Question

D. Diesel (DD) gave you the following information for 2021. DD became the vice-president of a public Canadian corporation, OPP Limited, on January 1, 2021.

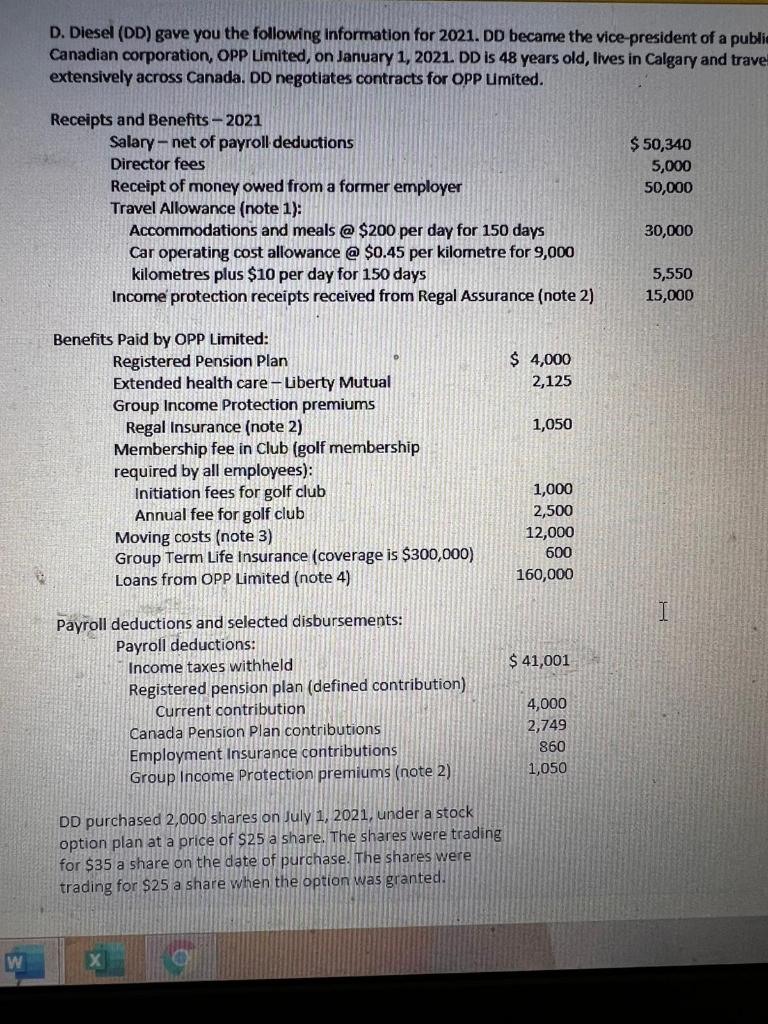

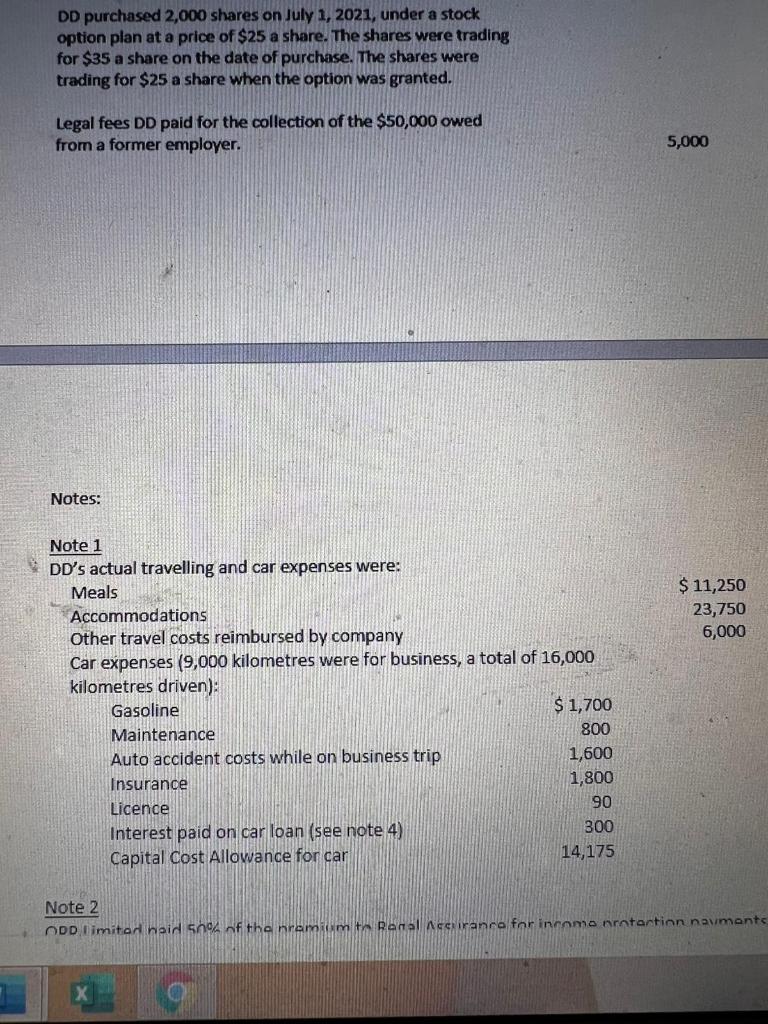

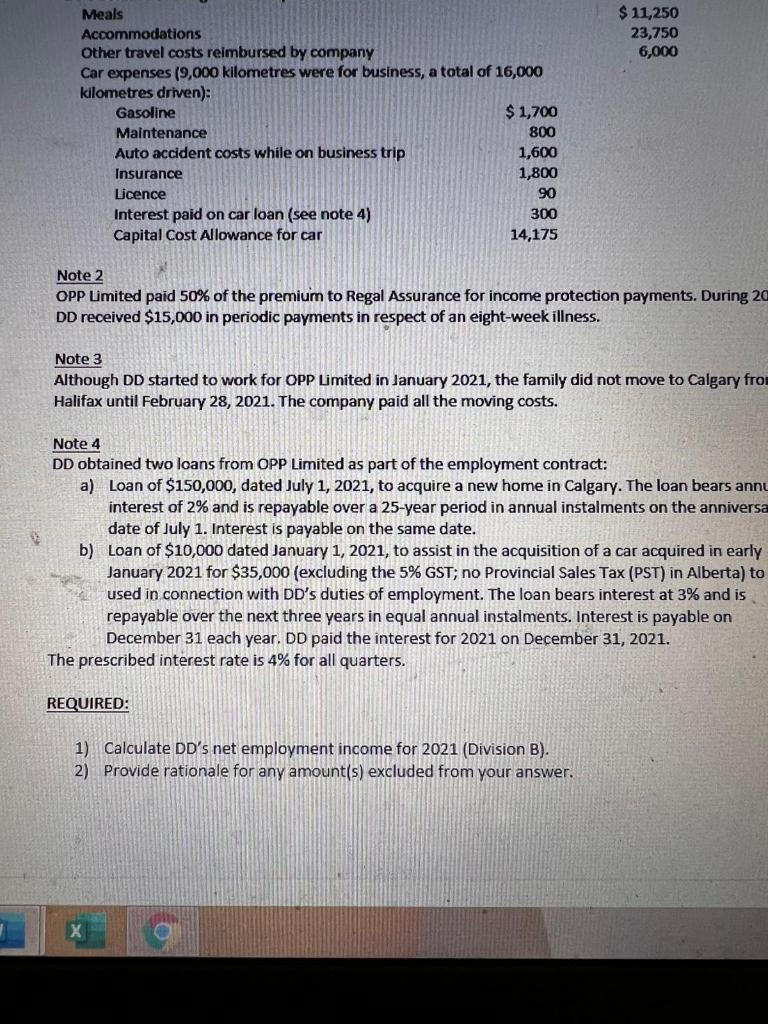

D. Diesel (DD) gave you the following information for 2021. DD became the vice-president of a public Canadian corporation, OPP Limited, on January 1, 2021. DD is 48 years old, lives in Calgary and travels extensively across Canada. DD negotiates contracts for OPP Limited. Receipts and Benefits 2021 Salary net of payroll deductions $ 50,340 Director fees 5,000 Receipt of money owed from a former employer 50,000 Travel Allowance (note 1): Accommodations and meals @ $200 per day for 150 days 30,000 Car operating cost allowance @ $0.45 per kilometre for 9,000 kilometres plus $10 per day for 150 days 5,550 Income protection receipts received from Regal Assurance (note 2) 15,000 Benefits Paid by OPP Limited: Registered Pension Plan $ 4,000 Extended health care Liberty Mutual 2,125 Group Income Protection premiums Regal Insurance (note 2) 1,050 Membership fee in Club (golf membership required by all employees): Initiation fees for golf club 1,000 Annual fee for golf club 2,500 Moving costs (note 3) 12,000 Group Term Life Insurance (coverage is $300,000) 600 Loans from OPP Limited (note 4) 160,000 Payroll deductions and selected disbursements: Payroll deductions: Income taxes withheld $ 41,001 Registered pension plan (defined contribution) Current contribution 4,000 Canada Pension Plan contributions 2,749 Employment Insurance contributions 860 Group Income Protection premiums (note 2) 1,050 DD purchased 2,000 shares on July 1, 2021, under a stock option plan at a price of $25 a share. The shares were trading for $35 a share on the date of purchase. The shares were trading for $25 a share when the option was granted. Legal fees DD paid for the collection of the $50,000 owed from a former employer. 