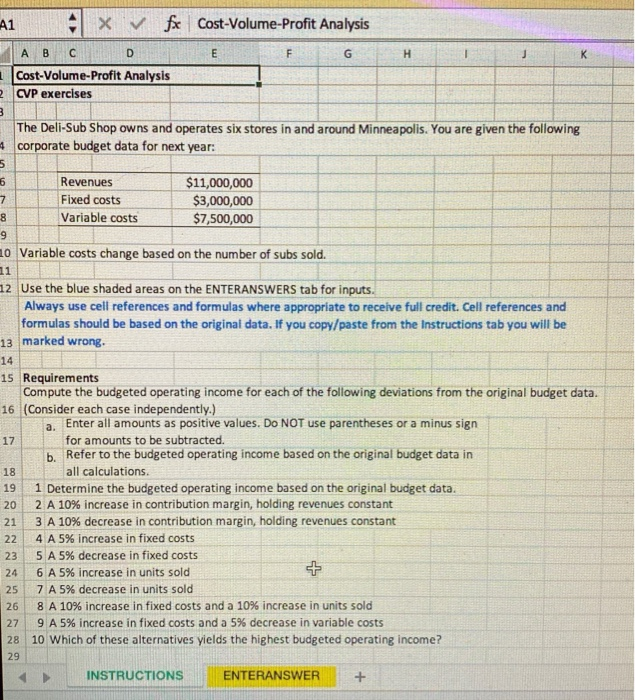

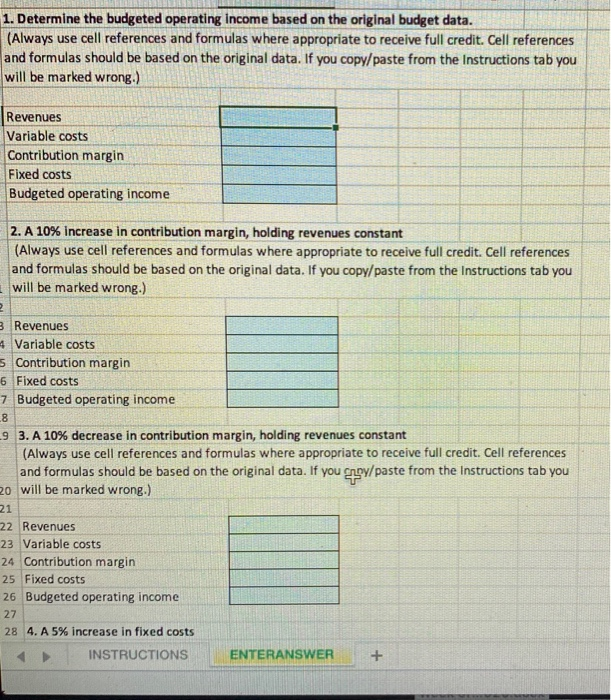

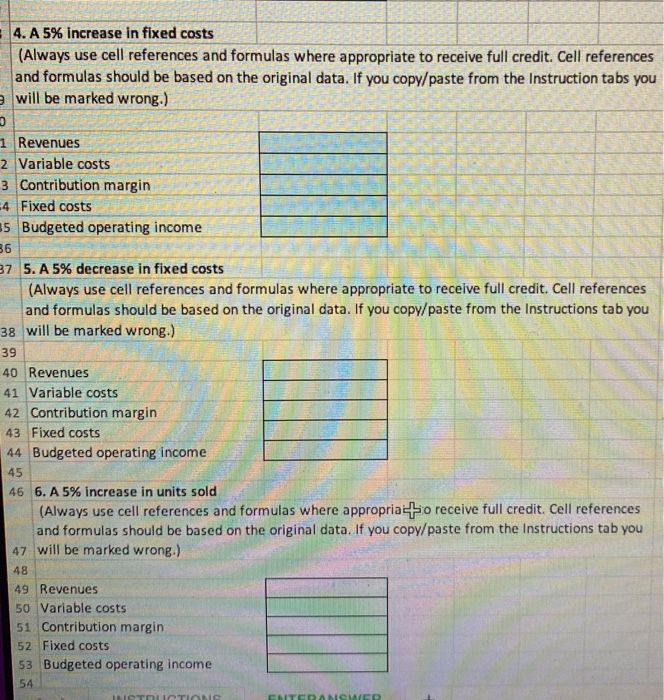

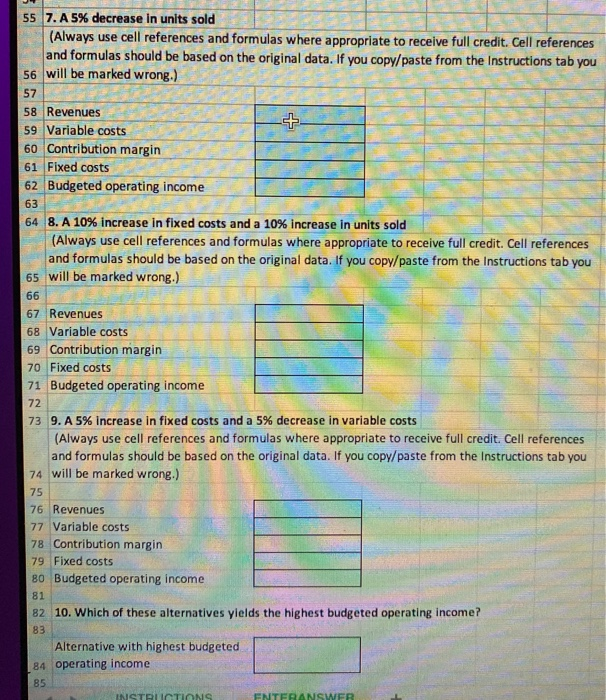

D E F 8 A1 x fx Cost-Volume-Profit Analysis G H 1 Cost-Volume-Profit Analysis CVP exercises 3 The Deli-Sub Shop owns and operates six stores in and around Minneapolis. You are given the following 4 corporate budget data for next year: 5 6 Revenues $11,000,000 7 Fixed costs $3,000,000 Variable costs $7,500,000 9 10 Variable costs change based on the number of subs sold. 11 112 Use the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instructions tab you will be 13 marked wrong. 14 15 Requirements Compute the budgeted operating income for each of the following deviations from the original budget data. 16 (Consider each case independently.) a. Enter all amounts as positive values. Do NOT use parentheses or a minus sign for amounts to be subtracted. b. Refer to the budgeted operating income based on the original budget data in all calculations. 19 1 Determine the budgeted operating income based on the original budget data. 2 A 10% increase in contribution margin, holding revenues constant 3 A 10% decrease in contribution margin, holding revenues constant 4 A 5% increase in fixed costs 5 A 5% decrease in fixed costs 6 A 5% increase in units sold 7 A 5% decrease in units sold 26 8 A 10% increase in fixed costs and a 10% increase in units sold 27 9 A 5% increase in fixed costs and a 5% decrease in variable costs 28 10 Which of these alternatives yields the highest budgeted operating income? 29 INSTRUCTIONS ENTERANSWER + 17 18 20 21 22 23 24 25 1. Determine the budgeted operating Income based on the original budget data. (Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instructions tab you will be marked wrong.) Revenues Variable costs Contribution margin Fixed costs Budgeted operating income 2. A 10% Increase in contribution margin, holding revenues constant (Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instructions tab you will be marked wrong.) 