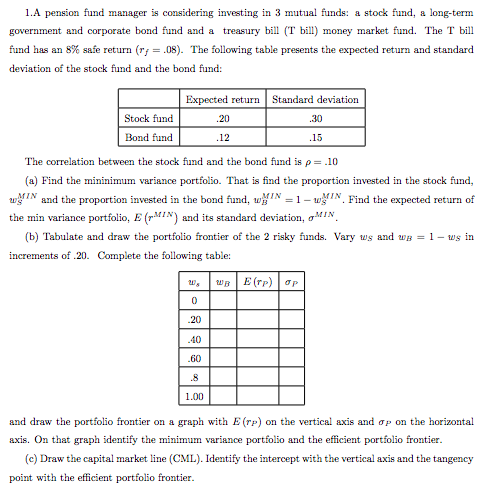

[d] Find the market portfolio. That is nd the proportion invested in the stool: fund, wngRKET and the proportion invested in the bond fund, WELFARE\" = 1 wyARKET of the market portfolio Find the eirpeoted return of the market portfolio, E [rMAHKET] and its standard deviation, JMARHET. Find the Sharpe ratio. {e} An investor requires a target expected return of 14%, that is E[rT} = .14. Find the standard deviation of her portfolio, o'T. What proportion will she invest in the nionetar}r market fund, wMg REF? What proportion will she invest in the stock fund, tug? What proportion will she its-rest in the bond fund, tog? {f} If the investor wanted to invest only in the stoek fund and bond fund and achieve a target return of E {Tr} = .14, how much would she have to invest in the stool: fund, mg and how much in the bond fund, tog?'What would he the level of risl: of this new portfolio? 1.A pension fund manager is considering investing in 3 mutual funds: a stock fund, a long-term government and corporate bond fund and a treasury bill (T bill) money market fund. The T bill fund has an 8%% safe return (ry = .08). The following table presents the expected return and standard deviation of the stock fund and the bond fund: Expected return Standard deviation Stock fund .20 .30 Bond fund .12 .15 The correlation between the stock fund and the bond fund is p= .10 (a) Find the mininimum variance portfolio. That is find the proportion invested in the stock fund, g'and the proportion invested in the bond fund, wg = 1- wg WIN. Find the expected return of the min variance portfolio, E () and its standard deviation, o MIN. (b) Tabulate and draw the portfolio frontier of the 2 risky funds. Vary ws and wg = 1 - ws in increments of .20. Complete the following table: E(rp) .20 10 60 FE 1.00 and draw the portfolio frontier on a graph with E (re) on the vertical axis and op on the horizontal axis. On that graph identify the minimum variance portfolio and the efficient portfolio frontier. (c) Draw the capital market line (CML). Identify the intercept with the vertical axis and the tangency point with the efficient portfolio frontier