Answered step by step

Verified Expert Solution

Question

1 Approved Answer

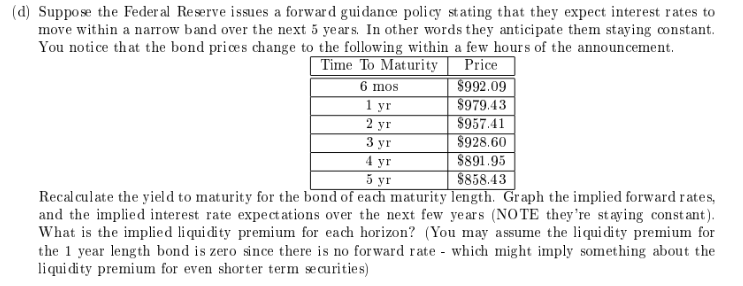

(d) Suppose the Federal Reserve issues a forward guidance policy stating that they expect interest rates to move within a narrow band over the

(d) Suppose the Federal Reserve issues a forward guidance policy stating that they expect interest rates to move within a narrow band over the next 5 years. In other words they anticipate them staying constant. You notice that the bond prices change to the following within a few hours of the announcement. Time To Maturity Price 6 mos 1 yr 2 yr $992.09 $979.43 $957.41 $928.60 4 yr $891.95 5 yr $858.43 Recalculate the yield to maturity for the bond of each maturity length. Graph the implied forward rates, and the implied interest rate expectations over the next few years (NOTE they're staying constant). What is the implied liquidity premium for each horizon? (You may assume the liquidity premium for the 1 year length bond is zero since there is no forward rate - which might imply something about the liquidity premium for even shorter term securities) 3 yr

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to follow these steps 1 Recalculate the yield to maturity for each bond maturity 2 Graph the implied forward rates 3 Gra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started