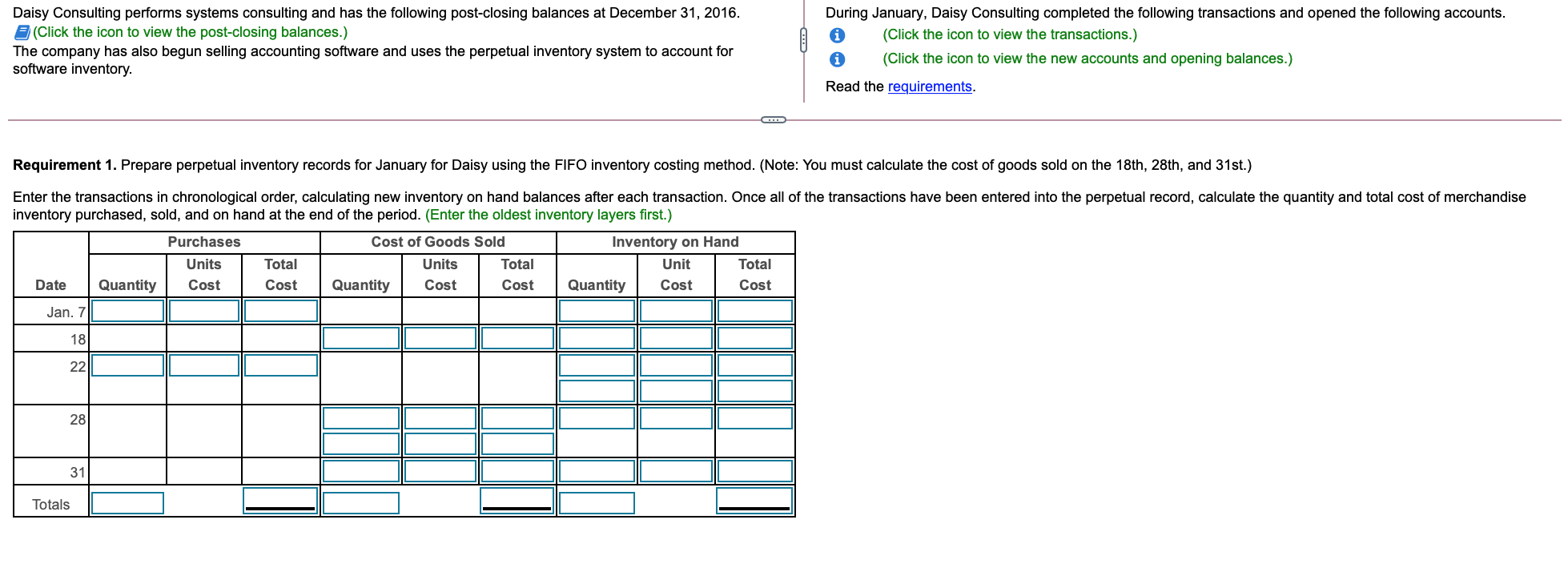

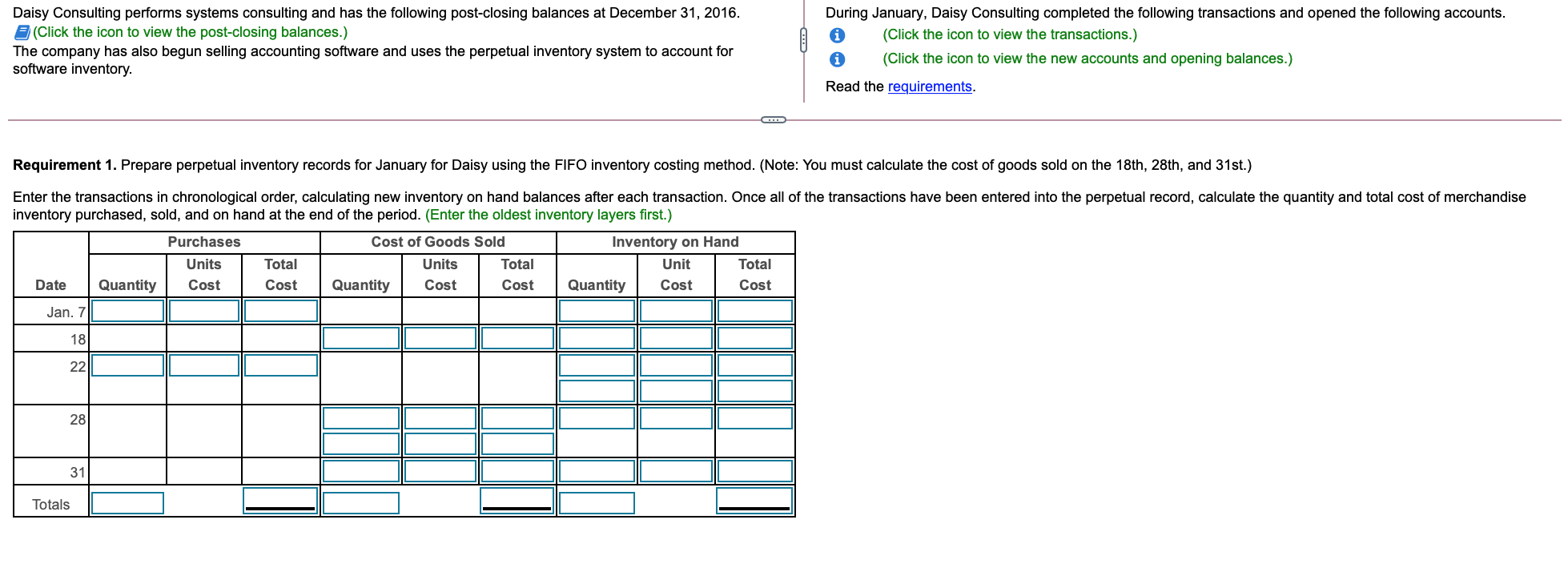

Daisy Consulting performs systems consulting and has the following post-closing balances at December 31, 2016. LOADING... (Click the icon to view the post-closing balances.) The company has also begun selling accounting software and uses the perpetual inventory system to account for software inventory. . . . Question content area top right Part 1 During January, Daisy Consulting completed the following transactions and opened the following accounts. LOADING... (Click the icon to view the transactions.) LOADING... (Click the icon to view the new accounts and opening balances.) Read the requirements LOADING... . Question content area bottom Part 1 Requirement 1. Prepare perpetual inventory records for January for Daisy using the FIFO inventory costing method. (Note: You must calculate the cost of goods sold on the 18th, 28th, and 31st.) Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.)