3 Revenues 4 Variable costs 5 Contribution margin 6 Fixed costs 7 Budgeted operating income 8 9 3. A 10% decrease in contribution margin, holding revenues constant (Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you qoy/paste from the Instructions tab you 20 will be marked wrong.) 21 22 Revenues 23 Variable costs 24 Contribution margin 25 Fixed costs 26 Budgeted operating income 27 28 4. A 5% increase in fixed costs INSTRUCTIONS ENTERANSWER + 4. A 5% increase in fixed costs (Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instruction tabs you will be marked wrong.) 1 Revenues 2 Variable costs 3 Contribution margin 4 Fixed costs 35 Budgeted operating income 36 87 5. A 5% decrease in fixed costs (Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instructions tab you 38 will be marked wrong.) 39 40 Revenues 41 Variable costs 42 Contribution margin 43 Fixed costs 44 Budgeted operating income 45 46 6. A 5% increase in units sold (Always use cell references and formulas where appropriato receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instructions tab you 47 will be marked wrong.) 48 49 Revenues 50 Variable costs 51 Contribution margin 52 Fixed costs 53 Budgeted operating income 54 INIO TRITION CNTCDANCED 55 7. A 5% decrease in units sold (Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instructions tab you 56 will be marked wrong.) 57 58 Revenues 59 Variable costs 60 Contribution margin 61 Fixed costs 62 Budgeted operating income 63 64 8. A 10% increase in fixed costs and a 10% increase in units sold (Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instructions tab you 65 will be marked wrong.) 66 67 Revenues 68 Variable costs 69 Contribution margin 70 Fixed costs 71 Budgeted operating income 72 73 9. A 5% increase in fixed costs and a 5% decrease in variable costs (Always use cell references and formulas where appropriate to receive full credit. Cell references and formulas should be based on the original data. If you copy/paste from the Instructions tab you 74 will be marked wrong.) 75 76 Revenues 77 Variable costs 78 Contribution margin 79 Fixed costs 80 Budgeted operating income 81 82 10. Which of these alternatives yields the highest budgeted operating income? 83 Alternative with highest budgeted 84 operating income 85 INSTRUCTIONS ENTER