Answered step by step

Verified Expert Solution

Question

1 Approved Answer

D, E, F aren't answered on the left problems. Please help. thanks Davis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and

D, E, F aren't answered on the left problems. Please help. thanks

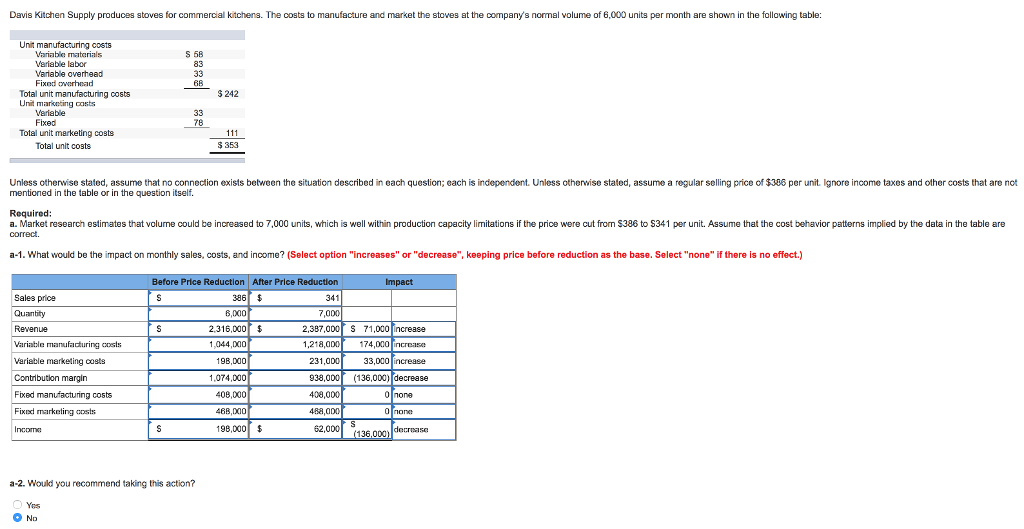

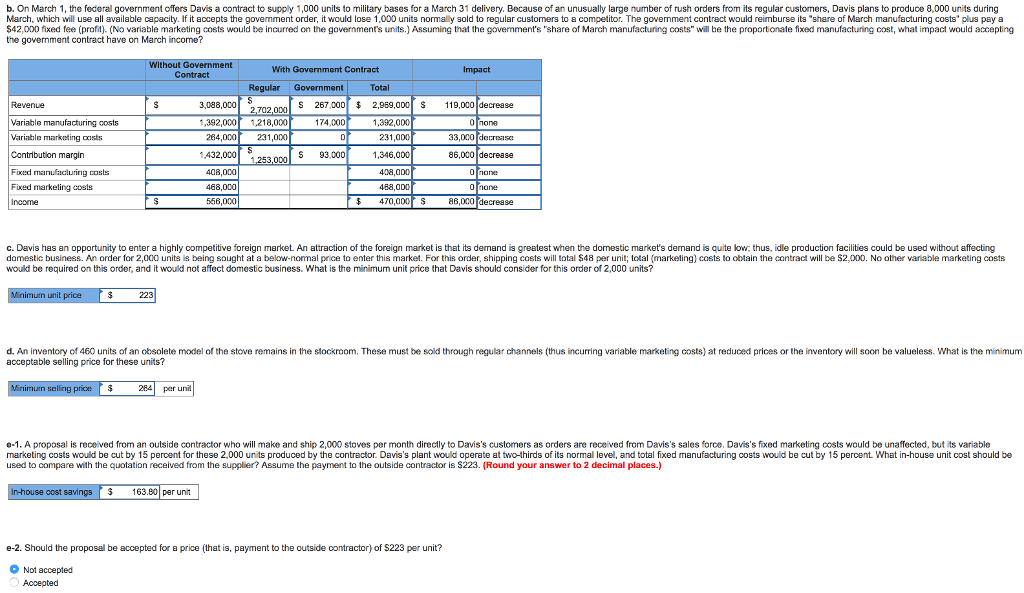

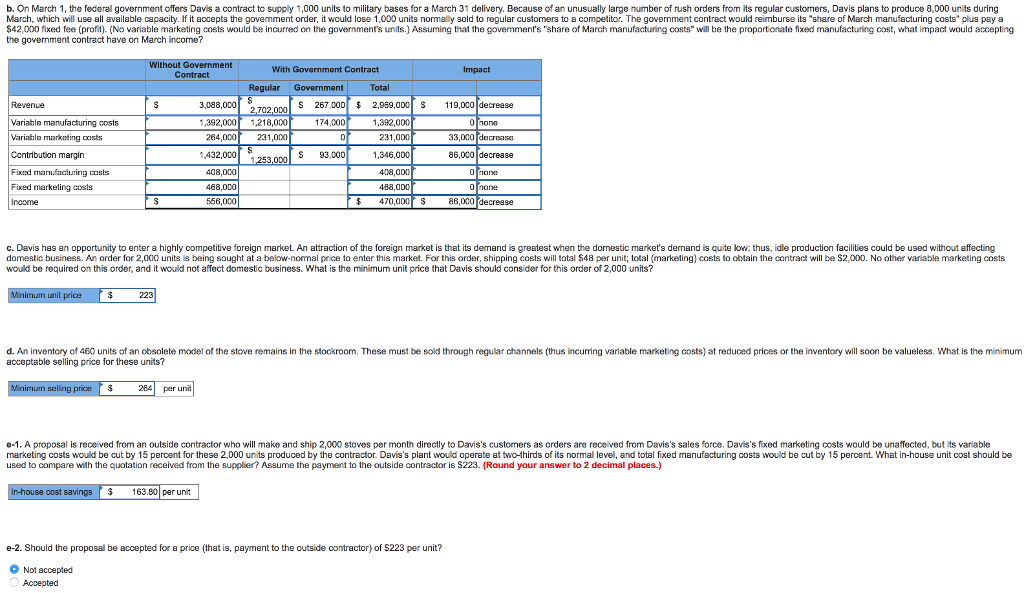

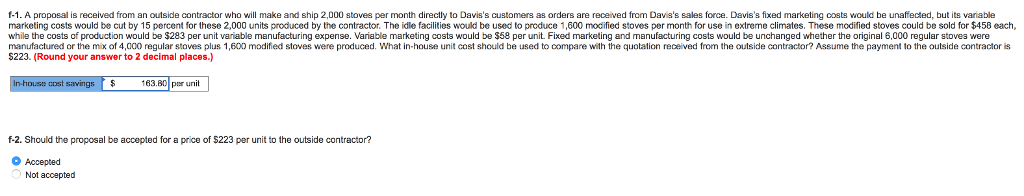

Davis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and market the stoves at the companys nomal volume of 6,000 units per month are shown in the following table: Unit manufacturing costs S 68 83 Variable materials Variable labor Variable overhead Fixed owerhead 242 Total unit manufacturing costs Unit marinting sts Variable Fixed 78 Total unit marketing costs Total unit costs S 353 Unless othervise stated, assume that no connection exists between the situation described in each question; each is independent. Unless otherwise stated, assume a regular selling price of $308 per unit. Ignore income taxes and other costs that are not mentioned in the table or in the question itself. Required: a. Market research estimates that volume could be increased to 7,000 units, which is well within production capacity limitations if the price were cut from $386 to S341 per unit. Assume that the cost behavior patterns implied by the data in the table are correct a-1. What would be the impact on monthly sales, costs, and income? (Select option "increases" or "decrease", keeping price before reduction as the base. Select "none" if there is no effect.) Before Price Reduction After Price Reduction 341 7,000 Impact 386 Sales price Quantity Revenue ariable manufacturing oss Variable marketing costs Contribution margin Fxed manufacturing costs Fixisd mairketing costs Income 6,000 2.316,000 $ 2,387,000S 71,000 ncrease 1,218,000 174,00 