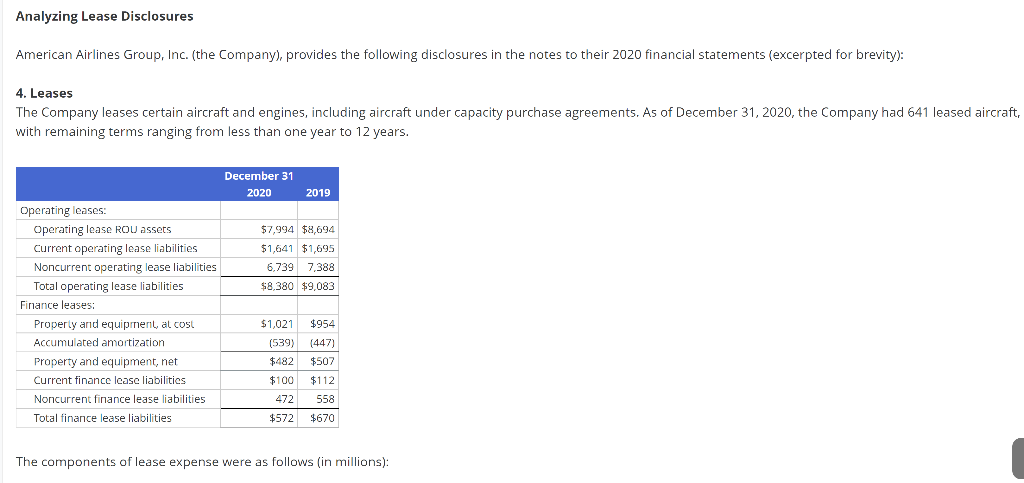

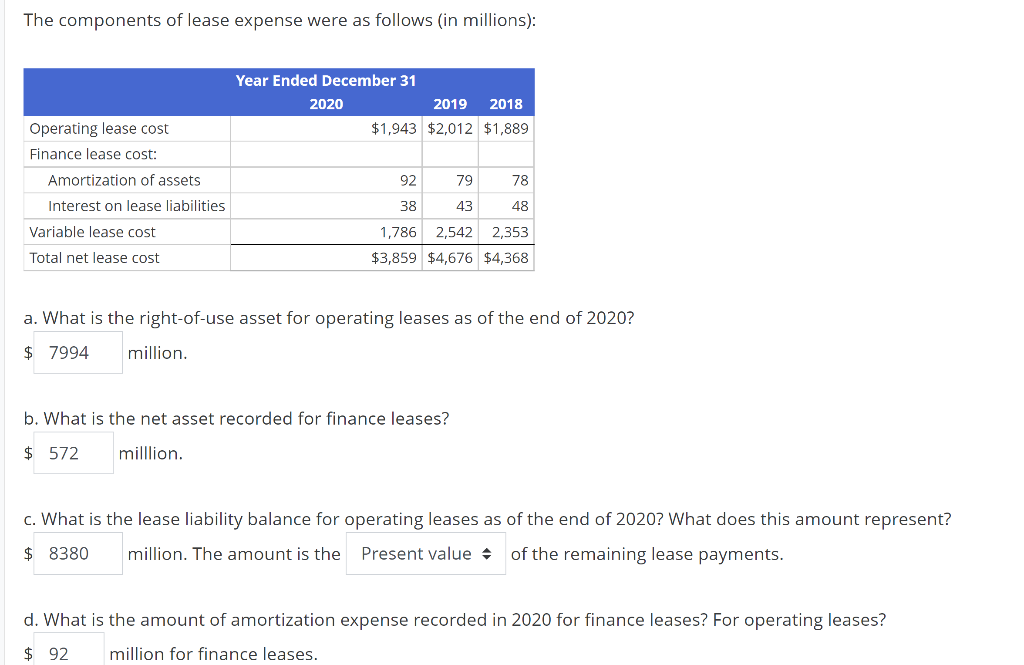

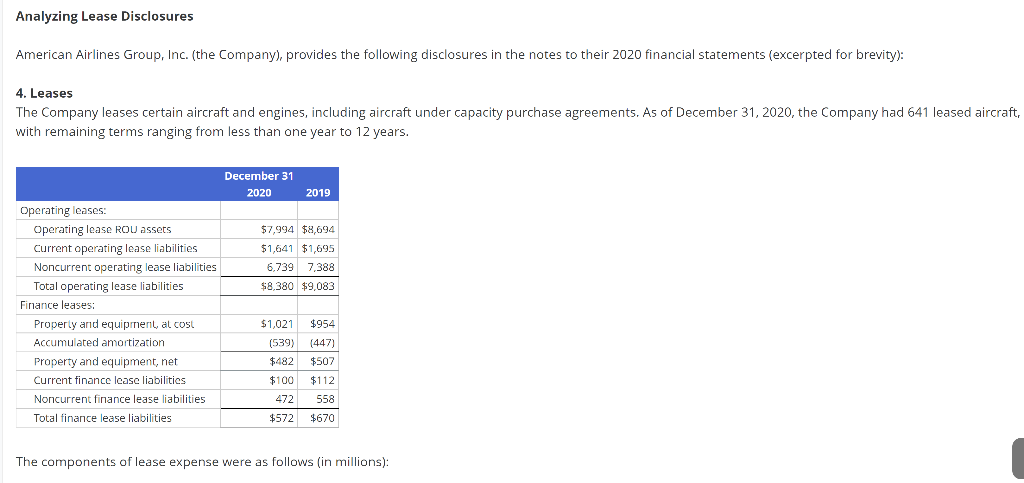

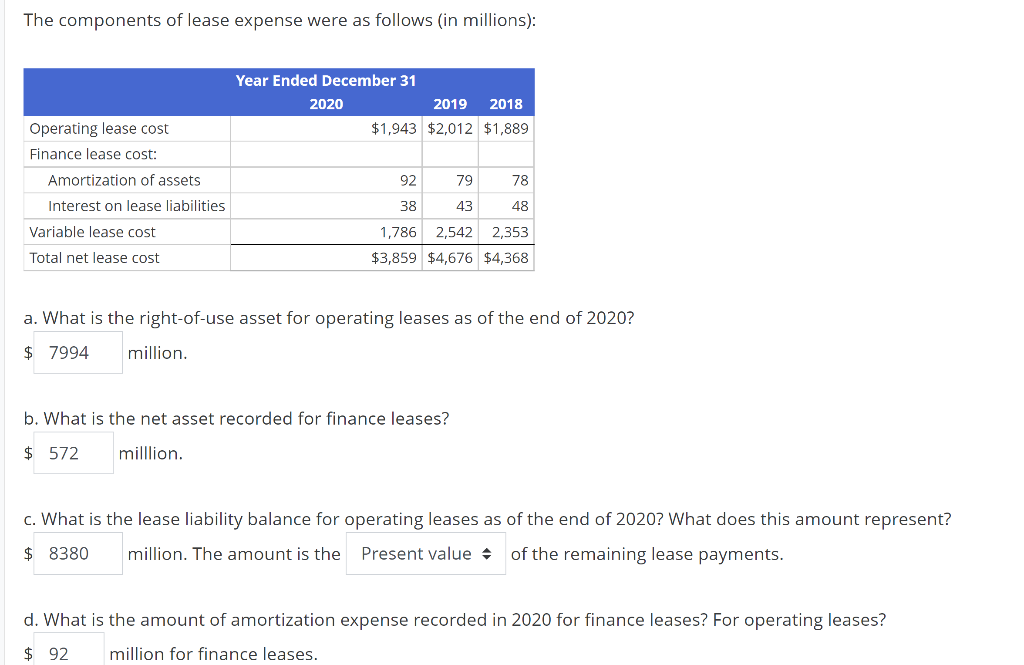

d. What is the amount of amortization expense recorded in 2020 for finance leases? For operating leases? $ million for finance leases. $ million for operating leases. e. What is the amount of interest expense recorded in 2020 for finance leases? For operating leases? $ million for finance leases. $ million for operating leases. Please answer all parts of the question. Analyzing Lease Disclosures American Airlines Group, Inc. (the Company), provides the following disclosures in the notes to their 2020 financial statements (excerpted for brevity): 4. Leases The Company leases certain aircraft and engines, including aircraft under capacity purchase agreements. As of December 31,2020 , the Company had 641 leased aircraft, with remaining terms ranging from less than one year to 12 years. The components of lease expense were as follows (in millions): The components of lease expense were as follows (in millions): a. What is the right-of-use asset for operating leases as of the end of 2020 ? $ million. b. What is the net asset recorded for finance leases? $ million. c. What is the lease liability balance for operating leases as of the end of 2020 ? What does this amount represent? $ million. The amount is the of the remaining lease payments. d. What is the amount of amortization expense recorded in 2020 for finance leases? For operating leases? $ million for finance leases. $ million for operating leases. e. What is the amount of interest expense recorded in 2020 for finance leases? For operating leases? $ million for finance leases. $ million for operating leases. Please answer all parts of the question. Analyzing Lease Disclosures American Airlines Group, Inc. (the Company), provides the following disclosures in the notes to their 2020 financial statements (excerpted for brevity): 4. Leases The Company leases certain aircraft and engines, including aircraft under capacity purchase agreements. As of December 31,2020 , the Company had 641 leased aircraft, with remaining terms ranging from less than one year to 12 years. The components of lease expense were as follows (in millions): The components of lease expense were as follows (in millions): a. What is the right-of-use asset for operating leases as of the end of 2020 ? $ million. b. What is the net asset recorded for finance leases? $ million. c. What is the lease liability balance for operating leases as of the end of 2020 ? What does this amount represent? $ million. The amount is the of the remaining lease payments