Answered step by step

Verified Expert Solution

Question

1 Approved Answer

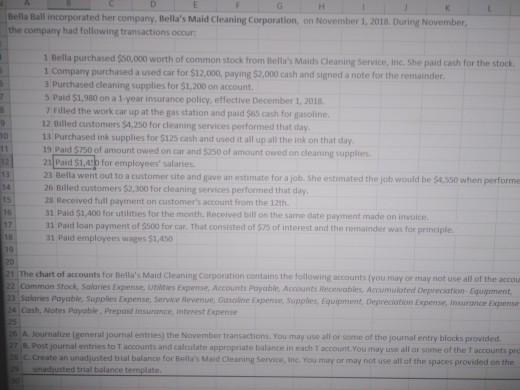

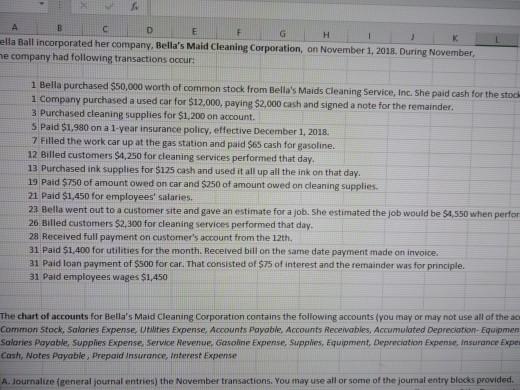

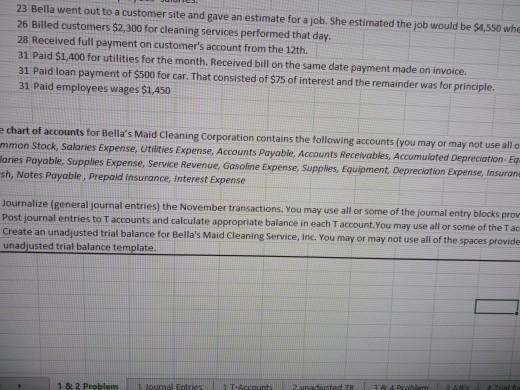

D H hella Ball incorporated her company, Bella's Maid Cleaning Corporation on November 1, 2011. Duriny November the company had following transactions occur 11 1

