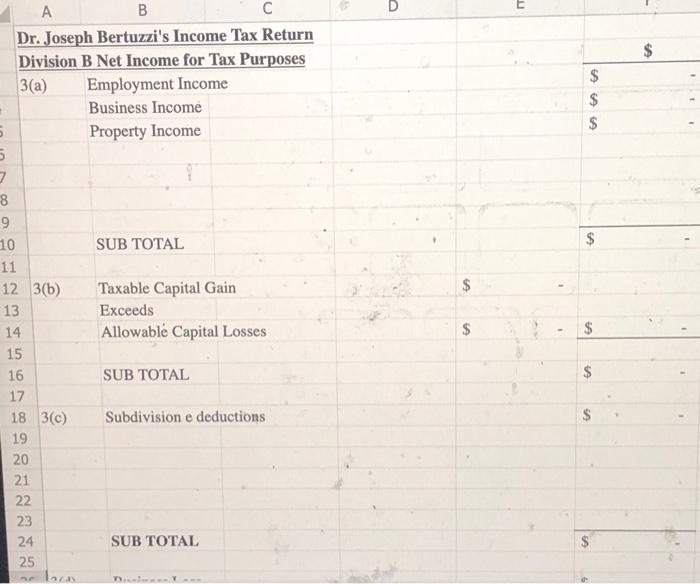

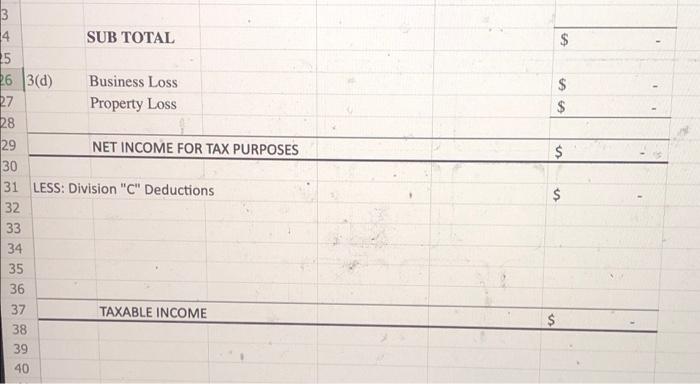

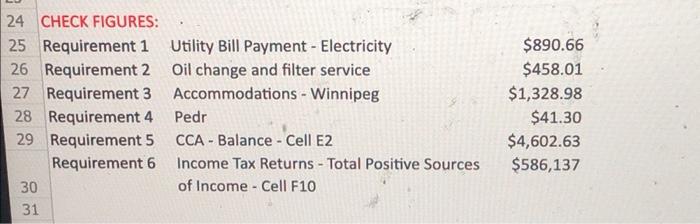

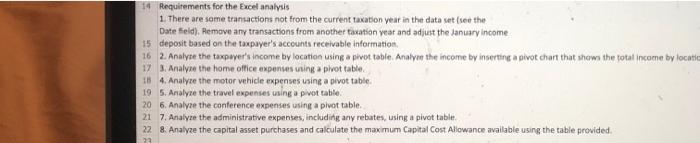

D E $ $ $ $ $ B Dr. Joseph Bertuzzi's Income Tax Return Division B Net Income for Tax Purposes 3(a) Employment Income Business Income 5 Property Income 5 7 8 9 10 SUB TOTAL 11 123(6) Taxable Capital Gain 13 Exceeds 14 Allowable Capital Losses 15 16 SUB TOTAL 17 18 3(c) Subdivision e deductions 19 20 21 22 23 24 SUB TOTAL 25 $ $ $ $ $ $ $ $ A $ 3 4 SUB TOTAL 5 26 3(d) Business Loss 27 Property Loss 28 29 NET INCOME FOR TAX PURPOSES 30 31 LESS: Division "C" Deductions 32 33 34 35 36 37 TAXABLE INCOME 38 39 40 $ $ 24 CHECK FIGURES: 25 Requirement 1 Utility Bill Payment - Electricity 26 Requirement 2 Oil change and filter service 27 Requirement 3 Accommodations - Winnipeg 28 Requirement 4 Pedr 29 Requirement 5 CCA - Balance - Cell E2 Requirement 6 Income Tax Returns - Total Positive Sources 30 of Income - Cell F10 31 $890.66 $458.01 $1,328.98 $41.30 $4,602.63 $586,137 14 Requirements for the Excel analysis 1. There are some transactions not from the current taxation year in the data set (see the Date field). Remove any transactions from another taxation veat and adjust the January income 15 deposit based on the taxpayer's accounts receivable information 16 2. Analyse the taxpayer's income by location using a pivot table. Analyer the income by inserting a pivot chart that shows the total income by locatie 17 3. Analyze the home office expenses using a pivot table 18 4. Analyze the motor vehicle expenses using a pivot table 19 5. Analyze the travel expenses using a pivot table 20 6. Analyze the conference expenses using a pivot table. 21 7. Analyze the administrative expenses, including any rebates, using a pivot table. 22 8. Analyze the capital asset purchases and calculate the maximum Capital Cost Allowance available using the table provided 22 D E $ $ $ $ $ B Dr. Joseph Bertuzzi's Income Tax Return Division B Net Income for Tax Purposes 3(a) Employment Income Business Income 5 Property Income 5 7 8 9 10 SUB TOTAL 11 123(6) Taxable Capital Gain 13 Exceeds 14 Allowable Capital Losses 15 16 SUB TOTAL 17 18 3(c) Subdivision e deductions 19 20 21 22 23 24 SUB TOTAL 25 $ $ $ $ $ $ $ $ A $ 3 4 SUB TOTAL 5 26 3(d) Business Loss 27 Property Loss 28 29 NET INCOME FOR TAX PURPOSES 30 31 LESS: Division "C" Deductions 32 33 34 35 36 37 TAXABLE INCOME 38 39 40 $ $ 24 CHECK FIGURES: 25 Requirement 1 Utility Bill Payment - Electricity 26 Requirement 2 Oil change and filter service 27 Requirement 3 Accommodations - Winnipeg 28 Requirement 4 Pedr 29 Requirement 5 CCA - Balance - Cell E2 Requirement 6 Income Tax Returns - Total Positive Sources 30 of Income - Cell F10 31 $890.66 $458.01 $1,328.98 $41.30 $4,602.63 $586,137 14 Requirements for the Excel analysis 1. There are some transactions not from the current taxation year in the data set (see the Date field). Remove any transactions from another taxation veat and adjust the January income 15 deposit based on the taxpayer's accounts receivable information 16 2. Analyse the taxpayer's income by location using a pivot table. Analyer the income by inserting a pivot chart that shows the total income by locatie 17 3. Analyze the home office expenses using a pivot table 18 4. Analyze the motor vehicle expenses using a pivot table 19 5. Analyze the travel expenses using a pivot table 20 6. Analyze the conference expenses using a pivot table. 21 7. Analyze the administrative expenses, including any rebates, using a pivot table. 22 8. Analyze the capital asset purchases and calculate the maximum Capital Cost Allowance available using the table provided 22