Question

dae (aaddae@mucg.edu.gh) METHODIST UNIVERSITY COLLEGE GHANA DEPARTMENT OF ACCOUNTING AND FINANCE MACC 304 CORPORATE FINANCIAL REPORTING Question 1 The following is the trial balance of

dae (aaddae@mucg.edu.gh) METHODIST UNIVERSITY COLLEGE GHANA DEPARTMENT OF ACCOUNTING AND FINANCE MACC 304 CORPORATE FINANCIAL REPORTING Question 1 The following is the trial balance of PIGMen Ltd, a trading company, as at 31st December 2019: Debit Credit GH000 GH000 Sales 78,860 Inventory 2,950 Cost of sales 36,100 Selling & distribution expenses 5,600 Administration expenses 8,540 Loan Note interest paid 120 Bank interest 170 Investment income 2770 Leasehold building at valuation-1 Jan 2019 14,000 Plant and equipment cost/depreciation 13,750 3,200 Computer equipment cost/depreciation 7,200 2,000 Motor vehicles cost/depreciation 1,500 400 Available-for-sale investments 8,700 Trade receivables 9,200 Bank 7,800 Cash on Hand 3,200 Trade payables 3,400 Deferred tax 1 Jan 2019 2,300 500,000 Ordinary shares 14,500 8% Loan notes (2015 2019) 2,500 10% Preference shares (redeemable) 3,000r54 Revaluation surplus 800 General reserve 1,500 Retained earnings 1 Jan 2019 3,600 118,830 118,830 Additional information: a. On 31 July 2019 the company made a bonus issue from retained earnings of one new share for every four shares in issue at GH 10.00 each. This transaction is yet to be recorded in the books. The company paid ordinary dividends of GH2.2 per share on 31 March 2019 and GH2.6 per share on 30 November 2019. The dividend payments are include

