Answered step by step

Verified Expert Solution

Question

1 Approved Answer

d. What is the cash inflow from the sale of the old equipment? Note: Do not round intermedlate calculations and round your answer to the

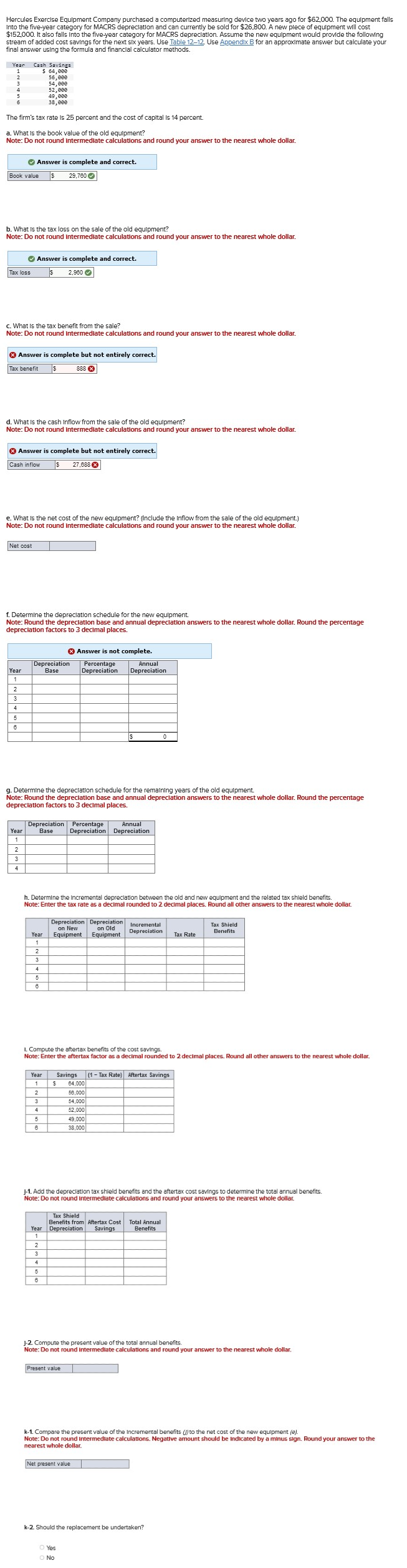

d. What is the cash inflow from the sale of the old equipment? Note: Do not round intermedlate calculations and round your answer to the nearest whole dollar. (8) Answer is complete but not entirely correct. e. What is the net cost of the new equipment? (Include the inflow from the sale of the old equipment.) Note: Do not round intermedlate calculations and round your answer to the nearest whole dollar. Net f. Determine the depreclation schedule for the new equipment. Note: Round the depreclation base and annual depreclation depreclation factors to 3 decimal places. g. Determine the depreclation schedule for the remalning years of the old equipment. Note: Round the depreclatlon base and annual depreclation answers to the nearest whole dollar. Round the percentage depreclation factors to 3 decimal places. -1. Add the depreclation tax shleld benefits and the aftertax cost savings to determine the total annual benefits. Note: Do not round intermedlate calculations and round your answers to the nearest whole dollar. J.2 Compute the prosent value of the total annual benefits. Note: Do not round intermedlate calculatlons and round y k-1 Compare the pre Note: Do not round in nearest whole dollar. d. What is the cash inflow from the sale of the old equipment? Note: Do not round intermedlate calculations and round your answer to the nearest whole dollar. (8) Answer is complete but not entirely correct. e. What is the net cost of the new equipment? (Include the inflow from the sale of the old equipment.) Note: Do not round intermedlate calculations and round your answer to the nearest whole dollar. Net f. Determine the depreclation schedule for the new equipment. Note: Round the depreclation base and annual depreclation depreclation factors to 3 decimal places. g. Determine the depreclation schedule for the remalning years of the old equipment. Note: Round the depreclatlon base and annual depreclation answers to the nearest whole dollar. Round the percentage depreclation factors to 3 decimal places. -1. Add the depreclation tax shleld benefits and the aftertax cost savings to determine the total annual benefits. Note: Do not round intermedlate calculations and round your answers to the nearest whole dollar. J.2 Compute the prosent value of the total annual benefits. Note: Do not round intermedlate calculatlons and round y k-1 Compare the pre Note: Do not round in nearest whole dollar

d. What is the cash inflow from the sale of the old equipment? Note: Do not round intermedlate calculations and round your answer to the nearest whole dollar. (8) Answer is complete but not entirely correct. e. What is the net cost of the new equipment? (Include the inflow from the sale of the old equipment.) Note: Do not round intermedlate calculations and round your answer to the nearest whole dollar. Net f. Determine the depreclation schedule for the new equipment. Note: Round the depreclation base and annual depreclation depreclation factors to 3 decimal places. g. Determine the depreclation schedule for the remalning years of the old equipment. Note: Round the depreclatlon base and annual depreclation answers to the nearest whole dollar. Round the percentage depreclation factors to 3 decimal places. -1. Add the depreclation tax shleld benefits and the aftertax cost savings to determine the total annual benefits. Note: Do not round intermedlate calculations and round your answers to the nearest whole dollar. J.2 Compute the prosent value of the total annual benefits. Note: Do not round intermedlate calculatlons and round y k-1 Compare the pre Note: Do not round in nearest whole dollar. d. What is the cash inflow from the sale of the old equipment? Note: Do not round intermedlate calculations and round your answer to the nearest whole dollar. (8) Answer is complete but not entirely correct. e. What is the net cost of the new equipment? (Include the inflow from the sale of the old equipment.) Note: Do not round intermedlate calculations and round your answer to the nearest whole dollar. Net f. Determine the depreclation schedule for the new equipment. Note: Round the depreclation base and annual depreclation depreclation factors to 3 decimal places. g. Determine the depreclation schedule for the remalning years of the old equipment. Note: Round the depreclatlon base and annual depreclation answers to the nearest whole dollar. Round the percentage depreclation factors to 3 decimal places. -1. Add the depreclation tax shleld benefits and the aftertax cost savings to determine the total annual benefits. Note: Do not round intermedlate calculations and round your answers to the nearest whole dollar. J.2 Compute the prosent value of the total annual benefits. Note: Do not round intermedlate calculatlons and round y k-1 Compare the pre Note: Do not round in nearest whole dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started