incrDase 33,000 increase 1044,000 19B,D00 1.074,000 408,000 46B,000 231,000 938,000 136,000) decrease 408,000 488,000 0 none 198,000 $ 62,000 a-2. Would you recommend taking this action? Yos ND Davis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and market the stoves at the companys nomal volume of 6,000 units per month are shown in the following table: Unit manufacturing costs S 68 83 Variable materials Variable labor Variable overhead Fixed owerhead 242 Total unit manufacturing costs Unit marinting sts Variable Fixed 78 Total unit marketing costs Total unit costs S 353 Unless othervise stated, assume that no connection exists between the situation described in each question; each is independent. Unless otherwise stated, assume a regular selling price of $308 per unit. Ignore income taxes and other costs that are not mentioned in the table or in the question itself. Required: a. Market research estimates that volume could be increased to 7,000 units, which is well within production capacity limitations if the price were cut from $386 to S341 per unit. Assume that the cost behavior patterns implied by the data in the table are correct a-1. What would be the impact on monthly sales, costs, and income? (Select option "increases" or "decrease", keeping price before reduction as the base. Select "none" if there is no effect.) Before Price Reduction After Price Reduction 341 7,000 Impact 386 Sales price Quantity Revenue ariable manufacturing oss Variable marketing costs Contribution margin Fxed manufacturing costs Fixisd mairketing costs Income 6,000 2.316,000 $ 2,387,000S 71,000 ncrease 1,218,000 174,00 incrDase 33,000 increase 1044,000 19B,D00 1.074,000 408,000 46B,000 231,000 938,000 136,000) decrease 408,000 488,000 0 none 198,000 $ 62,000 a-2. Would you recommend taking this action? Yos ND

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started