasty repurchased and retire 5,000 shares for $4.00 each. b. On September 30, Dynasty repurchased and retire 1,000 shares for $9.00 each. C. What is the balance in the APIC - Retirement account after the September purchase? $ Answer the following related to retired stock. a. Retiring stock reduces the number of stocks b. Retired stock is the same as and stock c. When stocks are purchased and retired common stock and APIC-C/S accounts related to the shares are d. If the purchase price exceeds the net amount removed from all capital accounts, the excess is debited first to (not below zero) then to e. If the purchase price exceeds the net amount removed from all capital accounts, the excess is f. A company's and are always reduced by the amount paid for the retiring stock. 5. Prepare the following formulas: a. Basic earnings per share (EPS) = b. Price Earnings ratio (PE) = C. Dividend yield = 6. Define Preferred stock preferences: a. Cumulative dividend b. Noncumulative dividend C. Callable d. Convertible e. Nonparticipating dividend 1. Participating dividend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started