5,000 Notes: Note 1 DDs actual travelling and car expenses were: Meals $ 11,250 Accommodations 23,750 Other travel costs reimbursed by company 6,000 Car expenses (9,000 kilometres were for business, a total of 16,000 kilometres driven): Gasoline $ 1,700 Maintenance 800 Auto accident costs while on business trip 1,600 Insurance 1,800 Licence 90 Interest paid on car loan (see note 4) 300 Capital Cost Allowance for car 14,175 Note 2 OPP Limited paid 50% of the premium to Regal Assurance for income protection payments. During 2021, DD received $15,000 in periodic payments in respect of an eight-week illness. Note 3 Although DD started to work for OPP Limited in January 2021, the family did not move to Calgary from Halifax until February 28, 2021. The company paid all the moving costs. Note 4 DD obtained two loans from OPP Limited as part of the employment contract: a) Loan of $150,000, dated July 1, 2021, to acquire a new home in Calgary. The loan bears annual interest of 2% and is repayable over a 25-year period in annual instalments on the anniversary date of July 1. Interest is payable on the same date. b) Loan of $10,000 dated January 1, 2021, to assist in the acquisition of a car acquired in early January 2021 for $35,000 (excluding the 5% GST; no Provincial Sales Tax (PST) in Alberta) to be used in connection with DDs duties of employment. The loan bears interest at 3% and is repayable over the next three years in equal annual instalments. Interest is payable on December 31 each year. DD paid the interest for 2021 on December 31, 2021. The prescribed interest rate is 4% for all quarters. REQUIRED: 1) Calculate DDs net employment income for 2021 (Division B). 2) Provide rationale for any amount(s) excluded from your answer.

