Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d. QUESTION NO. 13 The directors of Implant Inc. wishes to make an cquity issuc to finance a $10 m (million) cxpansion scheme which has

d.

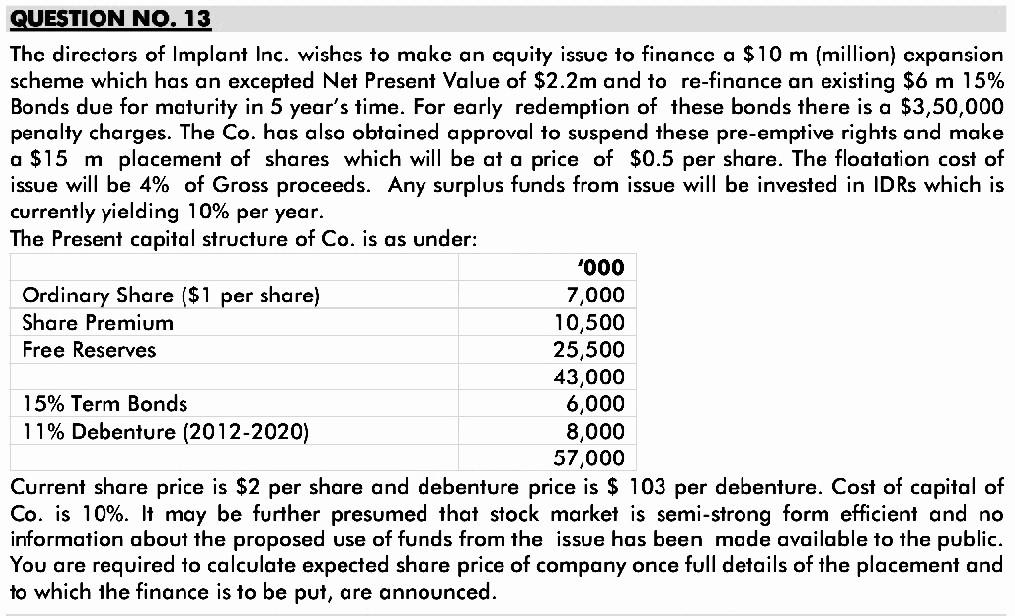

QUESTION NO. 13 The directors of Implant Inc. wishes to make an cquity issuc to finance a $10 m (million) cxpansion scheme which has an excepted Net Present Value of $2.2m and to re-finance an existing $6 m 15% Bonds due for maturity in 5 year's time. For early redemption of these bonds there is a $3,50,000 penalty charges. The Co. has also obtained approval to suspend these pre-emptive rights and make a $15 m placement of shares which will be at a price of $0.5 per share. The floatation cost of issue will be 4% of Gross proceeds. Any surplus funds from issue will be invested in IDRs which is currently yielding 10% per year. The Present capital structure of Co. is as under: '000 Ordinary Share ($1 per share) 7,000 Share Premium 10,500 Free Reserves 25,500 43,000 15% Term Bonds 6,000 11% Debenture (2012-2020) 8,000 57,000 Current share price is $2 per share and debenture price is $ 103 per debenture. Cost of capital of Co. is 10%. It may be further presumed that stock market is semi-strong form efficient and no information about the proposed use of funds from the issue has been made available to the public. You are required to calculate expected share price of company once full details of the placement and to which the finance is to be put, are announcedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started