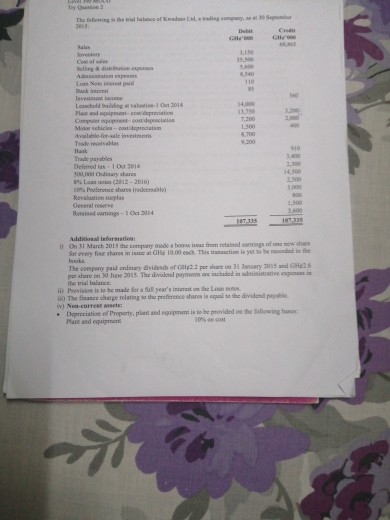

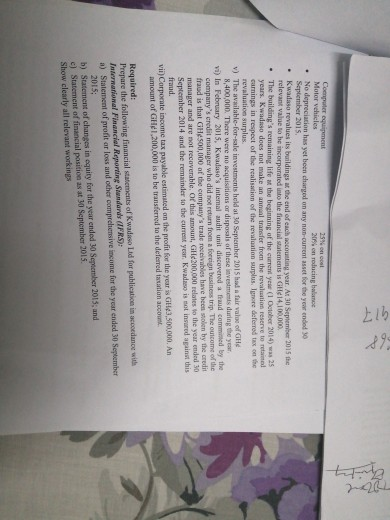

Toy The face of a company, we 2005 Cr G 15. 110 000 720 LS Course Selling & Apes Lates Thanks Teve Launched be 1014 Podpovi Mos vehicles con depreciation Albo-for-sales Trake marathon Tank Tradeables Defoedas - 1 03014 disa share Las 2012-2010) Pelete sutradale Reinis General reserve Headings -10014 9.300 910 14.500 1.500 Additional informatie On March 2015 the company made a barriers of nowhe for every for shares in it at 10.00. This traction is yet to be consiste The company andinary dividends of person 3ry 2015 and 26 pershare on June 2015 The dividend pay included in die the trial balance ii) Provision is to be made for all year's interest and Low The finance charge relating the preference shares is equal to the dividende w Non-currean Depreciation Property, plast and is to be provided on the towing Plant and equipment 30 Elb . Computer equipment Motor vehicles 25 l No depreciation has yet been charged on any non-current anset for the your ended 30 20% reducing balance September 2015 Kwadaso revalues its buildings at the end of each counting year. A 30 September 2015 the relevant value to be incorporated into the financial statements is 14.100.000 The building's remaining life at the beginning of the current yeu (1 October 2014) was 25 years. Kwadaso does not make an annual transfer from the evaluation reserve to real curnings in respect of the realisation of the evaluation surplus lunare deferred tax on the revaluation surplus v) The available for sale investments held at 10 September 2015 had a fair value of OH 8,400,000. There were no acquisitions or disposals of these investments during the year vi) in February 2015, Kwaduse's Intemal audit unit discovered a fraud committed by the company's credit manager who did not return from a foreign business trip. The outcome of the fraud is that GH 500,000 of the company's trade receives have been sen by the credit manager and are not recoverable. Or this amount, GH 200,000 relates to the year ended 30 September 2014 and the remainder to the current year. Kwadasso is not insured against this fraud. vii) Corporate income tax payable estimated on the profit for the year is GH 3,500,000. An amount of GH1,200,000 is to be transferred to the deferred taxation accou Required: Prepare the following financial statements of Kwadiso Led for publication in coeduce with International Financial Reporting Standards (IFRS): a) Statement of profit or loss and other comprehensive income for the year ended 30 September 2015: b) Statement of changes in equity for the year ended 30 September 2015; and c) Statement of financial position as at 30 September 2015. Show clearly all relevant working Toy The face of a company, we 2005 Cr G 15. 110 000 720 LS Course Selling & Apes Lates Thanks Teve Launched be 1014 Podpovi Mos vehicles con depreciation Albo-for-sales Trake marathon Tank Tradeables Defoedas - 1 03014 disa share Las 2012-2010) Pelete sutradale Reinis General reserve Headings -10014 9.300 910 14.500 1.500 Additional informatie On March 2015 the company made a barriers of nowhe for every for shares in it at 10.00. This traction is yet to be consiste The company andinary dividends of person 3ry 2015 and 26 pershare on June 2015 The dividend pay included in die the trial balance ii) Provision is to be made for all year's interest and Low The finance charge relating the preference shares is equal to the dividende w Non-currean Depreciation Property, plast and is to be provided on the towing Plant and equipment 30 Elb . Computer equipment Motor vehicles 25 l No depreciation has yet been charged on any non-current anset for the your ended 30 20% reducing balance September 2015 Kwadaso revalues its buildings at the end of each counting year. A 30 September 2015 the relevant value to be incorporated into the financial statements is 14.100.000 The building's remaining life at the beginning of the current yeu (1 October 2014) was 25 years. Kwadaso does not make an annual transfer from the evaluation reserve to real curnings in respect of the realisation of the evaluation surplus lunare deferred tax on the revaluation surplus v) The available for sale investments held at 10 September 2015 had a fair value of OH 8,400,000. There were no acquisitions or disposals of these investments during the year vi) in February 2015, Kwaduse's Intemal audit unit discovered a fraud committed by the company's credit manager who did not return from a foreign business trip. The outcome of the fraud is that GH 500,000 of the company's trade receives have been sen by the credit manager and are not recoverable. Or this amount, GH 200,000 relates to the year ended 30 September 2014 and the remainder to the current year. Kwadasso is not insured against this fraud. vii) Corporate income tax payable estimated on the profit for the year is GH 3,500,000. An amount of GH1,200,000 is to be transferred to the deferred taxation accou Required: Prepare the following financial statements of Kwadiso Led for publication in coeduce with International Financial Reporting Standards (IFRS): a) Statement of profit or loss and other comprehensive income for the year ended 30 September 2015: b) Statement of changes in equity for the year ended 30 September 2015; and c) Statement of financial position as at 30 September 2015. Show clearly all relevant working

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started