Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d) Critically evaluate the relationship between WACC and IRR on investment; also discuss the effect of agency problem on potential variable investment for Trust PLC,

d) Critically evaluate the relationship between WACC and IRR on investment; also discuss the effect of agency problem on potential variable investment for Trust PLC, insuring the response is supported with relevant academic research. (15marks)

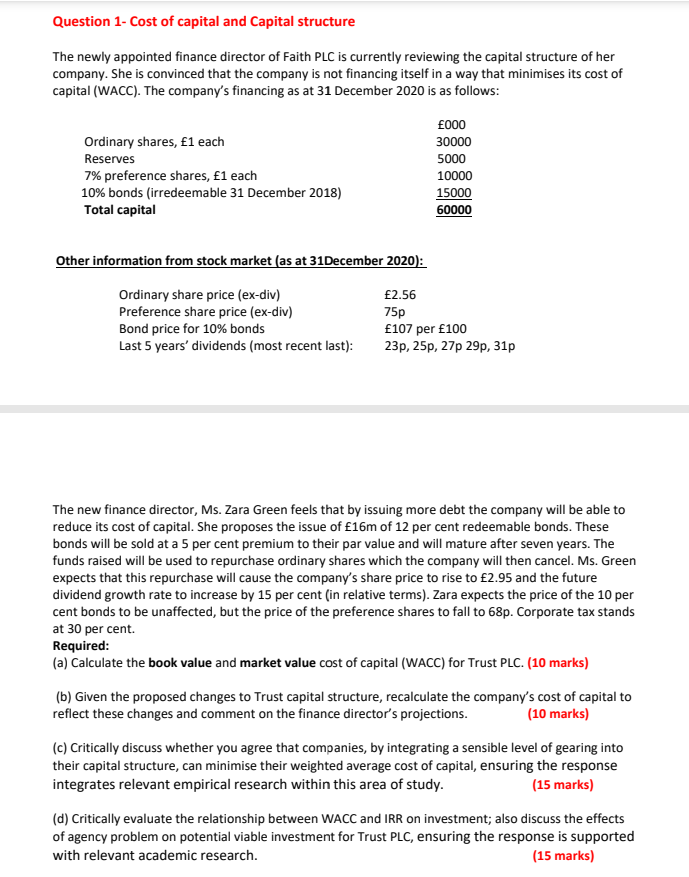

Question 1- Cost of capital and Capital structure The newly appointed finance director of Faith PLC is currently reviewing the capital structure of her company. She is convinced that the company is not financing itself in a way that minimises its cost of capital (WACC). The company's financing as at 31 December 2020 is as follows: 000 30000 Ordinary shares, 1 each Reserves 5000 7% preference shares, 1 each 10000 15000 10% bonds (irredeemable 31 December 2018) Total capital 60000 Other information from stock market (as at 31December 2020): Ordinary share price (ex-div) 2.56 Preference share price (ex-div) 75p Bond price for 10% bonds 107 per 100 Last 5 years' dividends (most recent last): 23p, 25p, 27p 29p, 31p The new finance director, Ms. Zara Green feels that by issuing more debt the company will be able to reduce its cost of capital. She proposes the issue of 16m of 12 per cent redeemable bonds. These bonds will be sold at a 5 per cent premium to their par value and will mature after seven years. The funds raised will be used to repurchase ordinary shares which the company will then cancel. Ms. Green expects that this repurchase will cause the company's share price to rise to 2.95 and the future dividend growth rate to increase by 15 per cent (in relative terms). Zara expects the price of the 10 per cent bonds to be unaffected, but the price of the preference shares to fall to 68p. Corporate tax stands at 30 per cent. Required: (a) Calculate the book value and market value cost of capital (WACC) for Trust PLC. (10 marks) (b) Given the proposed changes to Trust capital structure, recalculate the company's cost of capital to reflect these changes and comment on the finance director's projections. (10 marks) (c) Critically discuss whether you agree that companies, by integrating a sensible level of gearing into their capital structure, can minimise their weighted average cost of capital, ensuring the response integrates relevant empirical research within this area of study. (15 marks) (d) Critically evaluate the relationship between WACC and IRR on investment; also discuss the effects of agency problem on potential viable investment for Trust PLC, ensuring the response is supported with relevant academic research. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started