D. Diesel (DD) gave you the following information for 2021. DD became the vice-president of a public Canadian corporation, OPP Limited, on January 1, 2021. DD is 48 years old, lives in Calgary and trave extensively across Canada. DD negotiates contracts for OPP Umited. $ 50,340 5,000 50,000 Receipts and Benefits - 2021 Salary - net of payroll deductions Director fees Receipt of money owed from a former employer Travel Allowance (note 1): Accommodations and meals @ $200 per day for 150 days Car operating cost allowance @ $0.45 per kilometre for 9,000 kilometres plus $10 per day for 150 days Income protection receipts received from Regal Assurance (note 2) 30,000 5,550 15,000 $ 4,000 2,125 1,050 Benefits Paid by OPP Limited: Registered Pension Plan Extended health care-Liberty Mutual Group Income Protection premiums Regal Insurance (note 2) Membership fee in Club (golf membership required by all employees): Initiation fees for golf club Annual fee for golf club Moving costs (note 3) Group Term Life Insurance coverage is $300,000) Loans from OPP Limited (note 4) 1,000 2,500 12,000 600 160,000 I $ 41,001 Payroll deductions and selected disbursements: Payroll deductions: Income taxes withheld Registered pension plan (defined contribution) Current contribution Canada Pension Plan contributions Employment Insurance contributions Group Income Protection premiums (note 2) 4,000 2,749 860 1,050 DD purchased 2,000 shares on July 1, 2021, under a stock option plan at a price of $25 a share. The shares were trading for $35 a share on the date of purchase. The shares were trading for $25 a share when the option was granted. W x DD purchased 2,000 shares on July 1, 2021, under a stock option plan at a price of $25 a share. The shares were trading for $35 a share on the date of purchase. The shares were trading for $25 a share when the option was granted. Legal fees DD paid for the collection of the $50,000 owed from a former employer. 5,000 Notes: $ 11,250 23,750 6,000 Note 1 DD's actual travelling and car expenses were: Meals Accommodations Other travel costs reimbursed by company Car expenses (9,000 kilometres were for business, a total of 16,000 kilometres driven): Gasoline $ 1,700 Maintenance 800 Auto accident costs while on business trip 1,600 Insurance 1,800 Licence 90 Interest paid on car loan (see note 4) 300 Capital Cost Allowance for car 14,175 Note 2 ODD Limited naid 50% of the namemta Ramal Acekiranra for incomo nutartion navments $ 11,250 23,750 6,000 Meals Accommodations Other travel costs reimbursed by company Car expenses (9,000 kilometres were for business, a total of 16,000 kilometres driven): Gasoline $ 1,700 Maintenance 800 Auto accident costs while on business trip 1,600 Insurance 1,800 Licence 90 Interest paid on car loan (see note 4) 300 Capital Cost Allowance for car 14,175 Note 2 OPP Limited paid 50% of the premium to Regal Assurance for income protection payments. During 20 DD received $15,000 in periodic payments in respect of an eight-week illness. Note 3 Although DD started to work for OPP Limited in January 2021, the family did not move to Calgary from Halifax until February 28, 2021. The company paid all the moving costs. Note 4 DD obtained two loans from OPP Limited as part of the employment contract: a) Loan of $150,000, dated July 1, 2021, to acquire a new home in Calgary. The loan bears annu interest of 2% and is repayable over a 25-year period in annual instalments on the anniversa date of July 1. Interest is payable on the same date. b) Loan of $10,000 dated January 1, 2021, to assist in the acquisition of a car acquired in early January 2021 for $35,000 (excluding the 5% GST; no Provincial Sales Tax (PST) in Alberta) to used in connection with DD's duties of employment. The loan bears interest at 3% and is repayable over the next three years in equal annual instalments. Interest is payable on December 31 each year. DD paid the interest for 2021 on December 31, 2021. The prescribed interest rate is 4% for all quarters. REQUIRED: 1) Calculate DD's net employment income for 2021 (Division B). 2) Provide rationale for any amount(s) excluded from your answer. XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started