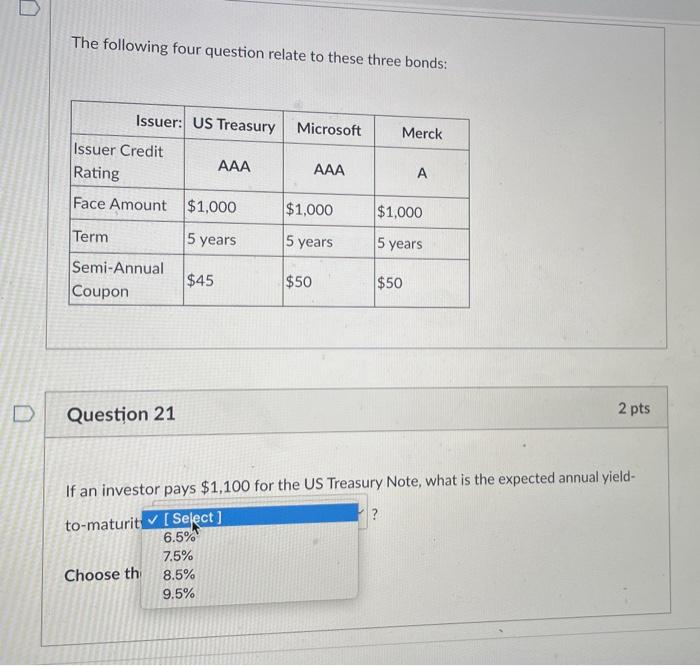

Question: D The following four question relate to these three bonds: Issuer: US Treasury Microsoft Merck Issuer Credit Rating Face Amount Term Semi-Annual Coupon Question

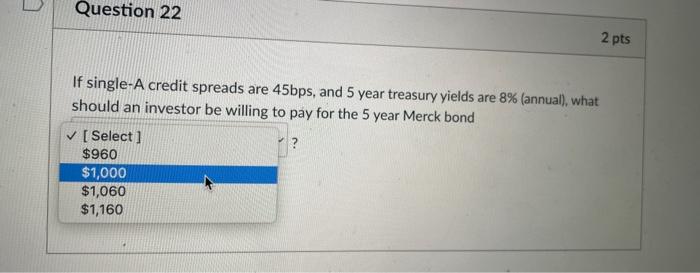

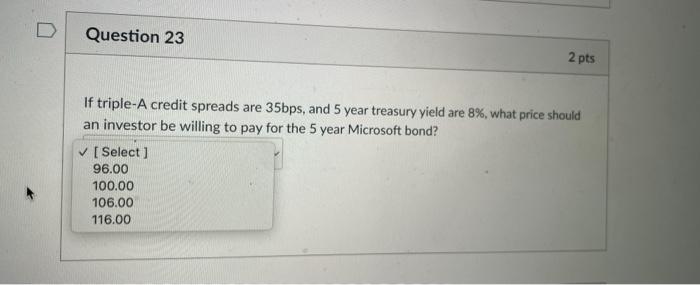

D The following four question relate to these three bonds: Issuer: US Treasury Microsoft Merck Issuer Credit Rating Face Amount Term Semi-Annual Coupon Question 21 Choose th AAA $1,000 5 years $45 AAA $1,000 5 years $50 $1,000 5 years $50 A If an investor pays $1,100 for the US Treasury Note, what is the expected annual yield- to-maturit [Select] 6.5% 7.5% 8.5% 9.5% ? 2 pts Question 22 If single-A credit spreads are 45bps, and 5 year treasury yields are 8% (annual), what should an investor be willing to pay for the 5 year Merck bond ? [Select] $960 $1,000 $1,060 $1,160 2 pts D Question 23 If triple-A credit spreads are 35bps, and 5 year treasury yield are 8%, what price should an investor be willing to pay for the 5 year Microsoft bond? [Select] 96.00 100.00 2 pts 106.00 116.00

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

SOLUTION Question 21 To calculate the expected annual yieldtomaturity we need to determine the annua... View full answer

Get step-by-step solutions from verified subject matter experts