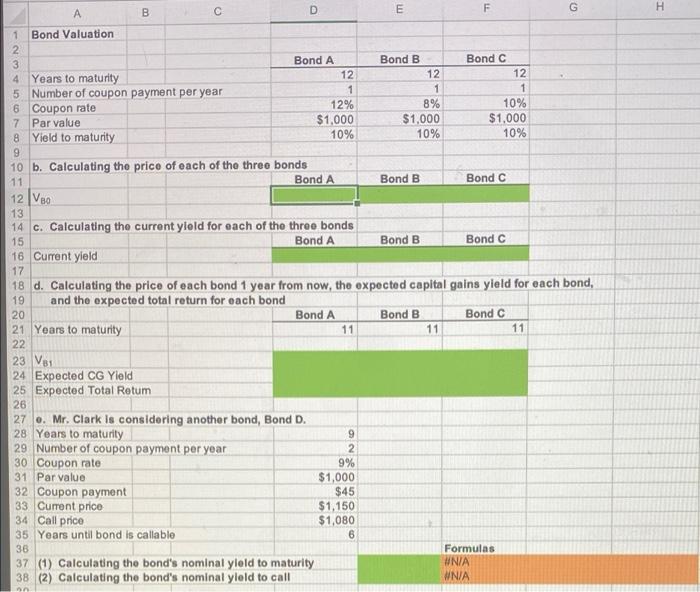

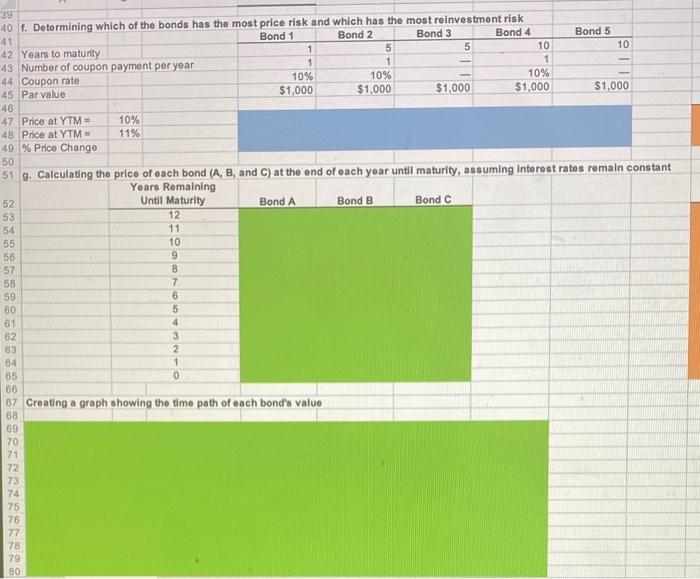

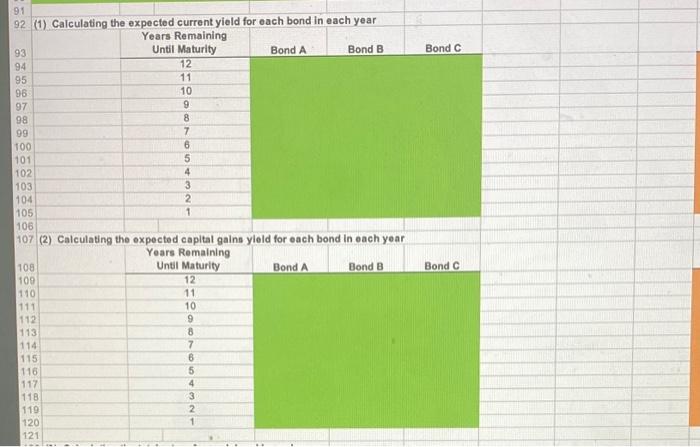

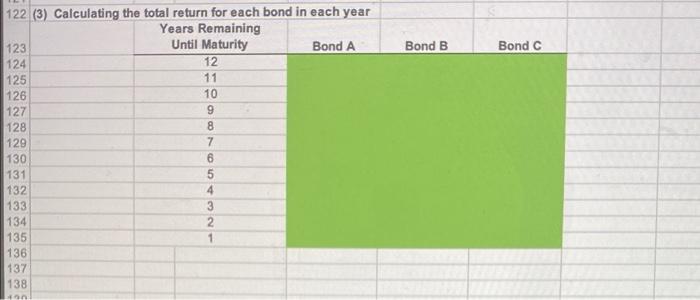

D Bond A 12 12 1 12% $1,000 10% E Bond B A B C Bond Valuation 2 3 4 Years to maturity 5 Number of coupon payment per year 6 Coupon rate 7 Par value 8 Yield to maturity 9 10 b. Calculating the price of each of the three bonds 11 Bond A Bond B Bond C 12 V80 13 14 c. Calculating the current yield for each of the three bonds 15 Bond A Bond B Bond C 16 Current yield 17 18 d. Calculating the price of each bond 1 year from now, the expected capital gains yield for each bond, and the expected total return for each bond 19 20 Bond A Bond B Bond C 21 Years to maturity 11 11 11 22 23 Vi 24 Expected CG Yield 25 Expected Total Retum 26 27. Mr. Clark is considering another bond, Bond D. 28 Years to maturity 29 Number of coupon payment per year 30 Coupon rate 31 Par value 32 Coupon payment 33 Current price 34 Call price 35 Years until bond is callable 36 37 (1) Calculating the bond's nominal yield to maturity 38 (2) Calculating the bond's nominal yield to call 20 9 2 9% $1,000 $45 $1,150 $1,080 6 12 1 F Bond C 8% $1,000 10% 12 1 10% $1,000 10% G Formulas #N/A #N/A H 39 40 f. Determining which of the bonds has the most price risk and which has the most reinvestment risk Bond 2 Bond 1 Bond 3 Bond 4 41 5 1 5 10 10 42 Years to maturity 1 - 43 Number of coupon payment per year 1 10% 1 10% 10% 44 Coupon rate $1,000 $1,000 $1,000 $1,000 45 Par value $1,000 46 47 Price at YTM= 10% 48 Price at YTM= 11% 49 % Price Change 50 51 g. Calculating the price of each bond (A, B, and C) at the end of each year until maturity, assuming Interest rates remain constant Years Remaining Until Maturity 52 Bond A Bond B Bond C 53 12 54 11 55 10 56 9 57 58 59 60 61 62 63 64 1 65 0 66 67 Creating a graph showing the time path of each bond's value 68 69 70 71 72 73 74 75 76 77 78 79 80 8 7 6 5 4 3 2 Bond 5 91 92 (1) Calculating the expected current yield for each bond in each year Years Remaining 93 Until Maturity Bond A Bond B 94 12 95 11 96 10 97 9 98 8 99 7 100 6 101 5 102 4 103 3 104 2 105 1 106 107 (2) Calculating the expected capital gains yield for each bond in each year Years Remaining 108 Until Maturity Bond A Bond B 109 12 110 11 111 10 112 9 113 8 114 7 115 6 116 5 117 4 118 3 119 2 120 1 121 Bond C Bond C 122 (3) Calculating the total return for each bond in each year Years Remaining 123 Until Maturity Bond A 124 12 125 11 126 10 127 9 128 8 129 130 131 132 133 134 135 136 137 138 430. 7654321 Bond B Bond C