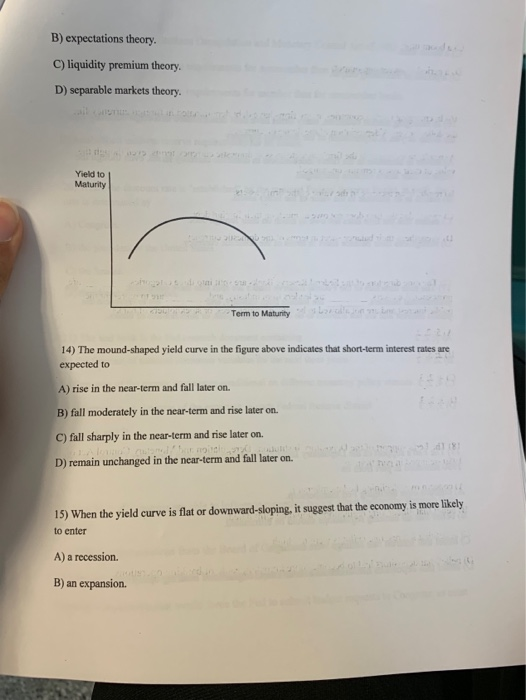

D) decreases; more 4) Risk premiums on corporate bonds tend to during business cycle expansions and during recessions, everything else held constant A) increase; increase B) increase; decrease C) decrease; increase D) decrease; decrease 5) Which of the following statements is TRUE? A)A liquid asset is one that can be quickly and cheaply converted into cash. B) The demand for a bond declines when it becomes less liquid, decreasing the interest rate spread between it and relatively more liquid bonds. C) The differences in bond interest rates reflect differences in default risk only. D) The corporate bond market is the most liquid bond market. the price of corporate bonds and 6) An increase in the liquidity of corporate bonds will the yield of Treasury bonds, everything else held constant. A) increase; increase B) reduce; reduce C) increase; reduce D) reduce; increase 7) Everything else held constant, abolishing the individual income tax will A) increase the interest rate on corporate bonds. B) reduce the interest rate on municipal bonds C) increase the interest rate on municipal bonds D) increase the interest rate on Treasury bonds 8) When yield curves are steeply upward sloping A) long-term interest rates are above short-term interest rates B) short-ternm interest rates are above long-term interest rates C) short-term interest rates are about the same as long-term interest rates. D) medium-term interest rates are above both short-ternm and long-term interest rates. 9) According to the expectations theory of the term structure, the interest rate on a long-term bond will equal the life of the long-term bond. of the short-term interest rates that people expect to occur over the A) average d B) sum its is S85 C) difference the me D) multiple 10) Over the next three years, the expected path of 1-year interest rates is 4, 1, and 1 percent. The expectations theory of the term structure predicts that the current interest rate on 3-year bond is er A) 1 percent. B) 2 percent. C) 3 percent. D) 4 percent 11) According to the liquidity premium theory of the term structure A) bonds of different maturities are not substitutes. B) if yield curves are downward sloping, then short-term interest rates are expected to fall by much that, even when the positive term premium is added, long-term rates fall below short-term so rates. C) yield curves should never slope downward D) interest rates on bonds of different maturities do not move together over time. 11) According to the liquidity premium theory of the term structure, a flat yield curve indicates that short-term interest rates are expected to A) rise in the future B) remain unchanged in the future. C) decline moderately in the future. D) decline sharply in the future 12) If the yield curve has a mild upward slope, the liquidity premium theory (assuming a mild preference for shorter-term bonds) indicates that the market is predicting A) a rise in short-term interest rates in the near future and a decline further out in the future B) constant short-term interest rates in the near future and further out in the future. C) a decline in short-term interest rates in the near future and a rise further out in the future even steeper decline further out D) a decline in short-term interest rates in the near future and an in the future. 13) In actual practice, short-term interest rates and long-term interest rates usually n together; this is the major shortcoming of the move A) segmented markets theory. B) expectations theory. C) liquidity premium theory. D) separable markets theory. Yield to Maturity Term to Maturity 14) The mound-shaped yield curve in the figure above indicates that short-term interest rates are expected to A) rise in the near-term and fall later on. B) fall moderately in the near-term and rise later on. C) fall sharply in the near-term and rise later on. D) remain unchanged in the near-term and fall later on. 15) When the yield curve is flat or downward-sloping, it suggest that the economy is more likely to enter A) a recession. tis expansion. B) an C) a boom time D) a period of increasing output. 16) In emerging market countries, many firms have debt denominated in foreign currency like the dollar or yen. A depreciation of the domestic currency A) results in increases in the firm's indebtedness in domestic currency terms, even though the value of their assets remains unchanged. B) results in an increase in the value of the firm's assets. C) means that the firm does not owe as much on their foreign debt. D) strengthens their balance sheet in terms of the domestic currency 17) The nine directors of the Federal Reserve Banks are split into three categories: are leaders from industry, and are professional bankers, public interest and are not allowed to be officers, employees, or stockholders of banks. are to represent the A) 5; 2; 2 B) 2; 5; 2 C) 4; 2; 3 D) 3; 3;3 18) The Fed's support of the Depository Institutions Deregulation and Monetary Control Act of 1980 stemmed in part from its A) concern over declining Fed membership. B) belief that all banking regulations should be eliminated. ) belief that interest rate ceilings were too high. bj belief that depositors had to become more knowledgeable of banking operations. B) reduce the interest rate on municipal bonds C) increase the interest rate on municipal bonds D) increase the interest rate on Treasury bonds 8) When yield curves are steeply upward sloping A) long-ternm interest rates are above short-term interest rates B) short-term interest rates are above long-term interest rates. C) short-term interest rates are about the same as long-term interest rates. D) medium-term interest rates are above both short-term and long-term interest anes 9) According to the expectations theory of the term structure, the interest rate on a long-sem bond will equal the life of the long-term bond of the short-term interest rates that people expect to occur over the A) average and. B) sum saso bon d C) difference the monee D) multiple 10) Over the next three years, the expected path of 1-year interest rates is 4, 1, and 1 percent. The expectations theory of the term structure predicts that the current interest rate on 3-year bond is A) I percent B) 2 percent. C)3 percent D)4 percent