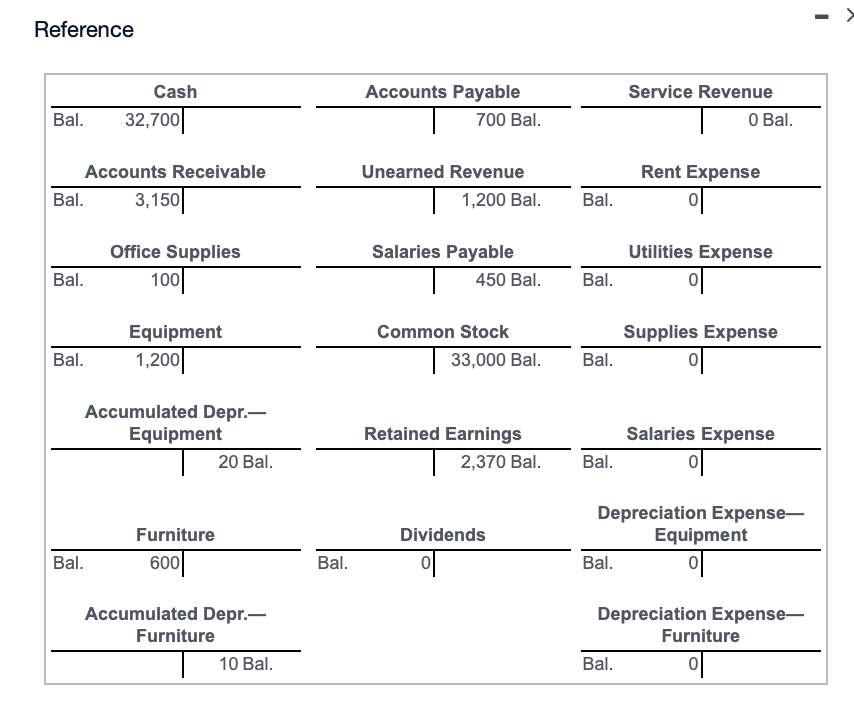

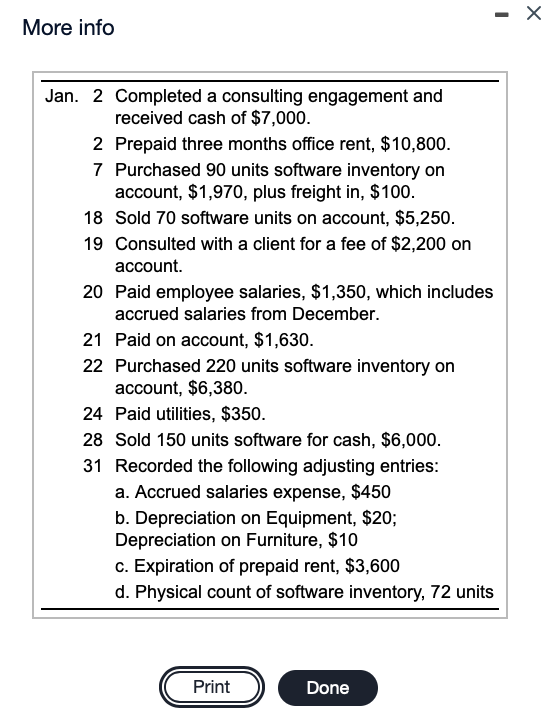

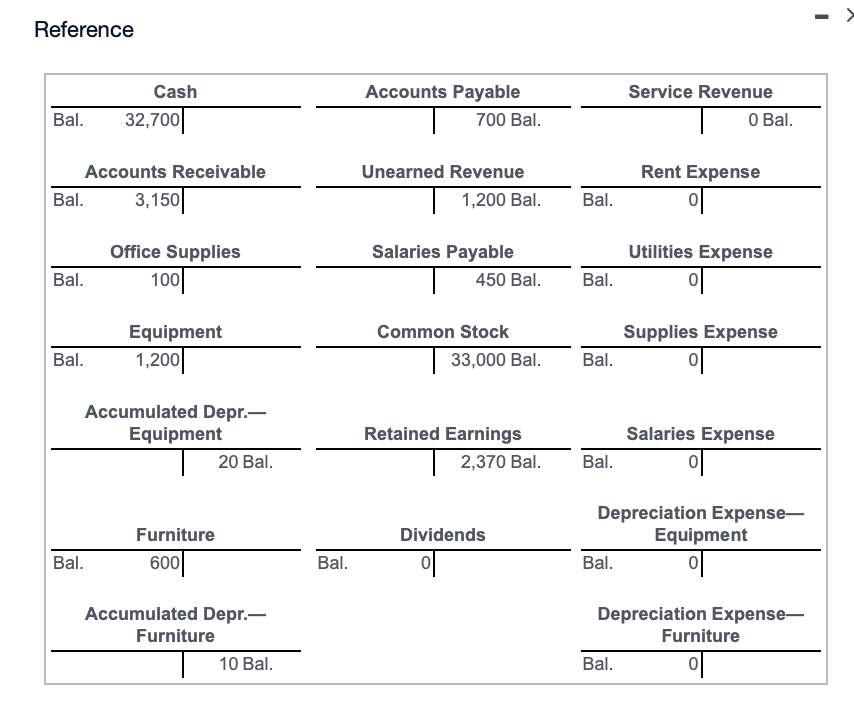

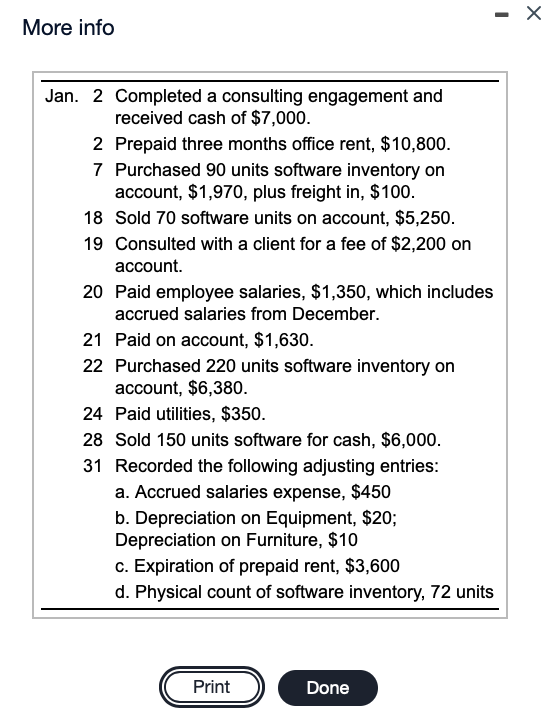

Daisy Consulting performs systems consulting and has the following post-closing balances at December 31, 2016. 2 (Click the icon to view the post-closing balances.) The company has also begun selling accounting software and uses the perpetual inventory system to account for software inventory. During January, Daisy Consulting completed the following transactions and opened the following accounts. (Click the icon to view the transactions.) (Click the icon to view the new accounts and opening balances.) Read the requirements. . Requirement 1. Prepare perpetual inventory records for January for Daisy using the FIFO inventory costing method. (Note: You must calculate the cost of goods sold on the 18th, 28th, and 31st.) Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Purchases Cost of Goods Sold Inventory on Hand Units Total Units Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Jan. 7 18 22 28 31 Totals Reference Cash 32,700 Accounts Payable 700 Bal. Service Revenue O Bal. Bal. Rent Expense Accounts Receivable Bal. 3,150 Unearned Revenue 1,200 Bal. Bal. Office Supplies 1001 Salaries Payable 450 Bal. Utilities Expense Bal. Bal. Supplies Expense Equipment 1,200 Common Stock 33,000 Bal. Bal. Bal. Accumulated Depr.