D H hella Ball incorporated her company, Bella's Maid Cleaning Corporation on November 1, 2011. Duriny November the company had following transactions occur 11 1 Dell purchased $50,000 worth of common stock trom des Math Cleaning Service in the path for the stock 1 company purchased car for $12.00, paying $2,000 cash and signed a note for the remainder 3 Purchased cleaning supplies for $1.200 on account Puid $1,900 ona 1 year insurance policy, efective December 1, 2011 y led the work car up at the gas station and paid cash for 12 billed customs 54,250 for deaning service performed that 11 Purchased in supplies for 5125 cash and use it all up all the ink on that day 19 Paid 150 of around on and 5350 at amount owed an ceaning supplier Pand S1, Cb for employees salaries 21 Bella went out to a customer site and permite for a job. She estimated the would be so when performe 20 Bled customers 5,300 for cleaning service performed that day, 21 Received the payment on customer's account from the 121 31 Pald 51.400 for utilities for the month old bill on the same date maent made on in 11 Paul loan payment of $500 for that consisted of 575 of interest and the mind wat for principle 11 Paid employees 51,00 20 21 The chart of accounts for Mad Cleaning Corporation the following counts you may or may not use all of the 22 Common Stock Salaries Utiles Account Payit Amanda Arum Orient Ses Payable Supplies Serwiennent Expensie A Journalistenerul journaliste November transaction. You may use all one of the journal entry blocks provided Postjournalisten and a propriate account. You may all of the accounts Create an unadjusted to blanco.ro may or may not use all of the spaces provided on the tadtral balance A D E H C ella Ballincorporated her company, Bella's Maid Cleaning Corporation, on November 1, 2018. During November, he company had following transactions occur 1 Bella purchased $50,000 worth of common stock from Bella's Maids Cleaning Service, Inc. She paid cash for the stoc 1 Company purchased a used car for $12,000, paying $2,000 cash and signed a note for the remainder. 3 Purchased cleaning supplies for $1,200 on account. 5 Paid $1,980 on a 1-year insurance policy, effective December 1, 2018 7 Filled the work car up at the gas station and paid $65 cash for gasoline. 12 Billed customers $4,250 for cleaning services performed that day, 13 Purchased ink supplies for $125 cash and used it all up all the ink on that day. 19 Paid $750 of amount owed on car and $250 ot amount owed on cleaning supplies. 21 Paid $1,450 for employees' salaries. 23 Bella went out to a customer site and gave an estimate for a job. She estimated the job would be 54.550 when perfor 26 Billed customers $2,300 for cleaning services performed that day. 28 Received full payment on customer's account from the 12th. 31 Paid $1,400 for utilities for the month. Received bill on the same date payment made on invoice. 31 Paid loan payment of soo for car. That consisted of S75 of interest and the remainder was for principle. 31 Pald employees wages $1,450 The chart of accounts for Bella's Maid Cleaning Corporation contains the following accounts you may or may not use all of the ac Common Stock, Salaries Expense, Uites Expense, Accounts Payable, Accounts Receivables. Accumulated Depreciation Equipmen Salories Payable, supplies Expense. Service Revenue. Gasoline Expense, Supplies, Equipment Depreciation Expense, Insurance Exper Cash, Notes Payable, Prepaid Insurance, Interest Expense A. Journalize feeneral journal entries the November transactions. You may use all or some of the journal entry blocks provided. 23 Bella went out to a customer site and gave an estimate for a job. She estimated the job would be $4,550 whe 26 Billed customers $2,300 for cleaning services performed that day. 28 Received full payment on customer's account from the 12th. 31 Paid $1,400 for utilities for the month. Received bill on the same date payment made on invoice. 31 Paid loan payment of $500 for car. That consisted of $75 of interest and the remainder was for principle. 31 Paid employees wages $1,450 e chart of accounts for Bella's Maid Cleaning Corporation contains the following accounts you may or may not use allo mmon Stock, Salaries Expense, Utilities Expense, Accounts Payable, Accounts Receivables, Accumulated Depreciation Eq Waries Payable, Supplies Expense, Service Revenue, Gasoline Expense, Supplies, Equipment, Depreciation Expense, Insuran sh, Notes Payable, Prepaid Insurance, interest Expense Journalize (general journal entries) the November transactions. You may use all or some of the journal entry blocks prov Post journal entries to T accounts and calculate appropriate balance in each Taccount. You may use all or some of the Tac Create an unadjusted trial balance for Bella's Maid Cleaning Service, Inc. You may or may not use all of the spaces provide unadjusted trial balance template. 1 & 2 Problem Journal Entries 1 T-Account rated TH Problem D H hella Ball incorporated her company, Bella's Maid Cleaning Corporation on November 1, 2011. Duriny November the company had following transactions occur 11 1 Dell purchased $50,000 worth of common stock trom des Math Cleaning Service in the path for the stock 1 company purchased car for $12.00, paying $2,000 cash and signed a note for the remainder 3 Purchased cleaning supplies for $1.200 on account Puid $1,900 ona 1 year insurance policy, efective December 1, 2011 y led the work car up at the gas station and paid cash for 12 billed customs 54,250 for deaning service performed that 11 Purchased in supplies for 5125 cash and use it all up all the ink on that day 19 Paid 150 of around on and 5350 at amount owed an ceaning supplier Pand S1, Cb for employees salaries 21 Bella went out to a customer site and permite for a job. She estimated the would be so when performe 20 Bled customers 5,300 for cleaning service performed that day, 21 Received the payment on customer's account from the 121 31 Pald 51.400 for utilities for the month old bill on the same date maent made on in 11 Paul loan payment of $500 for that consisted of 575 of interest and the mind wat for principle 11 Paid employees 51,00 20 21 The chart of accounts for Mad Cleaning Corporation the following counts you may or may not use all of the 22 Common Stock Salaries Utiles Account Payit Amanda Arum Orient Ses Payable Supplies Serwiennent Expensie A Journalistenerul journaliste November transaction. You may use all one of the journal entry blocks provided Postjournalisten and a propriate account. You may all of the accounts Create an unadjusted to blanco.ro may or may not use all of the spaces provided on the tadtral balance A D E H C ella Ballincorporated her company, Bella's Maid Cleaning Corporation, on November 1, 2018. During November, he company had following transactions occur 1 Bella purchased $50,000 worth of common stock from Bella's Maids Cleaning Service, Inc. She paid cash for the stoc 1 Company purchased a used car for $12,000, paying $2,000 cash and signed a note for the remainder. 3 Purchased cleaning supplies for $1,200 on account. 5 Paid $1,980 on a 1-year insurance policy, effective December 1, 2018 7 Filled the work car up at the gas station and paid $65 cash for gasoline. 12 Billed customers $4,250 for cleaning services performed that day, 13 Purchased ink supplies for $125 cash and used it all up all the ink on that day. 19 Paid $750 of amount owed on car and $250 ot amount owed on cleaning supplies. 21 Paid $1,450 for employees' salaries. 23 Bella went out to a customer site and gave an estimate for a job. She estimated the job would be 54.550 when perfor 26 Billed customers $2,300 for cleaning services performed that day. 28 Received full payment on customer's account from the 12th. 31 Paid $1,400 for utilities for the month. Received bill on the same date payment made on invoice. 31 Paid loan payment of soo for car. That consisted of S75 of interest and the remainder was for principle. 31 Pald employees wages $1,450 The chart of accounts for Bella's Maid Cleaning Corporation contains the following accounts you may or may not use all of the ac Common Stock, Salaries Expense, Uites Expense, Accounts Payable, Accounts Receivables. Accumulated Depreciation Equipmen Salories Payable, supplies Expense. Service Revenue. Gasoline Expense, Supplies, Equipment Depreciation Expense, Insurance Exper Cash, Notes Payable, Prepaid Insurance, Interest Expense A. Journalize feeneral journal entries the November transactions. You may use all or some of the journal entry blocks provided. 23 Bella went out to a customer site and gave an estimate for a job. She estimated the job would be $4,550 whe 26 Billed customers $2,300 for cleaning services performed that day. 28 Received full payment on customer's account from the 12th. 31 Paid $1,400 for utilities for the month. Received bill on the same date payment made on invoice. 31 Paid loan payment of $500 for car. That consisted of $75 of interest and the remainder was for principle. 31 Paid employees wages $1,450 e chart of accounts for Bella's Maid Cleaning Corporation contains the following accounts you may or may not use allo mmon Stock, Salaries Expense, Utilities Expense, Accounts Payable, Accounts Receivables, Accumulated Depreciation Eq Waries Payable, Supplies Expense, Service Revenue, Gasoline Expense, Supplies, Equipment, Depreciation Expense, Insuran sh, Notes Payable, Prepaid Insurance, interest Expense Journalize (general journal entries) the November transactions. You may use all or some of the journal entry blocks prov Post journal entries to T accounts and calculate appropriate balance in each Taccount. You may use all or some of the Tac Create an unadjusted trial balance for Bella's Maid Cleaning Service, Inc. You may or may not use all of the spaces provide unadjusted trial balance template. 1 & 2 Problem Journal Entries 1 T-Account rated TH

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started