- Equipment 20 Bal. Retained Earnings 2,370 Bal. Salaries Expense 01 Bal. Dividends Furniture 600 Depreciation Expense- Equipment Bal. Bal. Bal. Accumulated Depr.- Furniture 10 Bal. Depreciation Expense- Furniture Bal. - More info Jan. 2 Completed a consulting engagement and received cash of $7,000. 2 Prepaid three months office rent, $10,800. 7 Purchased 90 units software inventory on account, $1,970, plus freight in, $100. 18 Sold 70 software units on account, $5,250. 19 Consulted with a client for a fee of $2,200 on account. 20 Paid employee salaries, $1,350, which includes accrued salaries from December. 21 Paid on account, $1,630. 22 Purchased 220 units software inventory on account, $6,380. 24 Paid utilities, $350. 28 Sold 150 units software for cash, $6,000. 31 Recorded the following adjusting entries: a. Accrued salaries expense, $450 b. Depreciation on Equipment, $20; Depreciation on Furniture, $10 c. Expiration of prepaid rent, $3,600 d. Physical count of software inventory, 72 units Print Done More info Software Inventory, $0; Prepaid Rent, $0; Sales Revenue, $0; Cost of Goods Sold, $0 Print Done Requirements 1. Prepare perpetual inventory records for January for Daisy using the FIFO inventory costing method. (Note: You must calculate the cost of goods sold on the 18th, 28th, and 31st.) 2. Journalize the transactions for January 18th, 28th, and 31st (adjusting entry d only) using the perpetual inventory record created in Requirement 1. Print Done